All aspects of medical care in Australia are universal!

Australia is a country that attaches great importance to health care, health care benefits, health care system is very perfect, especially for women medical examination welfare policy, but also world-class.

Australia`s government, for example, has been investing more since 2015 to help women detect breast cancer, extending the age range to 70. The budget was increased by 55 million patacas per year.

In addition to epidemic prevention, Australian health policy is very caring for women, all kinds of medical tests are the top in the world.

It is necessary for women to do regular gynaecological examinations every year, especially for women with a sexual life history. Gynecological examination is a very common examination, mainly vaginal, cervix and uterus, fallopian tube, ovarian and parietal tissue and pelvic cavity wall. The main role is to make early diagnosis, prevention and early treatment of some gynecological diseases.

What circumstances need to do gynecological examination?

1: excessive mental tension

Premenstrual tension syndrome, mainly caused by endocrine disorder, can be alleviated by self-regulation. If you are in a state of tension for a long time and are accompanied by severe physiological reactions, you can go to gynecology for endocrine examination and, if necessary, take oral hormone therapy under the guidance of a doctor.

2: excessive pain

Dysmenorrhea and sexual intercourse pain are common problems for women, especially dysmenorrhea. The general degree of dysmenorrhea belongs to a tolerable range. For long-term unbearable dysmenorrhea, should not blindly take painkillers patience, should do a gynecological endocrine examination to see if they suffer from Endometriosis.

3: excessive menstruation

Menstruation is caused by a variety of reasons, uterine myoma is one of the important factors. There is a close relationship between uterine myoma and estrogen level. In addition, luteal dysfunction can also lead to excessive menstrual volume.

4: when vaginal itches repeatedly

For unexplained long-term, recurrent vaginal pruritus, endocrine factors need to be considered and endocrine examination should be carried out. Do not find the root of the problem, blind use of drugs, not only can not cure the root cause, but will lead to drug resistance, leading to chronic diseases.

So the question is, what kind of tests do women need to undergo on a regular basis?

1. B ultrasound examination

B ultrasound is a way of ultrasonic examination, is a non-surgical diagnostic examination, generally in clinical application. No pain, no injury, no radioactivity, no pain, no damage, no radioactivity, can be safely examined.

B-ultrasound can clearly display all kinds of cross-section images of each organ and its surrounding organs. Because the images are solid and close to the true structure of anatomy, ultrasound can be used to make a definite diagnosis at an early stage.

2. Gynecological internal examination

Internal examination is one of the routine gynecological examination methods. Peeper can be used to carry out vaginal related examination, or vaginal internal diagnosis and triplet diagnosis can be carried out.

Many diseases can be found by internal examination, including vulvar tumor, vaginal inflammation, leucorrhea, cervical inflammation, uterine leiomyoma, ovarian tumor and other diseases.

3. Cervical smea

Cervical smear examination is the routine method of cervical cancer screening at present. For women over 30 years of age, cervical cancer screening should be carried out regularly if contact bleeding occurs. The first thing to do is cervical smear examination. Cervical smear examination was to take cervical exfoliated cell smears and then fixed them with alcohol. Pap staining was used to observe the morphology of the cells in order to find out whether there was cancer or not.

4, HPV test

HPV is the abbreviation of human papillomavirus. It is a small DNA virus. It has many types and can cause a variety of benign papilloma or warts in human skin and mucous membrane. Some types of HPV infection also have potential carcinogenicity. HPV test mainly detects whether people carry HPV virus, which can be detected by staining microscope, DNA test of HPV or serological test to check whether HPV. is infected or not. HPV infection in reproductive tract of women is a common sexually transmitted disease. 50 per cent of sexually active women may have been infected with at least one type of HPV.

5. Urine routine

Urine routine is one of the three routine tests in clinic. As a fecal examination, urine reflects the metabolic status of the body and is an important index for the diagnosis of many diseases. Many kidney lesions can appear proteuria or visible components in urine sediment in the early stage. Abnormal urine routine is often a sign of kidney or urinary tract disease. Routine urine tests include urine color, transparency, pH, red blood cells, white blood cells, epithelial cells, tubular, protein, specific gravity and urine sugar.

6. form of examination: leukorrhea routine

Leukorrhea test is also relatively simple, doctors will take a small amount of leukorrhea from the vaginal, sent to test. Leukorrhea test can find the source of disease including some bacterial infections, inflammation, transmitted diseases and so on, the examination report will also indicate the extent of the corresponding disease.

Through all the above tests, it is basically possible to make a comprehensive assessment of the health status of women. On the basis of familiarizing with the source of all the diseases, we can communicate more fully with the doctor, and have a better understanding of the examination report and achieve better health management.

