Today's article, should be counted as a literacy post, the main is to tell you: in Australia, where do my pension come from? What exactly do we mean by "pension"?

Four stories:

1. International students: George

George has been studying in Sydney for more than a year. After school he will go to the retail store to work. On the day of pay, the missing part of Superannuation Guarantee's salary on the payroll confused him every time. George also asked his boss and co-workers. He was told that it was an Australian pension contribution.

"I do not know whether to stay in Australia or return to China. Hard work, but each year to pay hundreds of dollars in vain! An Australian pension that may not necessarily be used in the future. "

Every time he thought about it, George was a little depressed.

II. Accountants: Jessica

Jessica., who has emigrated to Australia for many years, is also depressed recently. She has just returned from maternity leave after nearly eight years as an accountant at a local company. As a mother of two, Jessica came back to work six months later to earn milk powder.

Recently I received another letter from Super Fund. The letter says there are now $53679.Jessica in her account that are inherently numeral-sensitive, especially money-related numbers. She vaguely remembers the letter she received before she went to maternity leave six months ago to say that she had about the same amount of money in her Super.

"for such a long time, the children grew up and the money in the pension didn't rise much. I don't know where the old-age money is invested, so it's better to take it out and pay off the mortgage. "

Although it is known that the money in the pension is not available now, Jessica still has some disgruntled pension assets crawling quickly. Her colleague advised her to change to a Super Fund..

But choosing an Super Fund is harder than choosing banks, mortgages and insurance. Faced with hundreds of Super Funds, and every Super Fund offering dozens or even thousands of freely chosen investment products, Jessica doesn't know where to start.

Third, parents emigrate: aunt Zhang

Jessica's mother, Aunt Zhang, has retired for three years.

After retiring, her daughter paid to emigrate to Australia for both herself and her partner. At the age of 60, she has to come over every year for half a year to help her daughter-in-law take care of her children. Recently the big grandchild went to kindergarten, the little granddaughter also did not need to get up to drink night milk.

Aunt Zhang and the old companion also have some time after dinner to go out for a walk in the park. In addition to controlling blood sugar, chatting with old friends in the park can always find new problems.

"my daughter said she'd be able to get a pension after she was 60, but we didn't work here. Where are we going to get it?"

"No," said Zhao Lao, whom I know. "it takes 65 years to get a pension from goverment!"

"I hear it takes five years in a row to get it."

"come on, I heard I'm going to be living for more than 10 years."

"how much can goverment give?"

"Lao Li next door to my house can get more than 20, 000 Australian dollars a year, or nearly one hundred thousand yuan!"

"how could there be so much! The old Hu couple I know can only get more than $30,000 a year. Say it is the highest, a person who has more than $20,000 ah! "

"it's as if everyone has different things. They need to be calculated on their own."

"it's so troublesome! How does it count? "

「…」

Aunt Zhang heard more confused, thinking of going home to ask her daughter how to get the Australian pension.

IV. Self-employed: Steven

On the way home, Aunt Zhang passed by the familiar coffee shop again. Coffee shop owner Steven is teaching the newcomer to work on the coffee maker.

Steven, who has been in Australia for more than 20 years, is glad that he quit the Taxi business five years ago before Uber was in Australia, and bought the coffee shop with the money to sell his Taxi licence.

I've heard friends say it's a good idea to buy an investment home with Self-Managed Super Fund (SMSFs). Steven's mind went up a couple of times in the last few years when house prices soared. But the shop had kept him busy and had no time to find out what to do.

"make the coffee shop a little better and sell it when you retire, and you're not nearly old-age enough."

Steven thought out, smiling and greeting Aunt Zhang. .

We may see the shadows of ourselves, friends or family in these four stories.

Whether they are working abroad, new entrants to the workplace, old Australia, or new immigrants who have just landed, Australia's pension system seems to be inextricably linked to us, but not clearly seen.

In fact, not just foreign students and immigrants, even the vast majority of native people do not know much about pensions.

