After emigrating to Australia, you, who work in Australia, will be entitled to an Australian pension, (Super)., upon retirement.

Moreover, if you have previously worked in China and have accumulated social insurance in China, you can retain the portion that you have paid and continue to pay for the full 15 years.

The advantage of this is that after you retire, even if you are abroad, you can also receive the same pension in China as the old people in China! With your pension in Australia, you will receive a double pension upon retirement!

Next we will do a specific explanation of this.

Chinese social security

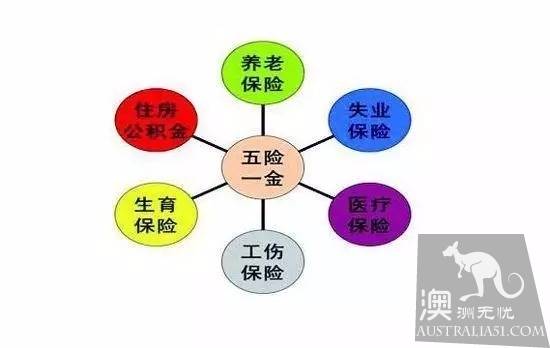

Distinguishing "Social Insurance" from "social insurance and house fund"

Social insurance includes old-age insurance, medical insurance, unemployment insurance. Many people may be confused with the concept of "social insurance and house fund" (old-age insurance, medical insurance, unemployment insurance, industrial injury insurance, maternity insurance & housing accumulation fund) and social insurance.

The "three insurances" in "social insurance and house fund", that is, old insurance, medical insurance and unemployment insurance, are the most basic social insurance, that is, what we often call "social security." Three insurance is the national social security policy, as long as you and the unit signed a labor contract, the unit should be insured for you.

For China's social security component, simply put, you have two options: refund or non-refund.

It seems simple, but in fact, we need to understand the relevant policies, combined with individual circumstances and needs, to make their own choices. Once you choose to withdraw, the operation is irreversible, that is, if you want to rejoin, the insurance needs to be cleared and re-paid and calculated.

Recommended scheme: do not refund, continue to pay after 15 years, to retirement age normal pension.

According to the current policy, male workers reach the age of 60, female workers reach the age of 50, and social security contributions reach 15 years to receive retirement benefits.

Note, however, that if the trip is interrupted, it must be repaid for 15 years before it can be collected.

Even if you live abroad, the Social Security Agency can send its monthly pension to the insured. Annual pension certification can also be sent home after certification by the local Chinese embassy.

Therefore, if it is not urgent to spend money, go abroad and continue to pay social security, after retirement age to receive social security is a very sound choice.

Options to choose: I must refund my insurance

If you must want to refund, take back the part that has been paid, stop paying the amount of insurance after, it is also OK. After immigration, in theory, old-age insurance, medical insurance and housing accumulation fund can be partially drawn. However, each local details may vary slightly.

According to the relevant policy of China, the insured person leaves the country to settle before retiring, the personal account storage amount is returned to the insurant, at the same time terminates the endowment insurance relation.

All you need to do is bring you

- Social security card

- Original and copy of Australian passport (if naturalized)

- Original and photocopy of certificate of cancellation of account

- Copy of identity card or Chinese passport

To the relevant agencies to cancel the social security account and accumulation fund account, take out the balance can.

Of course, if you choose to withdraw your insurance, you will no longer be eligible for your retirement pension in China.

Generally speaking, immigration to Australia does not affect pension payments in China, so most people choose not to return. Moreover, only the provident fund can be returned to the individual when the insurance is refunded, and the pension can only be refunded by the individual (because old-age insurance, medical insurance and unemployment insurance are jointly paid by enterprises and individuals).

Australian pension (super)

Understanding Australian pensions, adjusting savings habits and making reasonable investments will bring more money to your retirement life, allowing you to sit back and watch the sunset.

Here is a brief introduction to the important basic concepts of Australian pensions:

Australian Pension superannuation is a Retirement Protection system, abbreviated as super.

The law obliges employers to pay a certain percentage of their employees' wages, and may also make individual voluntary contributions to a special pension fund management company or self-administered pension fund (SMSF). When an individual reaches the prescribed retirement age or meets other conditions (such as disability, financial crisis, departure settlement), one-time or phased withdrawal of money from the pension account, or long-term income in the form of an annuity, can be obtained. In general, this is the money left for you after retirement.

Australia's current law requires companies to pay 9.5% of their basic Super (compared with 9.25% in previous years). Most may not know that the government-mandated pension rate will continue to rise, rising to 10% in 2021 and 12% after 2025, according to the current plan.

There are also common sense that you need to know:

1. The employer must pay an employee's pension at least 9.5% of his salary.

Your pension must be deposited at least every three months. If the employer fails to pay on time, you can report it to the Australian Inland Revenue Department.

3. Employees under the age of 18 must earn more than $450 a month and work more than 30 hours.

4. Recently updated rules: workers over the age of 70 are also entitled to pension benefits. Prior to fiscal year 2013 / 14, employers were not allowed to pay under the old rules.

5. Self-employed people also have the right to an old-age pension. If your personal income is primarily from business run by yourself, you have the right to pay your taxable pension, (deductible superannuation contribution).

Note that Super is different from Age Pension. The latter is the benefits provided by the government based on the income and assets of retirees. The more the balance of Super and income from the Super, the less Age Pension is available, and then, taking into account other income and assets, it is reduced to zero according to a certain formula. So Super is a mandatory means for the government to meet the future social security. Generally speaking, Super can also include a series of insurance, if interested, you can go to the details.

Under the current Australian pension system, immigrants in Australia actually have a rich pension income in their old age.

Plus the social insurance you have accumulated in China, you will still have a portion of your income in China after you retire. Then, believe that your retirement life must be like this: