Among Australia's many welfare policies that attract global migrants, the child-care benefits system is a particularly good one.

As a high-quality welfare country, the system of child-care welfare system in Australia has developed more mature and perfect. Having children in Australia can enjoy relatively comprehensive welfare care.

[5E48ADE6-2328-C95A-04C8-152C218B57B8]

The main confusion surrounding Australia's current childcare benefits system and its reform is as follows:

- What is the content of the current childcare benefit system?

- The main content and implementation method of this reform?

- the impact of parenting welfare reform?

In order to better interpret the content of the New Deal, this paper will focus on the analysis of the specific types of childcare welfare policy, as well as the content and impact of the New Deal, and combined with the general situation of parenting in Australia, to answer questions for the majority of readers.

Introduction to Australia's Childcare Benefit System

Referring to Australia's child-care benefits system, many people think of the Newborn Child Benefit and Childcare Benefit, etc.

In fact, Australia's parental benefit system is a relatively broad concept, including many aspects. The main categories of current benefits are:

- Family Tax Benefit Policy (Family Tax Benefit)

- Paid maternity leave (Paid Parental Leave)

- Fathers and partners benefit (Dad and Partner Payment)

- Benefits for newborns (Newborn Upfront Payment and Newborn Supplement)

- Childcare benefits (Child Care Benefit)

- Childcare cost allowance (Child Care Rebate)

- With regard to the following two welfare benefits, due to the new policy changes, implemented in accordance with the New Deal rules on July 2,2018, it is introduced separately in the second part of the article:

- Childcare benefits (Child Care Benefit)

- Childcare cost allowance (Child Care Rebate)

The main benefits, which remain unchanged, are as follows:

1. Family Tax Benefit Policy (Family Tax Benefit)

The family tax benefits policy of the Australian government is divided into two parts: welfare A and welfare B..

The welfare A does not apply to families with children of single parents who require additional autonomy or who have only one income, so government has a welfare B type of subsidy.

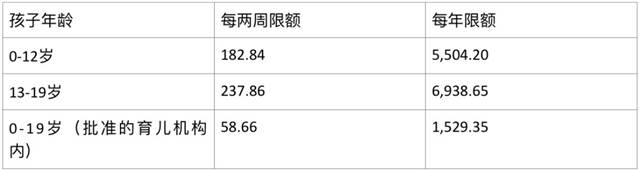

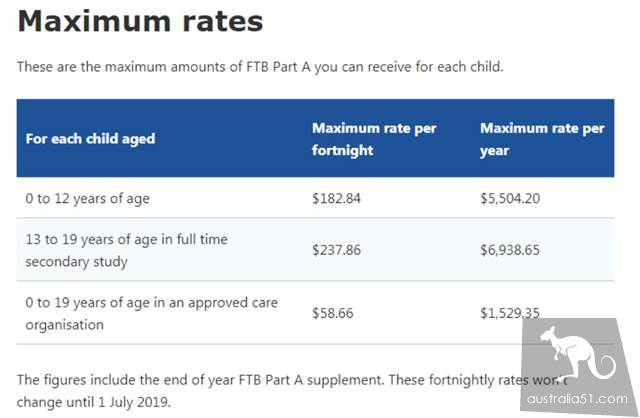

A of benefits

Benefits:

Basic allowance: A $58.66 per child every two weeks;

Maximum limit:

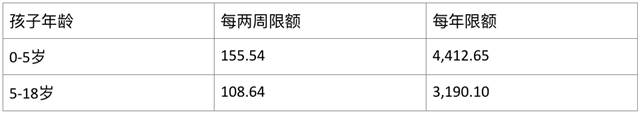

B of benefits

Specific welfare criteria:

Maximum limit:

For more details, please refer to the link:

https://www.humanservices.gov.au/individuals/enablers/payment-rates-family-tax-benefit-part

2. paid maternity leave (Paid Parental Leave)

The Australian government working pregnant women or adoptive parents of adopted children, the Australian government will allow a certain period of leave and provide corresponding economic support, i.e. paid maternity leave, if it is necessary to leave an active post for childcare reasons.