Today, the focus of the point, although many of these inspections are fee-paying items, but through some public insurance and private insurance, can achieve free!

Whether Australian Chinese, permanent residence, citizen or foreign students must know the specific details of Australian insurance, including the basic content of Australian medical insurance, how to reimburse medical expenses in Australia, Australian private insurance categories and so on, of course, in the spirit of learning, welcome to leave a message to discuss!

When it comes to insurance, are the friends of China disdainful? Because in China, the insurance industry seems to have a poor reputation, which is often synonymous with "cheating" and "neglecting people". Usually there is no disaster is not difficult, why to send money to the insurance company?

But have you ever thought about the little premium you pay each year, which may solve major problems for you when you need it in the future?

Existence is reasonable, not to mention now the domestic insurance industry is also booming. With the progress of the times and the standardization of the market, more and more people will begin to understand insurance and contact with insurance.

So before you start studying insurance in Australia, you have to put aside the prejudice against insurance. In Australia, private health insurance is a "supplementary version" of free medical Medicare in Australia, which will "upgrade" and "reinforce" your overall health insurance!

It is right to spend some money, because we can not predict whether there will be emergencies in the future, the monthly premium we pay is their own "advance" to their own peace of mind in the future.

Of course, choose which company, what kind of insurance, to reasonably analyze their own and family`s genetic history and current medical needs, in the budget, the choice of the most suitable type of insurance is the wisest choice, just like financial management, you need to change the corresponding type of insurance with the change of your body.

1. Australian National Health Insurance Medicare

What is Medicare?

Medicare is Australia`s federal health care system that covers most health care expenses and provides quality health care and security for citizen and pr in Australia.

You can only choose Medicare as your only health insurance, or you can combine Medicare with private health insurance, so that some items that Medicare does not reimburse through private insurance compensation, will make your life and health more secure!

What health care does Medicare provide?

The scope of Australian federal health care system protection mainly includes: hospital medical (Hospital), outpatient medical (Medical), drug welfare (Pharmaceutical).

Australian Hospital Medical Service Hospital

The most basic hospital medical services:

According to the list of National Health Insurance benefits (MedicareBenefits Schedule,MBS) developed by government, Australia, (PublicPatient) + Medicare: provides free access to accommodation, treatment, care and continued treatment in Australian public hospitals. Medicare will pay 100 per cent for Australian public hospitals.

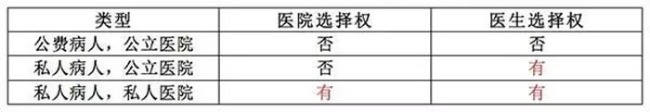

But! As a public patient, you don`t have a doctor to choose from, you have to be assigned by the hospital to see you, you can`t choose when to stay in hospital or operate, and you have to live in a large ward with other patients. (with the exception of emergencies)

Public patient Medicare private insurance: you can choose Australian public hospitals as public patient hospitalization, of course, you have to accept some drawbacks.

But! After you have private insurance, you can choose a more advanced and convenient private hospital.

Private patient (PrivatePatient): as part of the cost of medical services for private patients in Australian public or private hospitals can be reimbursed by Medicare according to 75 per cent of the MBS standard.

Other expenses, such as sick room fees, nursing expenses, etc., need to be taken care of by individuals or paid by private health insurance companies.

In general, no matter what visa you are, going to an Australian public hospital won`t cost money (except for medicine, of course), but it`s hard to say how long it takes to get sick.

Australian outpatient medical Medical

In this case, the Australian National Health Insurance Medical refers to medical institutions outside the hospital, such as general and specialist clinic, medical center, laboratory center and so on.

If you have Medicare, you can see GeneralPractitioner (GP family general practitioner at the clinic) without a penny, and if you see Specialist (specialist) MBS, you can reimburse 85%.

As long as you hang (BulkingBilling) in front of the clinic you go to, you don`t have to spend a penny!

Australian Drug Welfare Pharmaceutical

Medicare provides prescription drug subsidies to patients under Australia`s government drug benefit (PharmaceuticalBenefits Scheme, PBS).

Government has a clear list of prescription drugs, with individuals paying Co-payment for each prescription drug.

Different prescription drugs have different fees, and the 2015 standard is that the self-payment for each drug does not exceed $37.70.

However, in Tu`ao, not all drugs belong to the welfare program oh, some still have to pay out of their own pocket.

In Australia, poor people who are seriously ill don`t lose money buying drugs every day, because government has a drug-safe whole network program, (PBSSafety Net), which aims to help people control spending on drugs without causing economic difficulties.