This confusion and confusion are also reflected in our usual words. The term "old-age pension" is sometimes referred to as the goverment old-age benefit in Aunt Zhang's chat, and sometimes the personal pension fund George,Jessica and Steven think of (Superannuation or Super).

These systems, which we refer to as "pension", are all important parts of the Australian pension system, but there are great differences in the sources of funding, coverage, level of treatment, age of receipt, and so on. In addition, there is a close relationship between them, which needs to be interpreted as a whole.

"We are all called pensions, but we are not the same!"

by Age Pension & Superannuation

Australia's current pension system is made up of three important parts. We often call it a "three-pillar" system. The pension "three pillars" system here is divided according to the pension responsibility, which is quite different from the pension system in China, which is divided according to the industry and region (such as civil servants and institutions, urban workers, urban and rural residents).

As can be seen from the chart above, in Australia's "three-pillar" pension system design, the pension responsibility (that is, the source of pension funds) is shared by goverment, employers (enterprises) and individuals (employees).

1 goverment's responsibility:

Basic, through the welfare of the elderly (Age Pension) to achieve the minimum living security of the elderly.

(2) the employer's responsibility:

Help employees with mandatory pension savings. Mandatory pension savings are realized by depositing mandatory employer contributions (Superannuation Guarantee Contributions) into the employee's private pension fund (Superannuation Fund or Super Fund). The minimum statutory requirement now is 9.5% of employees' daily wages.

(3) individual responsibility:

For individuals, even with goverment's guaranteed benefits (Age Pension) and employers' mandatory savings (Superannuation Guarantee), most people are still unable to maintain the equivalent of pre-retirement water after retirement.

In order to achieve this goal, the individual's responsibility is to realize the retirement living standard that the individual wants to achieve through voluntary and independent pension savings and investment.

This includes investing more money in pension fund (Super Fund) through voluntary contributions of (Voluntary Contributions). Retirement savings and investments are carried out outside the pension fund by (outside super). For example, investing in stocks, bonds, funds and other financial products, operating private enterprises, investment in real estate and so on.

Therefore, the main characteristics of Australia's "three-pillar" pension income system are:

- Pillar 1: goverment benefits to guarantee basic living standards

- Second pillar: employers' contributions to achieve mandatory pension savings

- Third Pillar: self-financing, providing additional Old-age income

The first pillar is the (Age Pension) system, which is run and managed by goverment. (in the previous story, Aunt Zhang called it "old-age pension").

And the second pillar of the employer mandatory pension fund contribution (Superannuation Guarantee Contributions), And the third pillar of the individual voluntary pension fund contribution (Voluntary Contributions) part of the private sector run by the individual pension fund (Superannuation) system (George,Jessica and Steven in the previous story referred to as the "pension").

Let's take a separate look at the main features of each pillar.

Pillar 1: goverment benefits to guarantee basic living standards

The responsibility of goverment is to safeguard the basic, by relying on the "first pillar" of goverment finance-the (Age Pension) for the elderly, which covers all citizens (that is, permanent residents and citizens), to achieve the minimum security of living for the elderly.

The Australian Federal goverment Old Age benefits (Age Pension) was established in 1908.

This year, Australia's national emblem was approved by King Edward VII. The capital was eventually chosen in Canberra between Sydney and Melbourne.

In China in the same year, Emperor Guang Xu, 38, and Empress Dowager Cixi, 72, died successively, and Puyi, 3, the last emperor, ascended the throne.

The main features of the goverment (Age Pension) Age Pension can be summarized as follows:

- Poverty prevention (minimum security)

- Goverment pays (from tax)

- National benefits (non-contributory)

- To be rich and compassionate to the poor (financial test)

- Individual application (family unit)

Specifically:

1. Prevention of poverty (minimum security)

The purpose of goverment (Age Pension), which aims to realize the minimum living security of the elderly, is consistent with that of the domestic minimum living allowance. In other words, if an elderly person does not have any other source of income, the (Age Pension), which relies entirely on goverment, can achieve the most basic standard of living for the elderly without falling below the poverty line in Australia. The (Age Pension) pillar provides a social safety net to prevent old-age poverty.

