Q: how do I apply for Centrelink benefits?

A: the first step in applying for social security payment is to register your intention to apply for payment, the purpose of which is to let Centrelink know that you will apply for payment in the near future. You or the person applying on your behalf can register your application by telephone, Internet, email, fax or personally at Centrelink.

If your Centrelink payment application or discount card application is approved, your payment or discount card begins on the date of registration. But only if you are eligible for payment or discount card on the registration date and return the completed application form within 14 days.

Whether you can get Centrelink payment depends on your visa type (permanent residence visa PR or temporary visa), your residence status and specific circumstances, including your income and assets. Even if you have become a permanent resident of Australia, most income benefits will still be subject to waiting periods such as Centrelink payments.

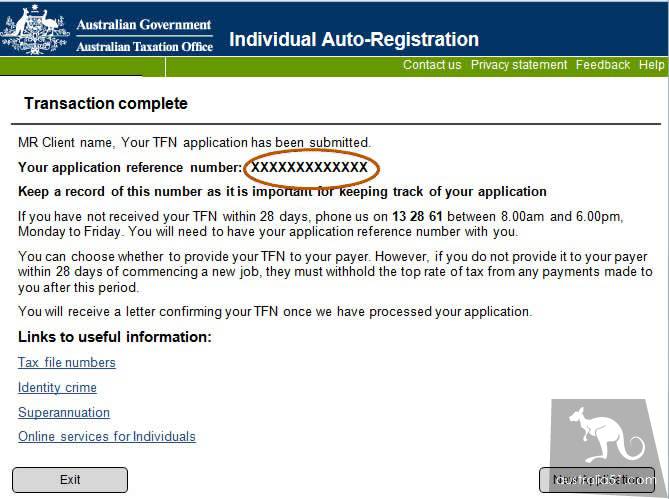

In addition, you must have a tax number (TFN) to receive any income grant. Centrelink can provide you with the tax number application form, you can submit the tax number application form to the Australian Revenue Department.

Q: what is automatic billing service (Centrepay)?

A: after receiving the Centrelink income grant, you can use Centrelink`s automatic billing service (Centrepay). This service allows you to deduct a certain amount from Centrelink payments on a regular basis to pay your bills. You can pay bills from guaranteed payments in an easy-to-manage amount without paying large bills every month or every three months, making it easier for you to manage your finances.

New Zealand citizen, which uses a special type of visa (SCV) to arrive in Australia, is usually not eligible for most income benefits unless they are in Australia on February 20, 2001, or 12 months in Australia for two years prior to that date. If you are a special category visa holder and arrive in Australia before this date, you usually need to apply for a permanent resident visa and obtain a permanent resident visa.

After obtaining a permanent resident PR visa, you need to complete a waiting period before you are eligible for payment.

Q: what are the major adjustments to the waiting period for welfare in 2019?

A: starting on January 1, 2019, new immigrants must stay in Australia on a permanent visa, PR, and live for four years to receive most of the social security benefits.

However, for:

- Family tax benefits A Milk (Family Tax Benefit A) takes 52 weeks (1 year) waiting period

- Nursing allowance (Carers Allowance) requires 52 weeks (1 year) waiting period

- Unemployment benefit (Newstart) takes 52 weeks (1 year) waiting period

- Paid maternity leave, father or partner benefits (paid parental leave) requires 104 weeks (2 years) waiting period

- Social security benefits and Concessioncards, waiting period increased from 104 weeks (2 years) to 208 weeks (4 years)

- The waiting period for farmers` subsidies was extended, from 104 weeks (2 years) to 208 weeks (4 years).

- bereavement benefit, childcare benefit,208 weeks (4 years) waiting period.

Q: what circumstances can I waive the waiting period?

A: most of the welfare payments are provided only to Australian residents and permanent residence visa PR people. If you are in trouble because of some significant situation of change, and this change is outside your control, you will be able to receive an allowance called special benefit (Special Benefit).

Special benefit allowance (Special Benefit) is provided only under very limited circumstances. Not being able to find a job or running out of money is not enough to justify special benefits. If you emigrate to Australia under economic guarantee, your guarantee will be responsible for reimbursing the payment of special benefits.

If you are taking care of a permanent resident and holding a special caregiver visa, the waiting period for the caregiver`s income subsidy will be exempted.

If you unfortunately lose your spouse, become a disabled person or a single parent after becoming an Australian resident, you are also eligible for a benefit or pension.