The 2015 threshold is $1453.9. After personal or family drug spending exceeds this threshold, you can get a discount card (PBSSafety Net card). From the pharmacy.

When you need to buy prescription drugs, you only have to pay no more than A $6.10 per drug.

Government adjusts the critical line of the drug who network every year. The system of western countries is perfect, it is worth learning and learning, so that there will not be so many poor people once they are ill.

In addition to the whole network program, Australia also has the National Health Insurance (NHS) whole network (MedicareSafety Net).

National Medical Insurance whole network mainly includes: general and specialist diagnosis and treatment expenses, medical imaging examination (ultrasound, CT, X-ray, MRI, etc.), as well as the cost of other medical tests.

The National Health Insurance whole network does not include the cost of treatment in the hospital and the payment of (BulkBilling) by transfer.

You can get this security as long as you register with Medicare to join the National Health Insurance (NHS) whole network,.

When medical expenses reach the Ann whole network threshold, Medicare will inform you that more expenses can be reimbursed from Medicare when Medicare medical services continue to be used in the current year.

For example, if you have a chronic disease and need to see a doctor frequently for an examination, are you worried about the burden of the cumulative cost of seeing a doctor?

This Ann whole network can help you reduce the cost of medical care when you visit a medical facility outside the hospital.

When the medical expenses of an individual or family reach a critical value, the cost of seeing a doctor in a clinic or medical center outside the hospital can be reduced.

From January 1, 2016, Medicare can reimburse another 80 per cent of its own medical expenses when individuals / families see a doctor in a medical institution outside the hospital (Out-of-PocketCosts), that is, after the difference between the actual medical expenses paid to the doctor (up to 150 per cent of the MBS standard) and the difference between the Medicare reimbursable expenses exceeds a certain amount. Depending on the family situation, the difference standard is $400, ≤ 700, or $1000.

Detailed explanation of the scope of reimbursement

Medicare reimbursable out-of-hospital medical services are:

Fees for the diagnosis and treatment of general practitioners and specialists;

Medical laboratory examination fees operated by doctors, such as X-ray, pathological examination, etc.

Ophthalmic examination operated by an ophthalmologist;

Most of the operations and treatments performed by doctors;

Partial dental surgery performed by dentists approved by government;

And other Medicare approved medical services.

Medicare non-reimbursable out-of-hospital medical services are:

Physical examination required by life insurance, pension management company, or other member organization (such as insurance company, employer, or government agency);

Receive medical treatment that is not needed clinically, such as cosmetic treatment, etc.

Ambulance costs (state government in some regions provides free ambulance services for retirees and low-income people or residents of the state, such as Kunkun and Ta provinces);

Most dental examinations and treatments;

Most of the costs of physiotherapy, artificial limbs, spinal massage, home care and so on;

Acupuncture (unless recommended by the doctor);

Myopic glasses and contact lenses;

Hearing aids;

Family care;

The medical expenses of the cardholder abroad.

Warm Tip

If you have to need medical services that Medicare can`t reimburse, and worry that the costs may exceed your personal affordability, you can choose an Australian private health insurance that suits your health needs to help share the costs.

If you need X-ray, MRI and other medical examinations, you must choose an imaging treatment center registered with Medicare before Medicare will reimburse the related medical expenses.

How do I reimburse medical expenses?

In general, after seeing a doctor in Australia, the doctor can send the bill directly to the Medicare department for settlement, or the patient can pay first and then apply to the Medicare for reimbursement.

1. You can reimburse you directly when you see a doctor in a clinic.

Many Australian doctor`s offices offer Medicare electronic reimbursement (Medicareelectronicclaiming) services. Clinic staff can help apply directly through the Internet, Medicare will reimburse the expenses directly to your account, is it very convenient?!

two. Check out directly with Medicare by the docto

The transfer charge system of Australian National Medical Insurance (BulkBilling) refers to the fact that when a doctor collects medical service fees according to the (MedicareBenefitsSchedule) standard of Medicare`s national health insurance benefit list, patients do not have to pay for diagnosis and treatment after seeing a doctor, but the doctor`s clinic accounts for medical expenses directly with Medicare.

If the doctor can transfer the charge, you don`t have to pay, just sign the corresponding form and hand it over to the Medicare.

If the doctor`s fee is higher than the Medicare reimbursement rate, for example, the general practitioner`s outpatient fee Medicare stipulates a reimbursement of $37, while many general practitioners charge $60 / 70. In this way, you will have to pay the medical expenses and then apply to Medicare for reimbursement.

3. Go to the Medicare office to reimburse

There are more than 200 Medicare offices across Australia. All you have to do is take the receipt and universal health insurance card to the Medicare office for reimbursement. Generally speaking, there are large community shopping malls in Westfield. But there are a lot of people who are reimbursed. They have to be arranged as soon as possible.