Conditions of application for paid maternity leave:

- Status conditions

- birth mother of the newborn; o

- adoptive parents of the child; o

- For special reasons, the child of another person needs to be taken care of;

- Personal income in the previous fiscal year was less than 150,000 Australian dollars;

- Working conditions

- The applicant worked for at least 10 months before the child was born or adopted;

- The applicant worked at least 330 hours, at least one day per week during the ten months;

- Amount of subsidy :$ A $695/week up to 18 weeks.

3. parental benefit (Parenting Payment)

Eligibility:

- Meet income and asset testing;

- Meeting the principle of primary carer:

- (b) Single persons with children under 8 years of age;

- (b) The child is under 6 years of age in the case of a partner;

- Conformity with the principle of residence: must be an Australian resident and have lived for 104 weeks prior to receiving the allowance;

- (b) Parents' allowance can not be paid before the child is born;

For more details, please refer to:

https://www.humanservices.gov.au/individuals/enablers/who-can-get-parenting-payment

4. of new baby benefits

Benefits for newborn babies (Newborn Upfront Payment and Newborn Supplement)

The first prerequisite for applying for the benefit is that if the parent has applied for paid maternity leave in the child's name, the parent will be disqualified from applying for the benefit of the newborn.

Newborn benefits are paid on a one-time basis. The amount of the benefit is as follows:

- First child allowance :$2158.89, if the first child is multiple births, each child can receive $2158.89;

- Second child or above :$1080.54;

Subsidies 5. fathers and partners (Dad and Partner Payment)

The Australian government has established a subsidy programme to reduce the economic burden on fathers of newborns or male adopters of adopted children as the primary source of family economic during their childcare.

Generally, the benefit lasts two weeks and the amount of the benefit is $$695.

II. New Deal Rules for Childcare Benefits

In China, children are sent to nurseries and kindergartens when they reach their age.

However, in Australia, because childcare is expensive, many mothers choose to quit their jobs and bring babies at home because they can not afford childcare.

According to Australian government data, nearly 200,000 parents across the country have not joined the local labour market because they need to look after their children at home. Australia's government has set up child care grants to encourage parents to return to work.

Australia has government a reform of the current child-care benefits system, and the new child-care subsidy system will be implemented on July 2 this year.

Under the New Deal, the level of childcare subsidies per family will depend on a combination of three factors:

- Parents'& quot; activity level & quot;, the degree of participation in work, study or job search;

- Type of childcare services used;

- (a) The combined income of the family;

The New Deal was implemented as follows:

The existing childcare benefits (Child Care Benefit) and childcare cost benefits (Child Care Rebate) will be replaced by the newly established childcare benefits (Child Care Subsidy).

A total of 1.2 million families in Australia now enjoy child-care benefits, and if they wish to continue receiving child-care benefits until the New Deal is implemented, they must update their information to My Gov for timely approval.

Centrelink will contact all families currently receiving these benefits in the next few weeks and provide further explanations on the subsidy policy, while parents can also complete the new form through MyGov direct access to the Centrelink website.

Time requirements: must be completed by 2 July to ensure that the distribution of benefits after the implementation of the New Deal is not affected.

1. reform content

A new childcare grant, Child Care Subsidy.

The single economic review subsidy (CCS) replaces the existing childcare benefit (CCB) and the childcare rebate subsidy (CCR).

Notably, CCR or CCB do not automatically change to CCS.

Maximum amount of rebate

For families earning less than A $186958 a year, there is no government annual tax rebate ceiling.

For families earning more than A $186958 a year, the ceiling is raised from A $7500 a year per child to A $10000.

2. eligibility

First premise: parents must work, study and find a job, or volunteer for at least eight hours in two weeks to get the new subsidy.