The minimum standard of protection used by the (Age Pension) is uniform across Australia. In other words, whether the elderly live in new state, Victoria, urban or rural, the full old-age benefit (Full Age Pension Rate) is the same. Regardless of the age of the elderly (by 2018 standards, men and women are eligible to apply for 65.5 years of age or above. The age is expected to rise by half a year every two years to 67 in 2023, according to the current plan. There is a good chance that they will continue to improve) and that they will receive full old-age benefits in the same way as their gender.

The Age Pension guarantee standards are defined in accordance with single (single) and husband and wife (couple) respectively. Couples' benefits are not twice as high as being single, but about 1.5 times that of singles. This is because the two people who live together can share a lot of fixed expenses, such as city fees, water charges, vehicle registration and insurance.

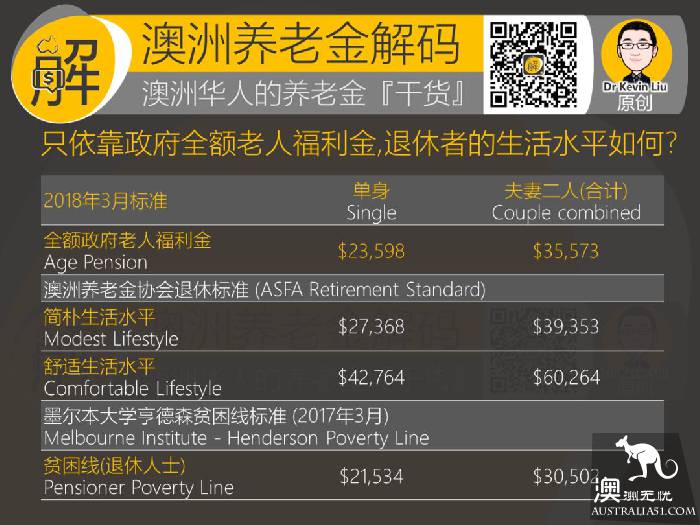

According to the standard of March 2018, the single full old age benefit (Full Age Pension- Single) is $23597.60 a year, and the husband and wife's (combined) full old age benefit (Full Age Pension- Couple is $35573.20 a year. Old-age benefits are automatically raised every six months with inflation indicators.

It is important to note that if only one of the couple meets the eligibility criteria (for example, the husband is 66 years old and the wife is 63 years old), the person who meets the criteria will receive half of the amount of the husband and wife (total), or $17786.60, Instead of a single full $23597.60.

It can be seen that the status of spouse relationship of elderly benefit applicants (relationship status) will affect their applicable benefits criteria: whether to adopt single (single) or marital (couple) standard. It is important to note that according to Australian regulations couple includes not only registered married couples (married), but also cohabitation / de facto marriage (defacto relationship, spouses.

For example (the following characters are all fictions)

Zhao Kelian, a 66-year-old man who has no property or income, is a 66-year-old man who has no marriage and no property or income. So the amount of old-age benefits that Lao Zhao can receive is $23597.60 a year of single full (Full Age Pension-Single.

Another old man, Li Youwu, also 66, has neither registered marriage nor any property or income. But Lao Li has a 63-year-old spouse, Wang Tong-ju, who has a cohabitation relationship with (de facto relationship).

Although Lao Li's spouse, Wang Tong-ju, has neither officially registered a marriage nor met the age requirement for the 65.5-year-old application for welfare benefits for the elderly, Lao Li will still receive up to half of the full benefit (Full Age Pension- Couple of the husband and wife, or $17786.60 a year, because he has a cohabiting spouse.