Of course, you can also apply for Medicare reimbursement via email, telephone, or online. Send a receipt for medical treatment (not a health insurance card) to your state`s Medicare office.

4. Medicare pays the medical expenses directly at the time of hospitalization.

If you are admitted to a public hospital as a public patient, as long as you show your national health insurance card, the hospital will not charge hospitalization and medical expenses that fall within the scope of Medicare reimbursement.

Medicare Levy Surcharge

In Australia, the higher the income is paid more taxes.

Are you scared?! Haha, who makes you earn more, then make some contributions to society!

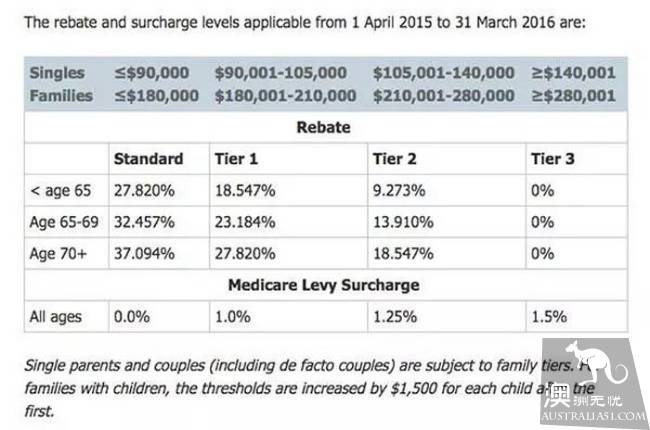

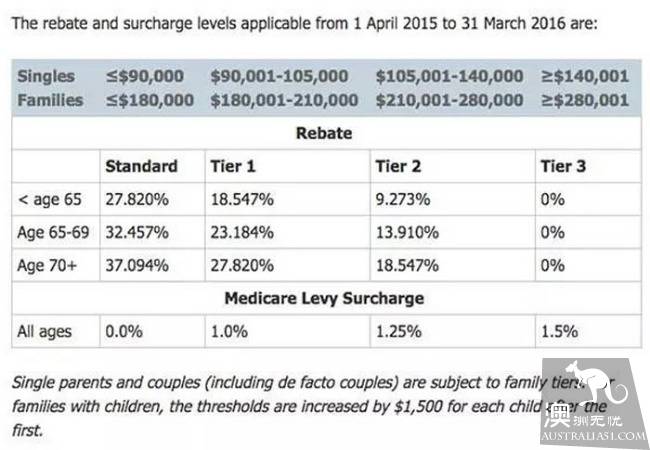

According to the 2015-2016 standard, if a family with a personal income of more than $90000 or a family income of more than $180000, if there are minor children, the tax standard for each child`s household income will be increased by $1500, and if the income exceeds this standard, the MedicareLevy Surcharge. will have to be paid at a rate ranging from 1 per cent to 1.5 per cent. For more information, please refer to the following table:

However, if a high-income person buys an additional supplementary private hospital insurance (HospitalCover), at an insurance company approved by government and the annual self-paid (Excess) of personal insurance is not more than $500, or the annual self-paid (Excess) of family insurance is not more than $1000, he or she can be exempted from supplementary insurance tax!

Does it feel subtle? Government in order to get everyone to buy private health insurance, for free medical decompression is really broken ah, changed the law to let us buy.

Australian private health insurance

To put it simply, when you have Medicare Australian National Health Insurance, you can choose to spend more money and get more health care.

For example, the dental examination mentioned above, optometry and mirror, etc. (depending on the type of private insurance you buy).

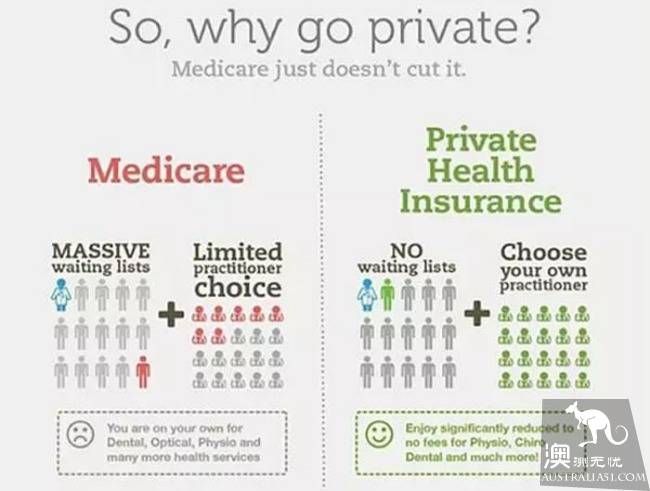

Most important of all is the problem of slow queue and delayed treatment of publicly funded australian health care, which has been widely criticized.