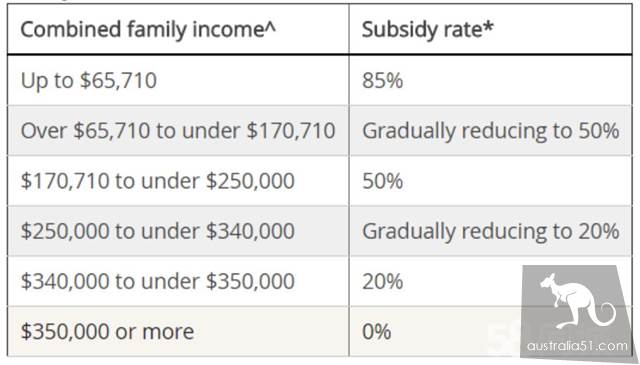

Annual income restrictions

- Households with annual income below $65710:85 per cent subsidy;

- Households with annual income of A $170710-250000:50% subsidy rate;

- Families earning over $350,000 a year: no subsidy.

If you want to calculate how much subsidy you can get, use the following link: https://www.centrelink.gov.au/custsite_pfe/pymtfinderest/paymentFinderEstimatorPage.jsf?. wec-appid=pymtfinderest&wec-locale=en_US #stay

[21761853-AD69-22B7-26A6-6A56FCC3D485]

[4DCADED3-605A-8E19-DCD7-C456915BA0D5]

According to the analysis, about 70% of Australian households will receive more subsidies, and 15% to 27% of households will receive less subsidies, depending on which state they live in.

According to this data, Western Australia is the worst-case scenario, with 67.55 per cent of households earning more ,5 per cent of households earning less and 27.5 per cent earning less.

Support for family reintegration

[C746361D-72DE-077A-9C02-30461848D464]

Birmingham, the Australian Federal minister of Education (Simon Birningham), said :" The program could benefit about 1 million families in general and increase the participation of more than 230,000 families in the workplace. "

Impact on the childcare market

Meanwhile, the new administration is expected to be hit by more than 17 more than 17care providers.

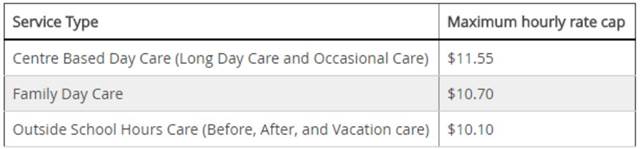

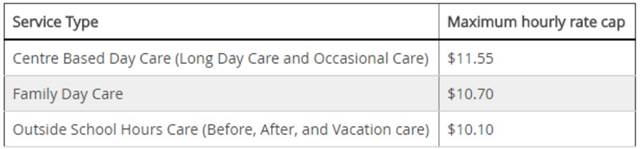

Under the provisions of the New Deal, different forms of childcare facilities have set a ceiling on subsidies, which:

- (b) The highest subsidy is for ordinary kindergartens, with a maximum hourly subsidy $of 11.55;

- Family day care allowance $10.70 per hour;

- (b) The minimum allowance is for childcare facilities outside school hours ,$10.10 per hour;

Welfare cuts and a dilemma for high-income families

In addition, after the implementation of the New Deal, some families will be completely unable to receive subsidies because they exceed the subsidy threshold.

The rule has been criticized by Australian netizens, who argue that it is unreasonable to measure a family's balance of payments by the level of income.

A number of high-income families are also struggling with child-care spending because of pressures such as home loans loans, private schools, and income growth, supported by recent research data on family, income and employment dynamics (HILDA) in australia.