Moreover, for retirees with private assets and incomes, especially when there is a sizeable balance in (Superannuation), the private pension fund that has just retired, most people do not receive full old-age benefits (Full Age Pension). Because the actual payment of old age benefits needs to be calculated and adjusted on the basis of the applicable full amount of old age benefits (means-test), and the private pension fund asset (Super) is also included in the financial test, We will read it in detail below.

So, what is the standard of living for the elderly who can receive the full old people's welfare allowance (Full Age Pension)?

Elderly people who rely solely on full Age Pension retirement (healthy and have a house, that is, no rent or mortgage payments) can only achieve a slightly higher retirement than the Australian poverty line, a little bit less than the simple retirement of water. And from the comfortable retirement of the water products are far from each other.

This reflects the purpose of the first pillar, the responsibility of the goverment is to ensure a minimum standard of living. In order to achieve a better retirement life needs to be achieved on their own.

2, goverment pays (from tax)

The elderly benefits (Age Pension) uses the goverment-managed pay-as-you-go (pay-as-you-go) model. That is, goverment provides funding through taxes and other revenue and is reviewed, managed and distributed by the goverment division, the Australian Social Welfare focal Point-Centrelink.

3, National benefits (non-contributory)

Old-age benefit (Age Pension) is national welfare, not social insurance (social insurance or social security), requires a contribution, and enough years of contribution can be received. For example, more than 15 years of social security contributions. Welfare is not required).

This means that (Age Pension) benefits for the elderly are only related to national status (permanent residents or citizens). And meet the residence requirements: at the time of application, I was in Australia and maintained Australian resident status for more than 10 years, including at least five consecutive years of residence in Australia. There is no need to pay taxes or contributions from individuals or employers (that is, it has nothing to do with the history of work: whether or not there is a job before retirement, in the goverment sector, in the private sector, in the self-employed or unemployed, and whether there is a tax record that does not affect Age Pension claims).

4. Rich and Poor (Financial Test)

The (Age Pension) for the elderly, which aims to prevent poverty, is a directed (targeted) goverment benefit, rather than a generalised (universal) goverment benefit (that is, everyone can receive the same pension, rich or poor).

The (Age Pension) is paid only to the elderly who rely on their own financial resources to provide for their old age.