For example, you need a life-free minor operation, which is called selective surgery in Australia, and you may have to wait a few weeks to treat it in the hospital of your choice. Public patients, on the other hand, often have to wait for months or years.

Warm Tip

Australian government also provides insurance premiums and tax exemptions for participating in private health insurance. Who asked you to contribute to reducing the burden of public health care?

Australia has a special government official website to popularize all kinds of knowledge of private health insurance.

The content of the website is mainly divided into the following parts: explain what private health insurance is? Who can buy private health insurance, what types, and what (Coverage) are included in the health insurance terms? Compare the private health insurance companies you are interested in.

Who can buy private insurance?

Almost anyone in Australia can buy private insurance.

Australian officials have listed six main groups: single, a pair of Couple, families (2 adults + underage children), special families Pack (2 adults + adult or minor children), single parent families (1 adult + minor children), special single parent families (1 adult + adult or minor children), children (minor).

Warm Tip

Some private insurance companies need you to provide birth certificates for others in the same pack or relationship certificates for your relatives.

The official term for a minor is Dependant, an adjunct, unmarried and under 18.

For example, your child is 22 years old and a full-time student. (Full-timeStudent)

What is included in private insurance in Australia?

Australian private health insurance usually includes: hospital insurance (HospitalCover), additional insurance (GeneralTreatment Cover or Ancillary or Extras Cover), ambulance insurance (AmbulanceCover).

Hospital insurance HospitalCove

Hospital insurance refers to helping to pay all or part of the expenses incurred during hospitalization, including doctor`s service charge, inpatient accommodation fee, operating room fee, drug cost, and ambulance fee if necessary.

In general, Australian private hospital insurance includes the basic hospital insurance provided by the National Health Insurance Medicare, and increases Medicare non-reimbursable hospital services according to different types of insurance.

For example, privatepatient receives medical services in both public and private hospitals. Medicare reimburses 75 per cent of the cost according to the MBS standard, and the private insurance you buy will reimburse you the remaining 25 per cent and other expenses.

Rights profile table

From the table, we can certainly feel the convenience and benefits of private insurance, but according to the different premiums, the protection content of the insurance plan is also different, the two are dialectical relationship, the more the protection content, the higher the corresponding premium.

Warm Tip

Suitable for use by the elderly. The elderly are prone to slow venereal disease. Public treatment is free, but there are often long teams in Australia, which is the use of Hospital Cover. You can go to a private hospital to avoid a long queue.

Suitable for having children, you can have an expert to take care of and observe the whole process.

You can avoid tax. If your personal annual income exceeds $90000, not buying HospitalCover will result in 1 per cent of your income being taken away by the Inland Revenue Department.

Additional insurance GeneralTreatment Cove

Additional insurance, also known as ExtrasCover, as the name implies, includes the general treatment (GeneralTreatment) or auxiliary treatment (AncillaryCover). That does not fall within the scope of Medicare reimbursement.

Such as dentistry, physiotherapy, acupuncture, spinal finger pressure therapy, lens and contact lenses, home care, hearing aids, artificial limbs and so on. (general additional insurance limits the amount of reimbursement for these assistive treatments)

ExtrasCover can be bought alone or with HospitalCover. Note, however, that buying ExtraCover, alone without buying HospitalCover does not exempt high-income families / individuals from 1 per cent of taxable income MedicareLevy Surcharge.

In addition, ambulance insurance is also included in ExtraCover. There are also insurance companies that accept separate ambulance insurance.

This is the insurance we usually need to see our teeth! When comparing types of insurance, you should pay attention to the following points:

Insurance is generally ordinary dental (General Dental), major dental (MajorDental), ophthalmic (Optical) and others, when buying insurance, you should pay attention to whether the insurance product includes major dental (MajorDental). Otherwise, root canal therapy, porcelain crowns, correction and other expensive items are not included.

The amount of compensation paid for each treatment item. This is usually marked as a percentage. Medibank Basic 70, for example, pays 70 per cent of the cost of treatment per treatment program., Bupa Silver Extras pays 60 per cent of the cost of treatment per treatment project.

For example, Medibank Basic 70 has a $700 annual general dental cap, and Bupa Silver Extras has Unlimited.

Monthly premium

Warm Tip

Large dental insurance companies are: Medibank,Bupa,HCF, NIB.

Summary:

1, large companies are more expensive, but the service is better, suitable for the elderly and people who do not understand English.