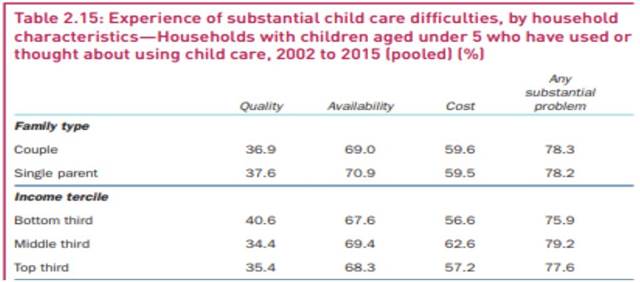

According to the Australian Family, Income and Employment Dynamics (HILDA) study, although supported by childcare benefits, nearly three quarters of households still express hardship in terms of childcare, of which 75.9 per cent are difficult for high-income households.

III. New Bill proposing extensions of benefits, etc.

Recently, a bill to extend the waiting period for new immigrants' benefits has received widespread attention.

The Act aims to extend the waiting period for new immigrants from two to three years, and the affected benefits include family tax benefits (Family Tax Benefit), paid parental leave (Paid Parental) and childcare allowance (Carers'Allowance), Newstart unemployment benefit, etc.

If the waiting period for family tax benefits is extended to three years, some 50,000 new immigrant families, including 110,000 children, are expected to be hit.

At the same time, an additional 30,000 people will be on the waiting list for paid parental leave, childcare allowance and Newstart unemployment benefit.

government is expected to save $1.3 billion under the New Deal. However, as the bill would seriously harm the interests of new immigrants, the bill encountered strong opposition.

Women and children will be the biggest "losers ", according to cro (Charmaine Crowe) of the australian social services commission (Australian Council of Social Service), since these two groups are the main beneficiaries of family tax benefits and paid maternity leave, which will be cut most in the bill.

The extension of waiting periods and their application to maternity and family benefits would result in migrants at the bottom of society, says Dr. Alia Imtoual, alliance of the Federation of Ethnic Communities ' Councils of Australia.

According to the latest feedback, the bill has not yet been submitted to the Federal parliament for consideration at this stage.

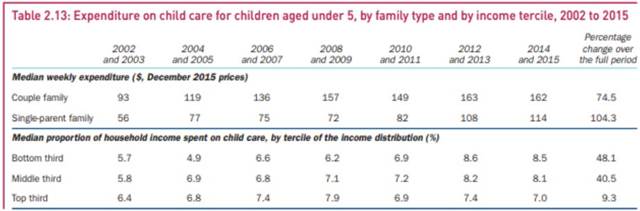

According to the latest research data from the Australian Family, Income and Employment Dynamics (HILDA), the cost of raising young children in Australian households has increased significantly since 2002, including:

- The median childcare cost for two-parent families rose from A $93 per week to A $162, up 75 per cent;

- The median child-rearing costs for single-parent families rose from A $56 a week to A $114, up 104 percent.

(Data :2002-2014/2015)

Above: The Household,Income and Labour Dynamics in Australia Survey: Selected Findings from Waves 1to 15:

Therefore, in the price rise at the same time, raising the cost of childcare is obvious to all.

although one may expect the difficulties of single-parent families to be greater due to economic conditions and manpower.

However, it is surprising that the results of the study show that there are general difficulties in parenting, both for both parents and single-parent families.

Over and above government positive reforms, opposition party Labour leader Bill Shorten also commented on child-care subsidies, saying the ruling party's subsidies were still insufficient.

"Too many families now spend their income on childcare, and economic growth requires better childcare policies ," Bill Shorten said. "He thus promised that, once elected, ways would be found to build more child-care centres to address the current situation of" shortage "of nurseries! Labour has also pledged $3 billion in future funding to ease parental pressure.

The issue of child-rearing in Australia has not only been the focus of public attention, but has also become an important bargaining chip for government and opposition party to win the hearts and minds of people, from a substantial increase in subsidies to a commitment to open low-requirement "nanny visas ".

As new immigrants, when we create an ideal life in this hot land, thanks to Australia's perfect and mature child-care welfare system, become a strong support behind us, so that we can let go to break, but also in a moment of rest, sigh, immigration is not easy, and do and cherish.