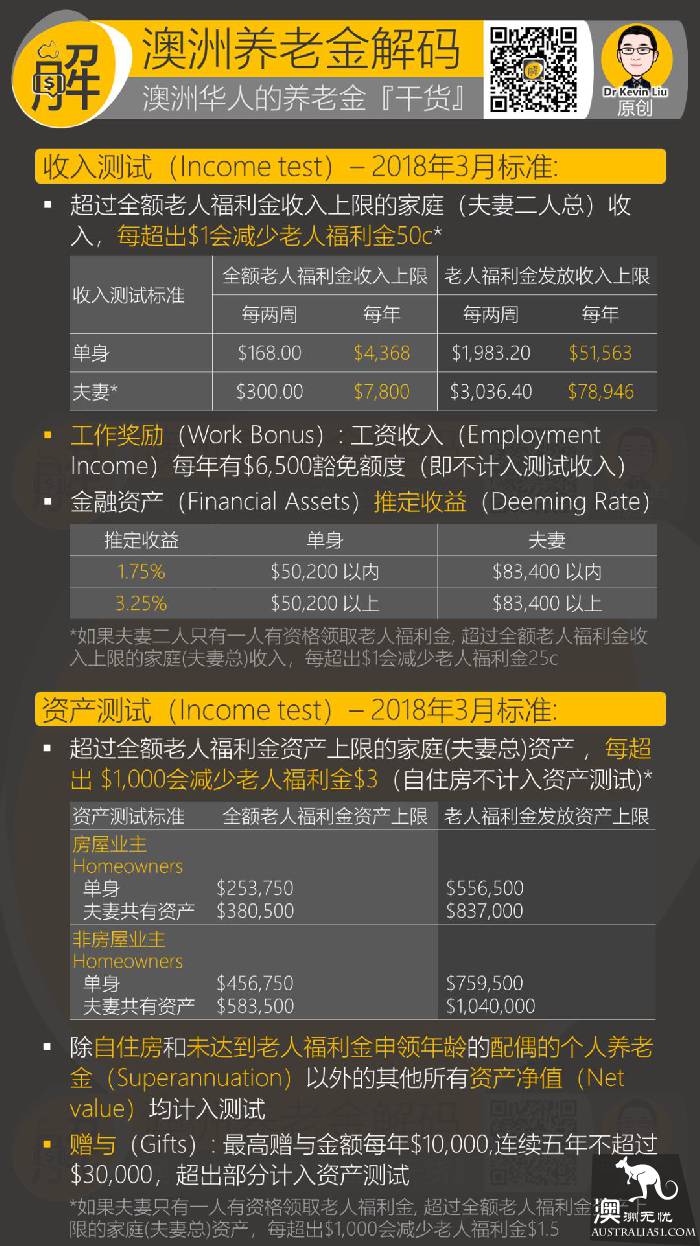

To determine whether an individual has the financial means to provide for the elderly, (Age Pension) applicants need to undergo a financial test of (means test). The test consists of two independent tests: the income test (income test, (personal financial flow) and the asset test (assets test, (personal financial inventory) (see chart below for income and asset categories included in the test).

If a person's financial resources exceed the goverment criteria for income and assets (which means that each household can only have one set of Principal Home not included in the asset test), the actual amount of (Age Pension) disbursed from the elderly benefits will be reduced accordingly. Until the goverment cap on income and assets is exceeded, it will no longer be issued (see chart below, which will also be raised annually to accommodate inflation).

5. Individual application (family unit)

Old age benefit (Age Pension) is an application for payment and will not be paid automatically after the elderly meet the age requirement. In other words, if an elderly person has met the requirement at the age of 65.5 but does not apply until the age of 68, then the payment of the old-age benefit (Age Pension) begins at 68 years of age when the application was submitted, not 65.5 years of age when the claim is met.

Although the pension is an individual application, both the property and income of both parties are included in the financial test of the applicant for the husband and wife (couple). The couple standard here also includes couples who have registered marriages, (married), and both cohabitation / de facto marriage, (defacto relationship, heterosexuality, as mentioned above.

give an example

Let's take the old man, Li Youwu, mentioned in the above article as an example.

Li, 66, did not register for marriage and had no property or income. But Li has a 63-year-old spouse who has a cohabitation relationship, (de facto relationship).

We mentioned above that although Lao Li's spouse, Wang Tong Ju, has neither officially registered marriage nor met the 65.5-year-old entitlement age requirement. However, Lao Li will still receive full benefit (Full) from husband and wife (total) only because he has a cohabiting spouse.

Half of Age Pension-Couple, or $17786.60 a year.

For an elderly person with a spouse, the old age benefit is tested in a family unit (two spouses). Therefore, Lao Li's cohabitation spouse Wang Tongju's income and assets will also be included in Lao Li's financial test, even though Wang Tongju has neither officially registered marriage nor met the 65.5-year-old eligibility age requirement for welfare benefits for the elderly.

Therefore, if Wang Tongju has a good job. For example, an annual income of $900,000. Then, according to the financial test, Lao Li will lose his eligibility to receive the old-age benefit (Age Pension).

If Wang Tongju has an investment house worth $1100000 in the suburbs of Sydney. Then according to the property test, Lao Li will also lose eligibility for any old-age benefit (Age Pension).

Because the (Age Pension) test of getting fewer benefits for the elderly in the asset and income test will be used, any one of the assets and income that exceeds the goverment ceiling will disqualify the applicant.

"it can be seen that if one of the couple is younger and the older spouse applies for old-age benefits, if the young spouse still has a well-paid job (for example, Lao Li's spouse has an annual income of $90000, as mentioned in the example above), Older applicants will lose their eligibility by failing the income test. This is why we find that many couples of different ages in Australia choose to retire at the same time with older spouses even when they are not yet eligible for old age benefits. "