2, choose a big company, basically can only see a doctor in a signed clinic of a big company, otherwise it will suffer a lot, unless the doctor gives you a discount on his own initiative.

Small dental insurance companies are: HIF, FRANK, AHM, etc.

Summary:

1, small companies are cheaper, the amount of compensation is higher, but there is no market store, the advertising effect is not as simple and clear as the big companies, and the threshold is higher.

2. Now doctors have Hicaps on-site payment machines in the clinic, and can pay by swiping the insurance card directly. The difficulty of paying small companies in the past no longer exists.

In addition, with regard to the eyes, the EyeCheck usually done in the glasses store can only be reimbursed by Medicare. The Optical of Extra in private insurance does not include eye examination.

So under what circumstances do you usually find Optometrist for EyeCheck? Instead of looking for Specialist, Optometrist will give you a good answer.

Ambulance insurance Ambulance

Some private health insurance schemes include ambulance insurance, which is paid by the insurance company when an ambulance is needed. In Australia, government does not offer free emergency care in most states, and ambulance insurance varies from state to state.

How to replace Australian private insurance?

Everyone has the absolute right to change their own private insurance, no matter the company and the type of insurance can be replaced.

Government recommends Check your insurance every year to meet your health requirements and whether it`s within your budget.

Accordingly, insurance companies are not stupid, every year the coverage of each type of insurance content and terms more or less have a little change, the price will also change, so to develop a good habit of checking their own insurance oh, maybe one day to raise money, you do not know! (it usually varies in years)

Change company: you usually have a 30-day cooling-off period after replacing a new insurance company, during which time you may receive a full refund if you do not have any claim reimbursement.

Change insurance within the same company: insurance companies usually have FundLoyalty Bonuses. It means giving back to loyal customers. For example, cumulative points can lower your HospitalExcess or increase ExtraBenefits`s AnnualLimits..

However, it should be noted that after the replacement, many reimbursement items have to have a waiting period. That is to say, you can`t suddenly find yourself sick, immediately changed a higher amount of insurance, such a cost-effective account is not only you can think of oh, most of the items in your new insurance have to have a waiting period to reimburse!

Therefore, a good plan to change insurance, be a person with a long-term vision Oh.

Is it possible to suspend insurance?

If you want to stay abroad for a long time, such as returning home to visit relatives on vacation, traveling abroad for a few months or working abroad for a year or two, be prepared before you leave. How?

First of all, we should ask or inquire about the current policies of their own health insurance companies, explain their own situation, the policies of different insurance companies are generally different.

But most of you can apply for a suspension before leaving the country and renew it when you return to Australia. Be a meticulous person. Oh, oh, oh.

Private health insurance rebate policy PrivateHealth Insurance Rebate

This is the government subsidy just mentioned, but it is only suitable for residents who already have Medicare.

The specific policy is this: about 30 per cent of the premium (Premium) paid when buying supplementary private health insurance can be refunded from government in Australia.

For example, if you spend $1000 on private health insurance, government will return it to you for $300. As a result, the actual premium expenditure was $700.

However, the premium subsidies for the purchase of private medical insurance vary according to the income standard of individuals and families.

According to the 2015-2016 standard,27.82% of premiums paid by individuals earning less than $90,000 or households earning less than $180,000 for supplementary private health insurance can be refunded by government.

If the age is over 65, government can refund 32. 457% of the premium. The premium of 37.094% can be refunded when the age is over 70 years old!

After a personal income of more than A $140000 or a household income of more than A $280000, government`s private health insurance rebate will no longer be refunded.

So before buying insurance, it is best to confirm to the insurance company whether you can get a government insurance rebate on the insurance plan of your choice!

Lifelong health insurance LifeHealth Cove

This is also a trick for Australia`s government to encourage people to buy private health insurance.

The policy shows that if you join private health insurance before you reach the age of 31, you can waive the life-long health insurance surcharge.

If private health insurance is added after the age of 31, additional insurance premiums will have to be paid. After 31 years of age, for each additional age of one year, the hospital premium (HospitalCover) in your private health insurance increases by 2%, up to a maximum of 70%.

For example, if you start buying private insurance at the age of 40, you have to pay the premium, plus 2% x 10 x 20% premium as an additional cost of lifelong health insurance, so you have to pay a total of 120% of the premium (premium).

But!! If you are buying additional insurance (ExtrasCover), you do not have to pay additional insurance premiums for lifelong health insurance.

When you start buying hospital insurance in private health insurance before July 1 after your 31st birthday, (HospitalCover), doesn`t have to pay a lifetime health insurance surcharge.

If you buy private health insurance for more than ten years in a row, you no longer have to pay a life-long health insurance surcharge. But if you stop buying private health insurance, start paying a life-long health insurance surcharge again. Is it not easy to live in the world when you are tired and not in love?