If you are guaranteed by an international social security agreement, you may not have to live in Australia for ten years to get pension.

Refugee and humanitarian immigrants are exempt from the waiting period. His partner and his or her raised children may also be exempted as long as their relative relationship exists at the time the refugee or humanitarian immigrants arrive in Australia.

Similarly, australia`s citizen and people who have been in permanent residence for two years may be exempted from waiting periods for their partners and dependent children. Other exemptions may also apply.

Q: what is the refugee and humanitarian immigration crisis allowance?

A: refugee and the humanitarian crisis Allowance are one-time additional grants designed to help refugee initially settle down. The amount of the crisis allowance is equivalent to a person`s basic Centrelink payment of one week (excluding rent subsidies or other benefits such as drug allowances).

The categories of visas eligible for crisis allowance are: 200 refugee visas, 201 country of origin special humanitarian grounds visas, 202 global special humanitarian grounds visas, 203 emergency relief visas and 204 women`s visas at risk.

To qualify for payment, humanitarian immigrants must be eligible for Centrelink pension or benefits and must be in Australia on the date of application. You must apply within seven days of arrival in Australia, or contact Centrelink within seven days of arrival, and submit your application within 14 days of contact.

When applying for payment to prove your identity to Centrelink, you must provide Centrelink with certificate of identification documents (passport and travel documents, bank account information and accommodation information). If your files are not English files, Centrelink can arrange for them to be translated.

For more information about certificate of identification requirements, download (Proving your identity to Centrelink) instructions from the Centrelink website to prove your identity to Centrelink.

Q: what is the applicant`s economic guarantee?

A: depending on the visa category, some immigrants may have to provide economic guarantee, and may have to pay a deposit or may not pay a deposit until a visa application is approved. Economic guarantee means that Australian citizen or permanent residents promise to provide you with economic support during the economic guarantee period and are responsible for any social security payments that may be made to you.

If you submit economic guarantee, when you emigrate but apply for and receive social security payments during economic guarantee, your economic guarantee person will be responsible for repaying the amount paid to you.

If economic guarantee includes a bond and you receive social security payments during the economic guarantee, the amount paid to you will be deducted from the deposit first. The amount paid to you in excess of the margin will be the responsibility of your economic guarantee. This rule applies whether or not your waiting period is over or you are exempt from the waiting period.

To find out what payments are required under the economic guarantee plan, please contact Centrelink at 13 28 50. Multilingual call Center (non-English language) helps 13 12 02.

Q: what is family assistance payment?

A: If you have a dependent child, Australian government pays a family allowance through the Family Assistance Office. In general, you must have a permanent visa to be eligible. You need to understand that the family allowance is not sufficient to support your child. Only if your other income is less than a certain amount can you receive the family allowance.

Q: what are the types of family benefits?

A: family benefits mainly include family tax benefits AB (Family Tax Benefit AB), child care benefits (Child Care Benefit), child care fee refund (Child Care Rebate) and infant immunization allowance (Maternity Immunisation Allowance).

The amount of benefit you may be eligible for depends on your family situation, including the age and number of the child, as well as the annual total income of the family. The baby allowance (Baby Bonus Payment) also subsidizes the extra cost of the newborn.

The Family Assistance Bureau provides information on its services and payments. For new immigrants and anyone whose mother tongue is not English, the Family Assistance Bureau can also provide a range of translations of family assistance. If you need a translated version of the instructions for family assistance payments, you can call 13 12 02 or visit the family assistance website and click on the Multilingual Services (multilingual service).

All Medicare offices and Centrelink offices provide family assistance services.

In addition, you can nominate another person or organization (nominated) to communicate with Centrelink or the Family Assistance Bureau on your behalf.

Q: what are the rights and responsibilities of the welfare applicant?

A: if you want to get payment, you must meet certain provisions and conditions. Otherwise, the payment you receive may be affected or even stopped. If you receive benefits, you must notify Centrelink when your current situation changes to ensure that you receive the correct amount of benefits. At the same time, you must read all Centrelink letters to you, if necessary, to respond in a timely manner.

Changes in the status quo include: your income change, living arrangements change, marry or separated change, starting or suspending change, starting or stopping working change.

Q: will the applicant`s information be protected?

A: yes, I will. Centrelink or the Family Assistance Bureau will disclose your personal information only if law allows or you have already provided permission.

Reprinted from: the Voice of Hope