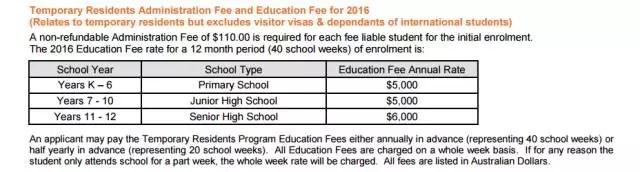

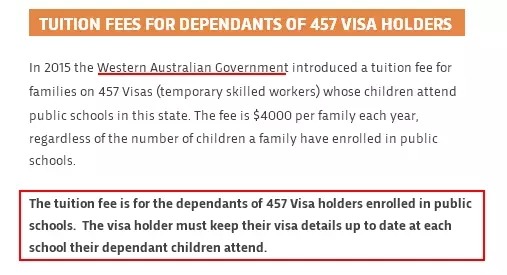

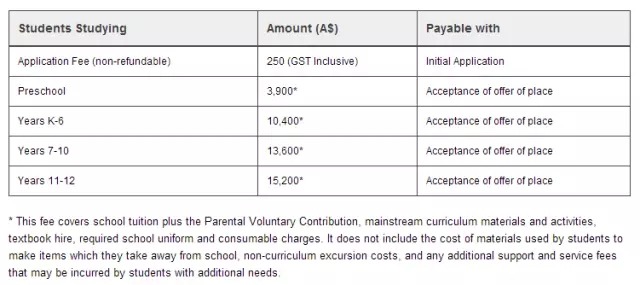

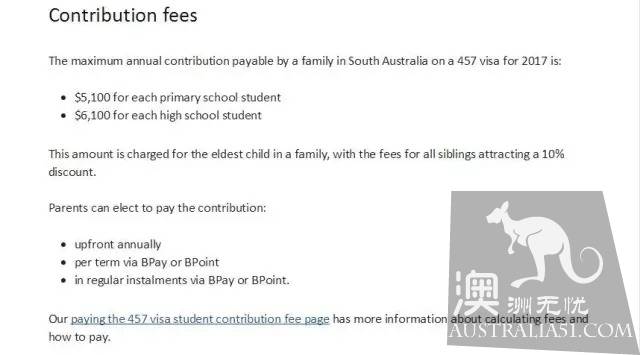

The eldest children pay $5,100 a year for primary school students and $6100 for high school students. For every extra child, a 10% reduction in tuition fees can be paid on an annual, term-by-semester basis.

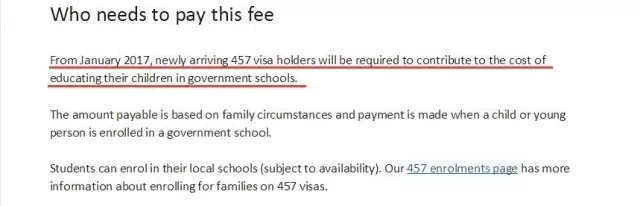

After January 1, 2017, the sum of parents' annual income is less than $57000 for free, and the child of a 457 applicant will receive contribution fee:

The eldest children are $5100 a year for primary school students and $6100 for high school students. For every extra child, a 10% reduction in tuition fees can be paid on an annual, term-by-semester basis. Families with one child earn $77000 a year to charge full tuition fees, or $10000 more than the threshold for each additional child. So families with two children earn more than $87000 a year to be required to pay full tuition fees, and families with three children earn more than $97,000 a year. When the total annual income of a family exceeds $57,000, but below the threshold, tuition fees are paid as a percentage of the full tuition fee. According to how many children have different percentage oh, family income is more than $57000 more than $1000 for every extra $1000 a child will pay 5% more two children 3.33%, three children 2.5%. To be easy to understand, let's look at two examples: example 1: Xiao Wang works in Western Australia on a 457 visa, earns $67000 a year, his wife doesn't work, and his family has an 8-year-old daughter enrolled in a government public primary school. The tuition fees payable are calculated as follows: Step 1: primary school fees $5100 Step 2: total annual family income $67000 Step 3: the threshold for a child's full tuition is $77000 Step 4: because the family's annual income is between $57000 and $77000, Xiao Wang will not be required to pay the full tuition fee. His income is $10000 above the $57000 bottom line. So the tuition is calculated as follows: 10 x 5% x $5100 = $2,550, which means $2550 a year.

Example 2: Xiao Li works in Western Australia on a 457 visa and earns $6,1200 a year. His wife has a part-time job of $20,400. He has two children, one in government primary school and one in public secondary school. The tuition fees payable are calculated as follows: Step 1: two children's full tuition $6100 ($5100 x 90%) = $10690 Step 2: total annual family income (calculated to the most recent full $1000) is $81000 Step 3: a child's full tuition threshold family charge $87000 Step 4: because the family's annual income is between $57000 and $87,000, Xiao Li will not be required to pay the full tuition fee. His income was $24000 above the $57000 bottom line. So the tuition is calculated as follows: 24 x 3 * 1 / 3% x $10690 = $8552. Example 3: Xiao Hong is a single mother of three children coming to work in Australia on a 457 visa. Her annual income is $200000. After coming to Australia, the children went to the government school. One in high school and two in primary school. The fees payable are calculated as follows: Step 1: full tuition for three children $6100 ($5100 $5100 x 90%) = $15280 Step 2: total annual family income $200000 Step 3: threshold family income for three children's full tuition is $97000 Step 4: because of this The total annual income of a family is more than $97,000, Xiao Hong has to pay a full tuition fee of $15280.