If your parents emigrated to Australia, they would be over 30 years old, wouldn`t they? What can we do? Easy!

As long as the national health insurance Medicare within 12 months after the purchase of compliance with the private hospitalization insurance, you can be exempted from life-long health insurance surcharge!

After more than 12 months, the premium will increase according to the age. Be sure to remember! Be sure to remember! Be sure to remember!

3. Australian overseas students Medical Insurance AustraliaOverseas Student Health Cove

To study in Australia, the vast number of international students must be very clear, to study abroad is not able to participate in Australia`s National Health Insurance Medicare.

All international students must take out Australian overseas student medical insurance during the validity period of the student visa, and if the student visa is extended, you must also extend your insurance plan accordingly.

If foreign students have a spouse or children under the age of 18 who are in Australia, they must also take part in overseas student health insurance (it is clear here that parents of studying monks need to take out international travel health insurance when they visit their relatives).

OSHC payment is based on the current medical guidance charges. This means that international students can enjoy health benefits that are basically consistent with those of Australian residents under the OSHC policy.

What does OSHC insurance include?

The amount of reimbursement for in-hospital medical services (for example, general practitioners) on the list of medical guidance rates (MBS referred to above);

Inpatient medical services in (MBS) can be reimbursed 100 per cent on the standard list of medical guidance fees (for example, surgery);

Reimbursing public hospitals or private hospitals with agreements with insurance companies for room and board expenses for multi-person wards;

Each member will enjoy a drug reimbursement benefit of one year from a unit price of $50 to a maximum consumption of $300 ($600 for a family member). Overseas students are likely to face a huge cost of medical supplies, especially cancer treatment, without any appropriate insurance coverage;

Ambulance service.

What does OSHC insurance not include?

Expenses already advanced before going to Australia;

The extra expenses incurred on a trip to or leave Australia;

Overseas students sent out of Australia or dependent on Australian students for any reason;

Where compensation for damage and compensation has been received.

As you can see, the above insurance content is similar to the basic Medicare content, so if you want to enjoy more medical services, monks can also buy the additional insurance (GeneralTreatment or ExtrasCover), mentioned above, such as dental treatment, optometry, massage acupuncture, physiotherapy (Physiotherapy), podiatrics, spinal finger pressure massage (Chiropractor) and other auxiliary medical items.

How do I apply for medical insurance for overseas students?

When applying for a student visa, you must receive medical insurance for overseas students while studying in Australia. Usually, the school will work with an insurance company to provide medical insurance for monks studying abroad. Pay the medical insurance fee at the same time as paying the tuition fee. (if it is an international student funded by government, then Australian government comes to cover your insurance premium)

If you have your own plans and do not want to choose the insurance recommended by the school, you can buy the OSHC~ of other government insurance companies, such as: the main five government designated insurance companies provide student insurance, MedibankPrivate, BUPAAustralia, AustraliaHealth Management, AllianceGlobal Assistance, NibOSHC

You can compare insurance prices and insurance services on the websites of these companies and buy them directly through their websites.

According to 2016 fee standards, the annual premium for single dog students is about $400 / 550, and that for family insurance families is about $4000 / 6000.

However, you can`t think about changing your visa and not changing insurance. If you are not a student visa, you need to contact the insurance company immediately to replace the insurance. Of course, the general insurance period will be a few months longer than your visa, and you will have plenty of time to choose the insurance plan that suits you.

How do foreign students use OSHC to see a doctor?

Although you are a monk studying abroad, you can go to the GP or public hospital clinic in Tuao, or be recommended to a specialist. As usual, all public hospitals are free of charge when they see a doctor.

OSHC Insurance Company usually provides 24-hour emergency consultation and help to its members. If you have any questions, you can contact the insurance company at any time. Some insurance companies provide translation services to their members.

How to reimburse OSHC for seeing a doctor?

The difference between the doctor`s fee and the MBS reimbursement rate is your own expense. For example, general practitioners are generally reimbursed 100 per cent according to the MBS standard stipulated in the Australian National Health Insurance.

According to the 2015 Medicare reimbursement rate, the cost of consultation within 20 minutes can be reimbursed $37. 5%. If your general practitioner charges $50, the insurance company will reimburse 37 x 100% / 37, and you will personally have to pay 50 / 37 / 13.

There are usually the following ways:

You can pay all medical expenses at your own expense and then reimburse the insurance company with a receipt (recommended)

You can settle the expenses directly from your insurance company by the medical organization (the best choice!)

Can apply for reimbursement through the insurance company website (do not recommend, because want to choose the doctor that sees a doctor to you according to the various No. on reciept, gray often complex, easy to make mistakes! ).

You can mail the information to the insurance company according to the request of the insurance company (this is not very recommended, but if you buy the student insurance of the chicken rib company such as medibank, you will find that you have asked the office all the time call your reply can only be sent. ! Bad reviews! ).

You can go to the school cooperation point and apply for reimbursement directly.

If hospitalization is required, the hospital usually sends the bill directly to the insurance company.

If you are hospitalized in a private hospital, it is best to check with the insurance company whether the hospital is reimbursed.

If not, you have to think about it, because you personally have to pay extra hospitalization.

How does OSHC buy medicine?

As mentioned earlier, the vast number of studying monks in PBS can not enjoy it. And OSHC also has restrictions on prescription drug reimbursement, so spending on drugs may be higher.

In general, insurance companies require reimbursement of no more than $50 per drug, no more than $300 per person per year ($600 per family per year).

When you buy a drug, you personally have to pay a co-payment for each drug. If the cost of the medicine exceeds $50, you will have to pay the excess fee.

If you exceed the annual drug reimbursement limit, you will have to pay for it yourself. All expenses must be paid at their own expense and then reimbursed to the insurance company.

Warm Tip

The over - the - counter medicine that buys by oneself in pharmacy also cannot reimburse.

Appendix: some common concepts about health insurance in Australia

The upper limit of the excess part of Excess: is actually the pay-out part. For example, if a person buys an insurance policy with a excess of 1000 per person per year, he is hospitalized after the waiting period, and the cost of the hospital operating room fee is 1500, then the patient himself pays 1000, and the remaining 500 is reimbursed by the insurance company.

Co-payment: is also the out-of-pocket part, for example, the hospitalization fee is 500 / night, if your type of insurance listed Minny`s co-payment is 50, that is, the insurance company reimburses 450 / night, you pay the hospital 50 / night.

Waitingperiod: waiting period. New insurance, replacement of insurance companies, or upgrading of insurance in the same insurance company, there is a certain waiting period. The waiting period for each beneficiary project is different, and some insurance companies will eliminate the waiting period for some of the insured`s projects.

Rebate: government encourages people to buy private health insurance (hospitalcover& general treatment cover), introduced the FederalGovernment 30%Rebate program in 1999, that is to say, to buy private insurance, government subsidizes 30 percent of the premium (Premium), 65 to 35 percent of government stickers aged 69 and 40 percent of government stickers over 70 years of age.

Because of this policy, most insurance companies will give you a discount when you choose the insurance, because the insurance company will directly ask government to subsidize, the premium charged to the insured is already discounted. Government is entitled to this premium subsidy for all Australian public medical card Medicare holders. Visitors do not enjoy federal government subsidies for private insurance.

Loading: over-age insured need to pay more premiums, government advocates early to buy private insurance, lifelong purchase, annual payment.

If you buy late, you have to overpay the premium. It`s called loading.. The insured will have to pay 2% loading for every time he or she is over 30 years of age before July 1, the first July 1 after the 31st birthday, up to a 70% premium.

Insured people who need to overpay loading do not have to pay loading after paying premiums for 10 years in a row.

A patient who has been hospitalized for a long time in Longstaypatient:. If the patient has been hospitalized for more than 35 days in a row, it is considered to be a long-term inpatient or a patient with a nursing home nature, which means that patients must pay more of their own hospitalization fees if they continue to stay in hospital., TheHealth Insurance Act 1973 stipulates that insurance companies are not allowed to reimburse patients for hospitalization beyond this period.

AccessGap Cover / gap cover

The treatment fee charged by each doctor (or specialist) is different. Medicare reimburses inpatients for 75% of the doctor`s fees for the (MedicareBenefit Schedule) MBS project, while the remaining 25% is paid by the insurance company, but because some doctors charge more than the MBS project fee, the insurance company offers a concept called AccessGap Cover.

For example, for an appendicitis patient, the doctor charges a total of $3000 for surgery and treatment in the hospital after operation, of which $2000 belongs to MBS and $1000 exceeds the cost of MBS. Then Medicare reimburses 2000 ≤ 75% first, and then the insurance company reimburses 2000 ≤ 25%. If the insurance company provides AccessGap Cover, and the doctor also accepts the AccessGap Cover agreement, Then the insurance company will reimburse another GapCover (with a ceiling). If it is $400, the patient will eventually pay the doctor $3000 / 2000 / 400 / 600.

All right, this time the Australian medical insurance basically gives everyone the comprehensive science popularization!

To live in a new country, you must understand the local medical policy and security. These spitting blood to sort out the content, let`s slowly digest it.