Let`s take a look at Australia`s health care system.

1. Medicare:A public health care system in Australia, available to all citizen and most permanent residents.

But "free health care" is not actually free, public health care is also an insurance, premiums are deducted from the income of residents, of course, if the income is very low, it is really free.

two. Private health care system: includes private health insurance companies such as Bupa Health Insurance Company, which work with Medicare to provide health care services to people in Australia.

Medicare generally does not include dental, physiotherapy and massage services, so some middle and high income groups are willing to buy private insurance in order to get better, faster and more effective medical services.

In the case of non-Australian citizen or permanent residents, such as students studying in Australia, tourists and family visitors, Medicare services are not available.

(DIBP), the Australian border agency, stipulates that overseas citizen travel to Australia will be forced to buy insurance products depending on the type of visa.

Examples of insurance requirements in the application of Australian visas:

- Australian study visa: applicants must take out OSHC overseas student health insurance in order to apply for a visa;

- Australian 408th Visa (visiting Scholar): in accordance with local policy, visiting scholars can purchase OVHC Australian overseas visitors Medical Insurance;

- Australian 400th visa (temporary work visa): the embassy must provide an insurance policy when applying for 400visa. According to the local policy, the minimum medical expenses reimbursement amount is RMB 500000 yuan when staying in Australia for less than three months; if the insurance policy stays for more than 3 months, the total insurance policy must be in the equivalent Australian dollar 1 million yuan (about RMB 5 million according to the current exchange rate) or more;

- Australian parents visit long-term visa: the applicant must prove that he or she is insured and covers the first 12 months of his visit to Australia. The total amount of insurance policy must be 1 million Australian dollars (about 5 million yuan at the current exchange rate) or more. At the same time, during subsequent visits to Australia, applicants should also ensure that they hold adequate health insurance, otherwise their visas may be cancelled;

- Australian tourist visa: insurance is not mandatory, but the embassy recommends that applicants take out travel insurance before going to Australia. According to local policy, stay in Australia for three months or less, the minimum medical expenses reimbursement is 500000 yuan.

The Australian overseas Student Medical Insurance (Oversea Student Health Cover, (OSHC) is a special insurance for students studying in Australia. According to the requirements of the Australian Immigration Service, student visa holders must be insured against OSHC, before going to Australia and the scope of the insurance must include all visa rooms. If overseas students have a spouse or children under the age of 18 to accompany them in Australia, They must also take part in medical insurance for overseas students.

Australian overseas visitor health insurance (Oversea Visitor Health Cover (OVHC) is designed for overseas tourists and temporary residents, which is more suitable for foreign citizen living temporarily in Australia.

Guardians of overseas students (parents study visas), or work visas that visit Australia for more than one year, can choose this insurance.

If it is a short-term visitor to Australia, the local government has no special requirements for the type of insurance, can buy overseas travel insurance, or has its own high-end health insurance.

Travel insurance and high-end health care are free to choose according to the actual situation, but the Australian overseas study Health Insurance (OSHC) and the Australian overseas Visitor Health Insurance (OVHC), are insured by local Australian insurance companies and the product liability must meet the requirements of Medicare, and if so, they must also be insured from these insurance companies.

At present, there are a total of five insurance companies in Australia that can provide such insurance, namely: bupa,Medibank, NIB (Security Insurance), Allianz (Allianz), AHM.

In China, bupa Australia, in partnership with Yongcheng Insurance Company, is the only company in China that legally sells such insurance products and pays in RMB. It is irregular for four other insurers to sell such insurance in China and will have to be paid in US dollars / Australian dollars if they buy it.

From the aspect of safeguard liability, it is also suggested that Yongcheng Bupa insurance should be preferred, after all, the medical expenses in Australia are not low, although the insurance rate is a little higher, but the reimbursement rate is high. Otherwise, in the event of an unfortunate illness, the out-of-pocket part will be much higher than the premium saved.

Select other services available to Yongcheng Bupa:

Taking Yongcheng + bupa as an example, this paper introduces these two kinds of insurance.

Claims settlement services:

- Direct payment (OSHC): to the cooperative hospital / cooperative doctor, no charge, hospital / doctor and insurance company settlement;

- Post-event claim settlement:the customer shall pay⇨apply for claims to bupa⇨bupa audit materials⇨bupa audit and correct claims.

First, Australian overseas students Medical Insurance OSHC

According to the Australian Immigration Service, students studying in Australia and their spouses, children, etc., are required to purchase insurance for overseas students covering the whole course of their studies in Australia at one time.

The effective date and the end date of the insurance correspond to the date of going abroad and returning to China respectively. Generally speaking, the end date of insurance needs to be three months after the end of coe, because it may not return immediately after the end of school, and it is also necessary to have insurance during your stay in Australia. If the insurance expires, the insurance contract needs to be renewed, otherwise the student visa may be affected.

OSHC insurance is purchased on a monthly basis. When insuring, calculate the time of going abroad and return home, the premium is paid at one time, and after the insurance is completed, it is not affected by the new rate.

(I) the insured and the insured

Policy holder: Chinese adult citizen or his guardian applying for an Australian student visa

Principal insured: Chinese citizen for Australian Student Visa

Associated insured: legal spouse, minor children

(2)Type of protection.

Single person protection: insurance protection without joint and several insured

Double protection: insurance for the principal insured and the legal spouse listed on his or her student visa only

Family security: protection of the principal insured, and the children listed on his or her student visa, (and / or) the legal spouse

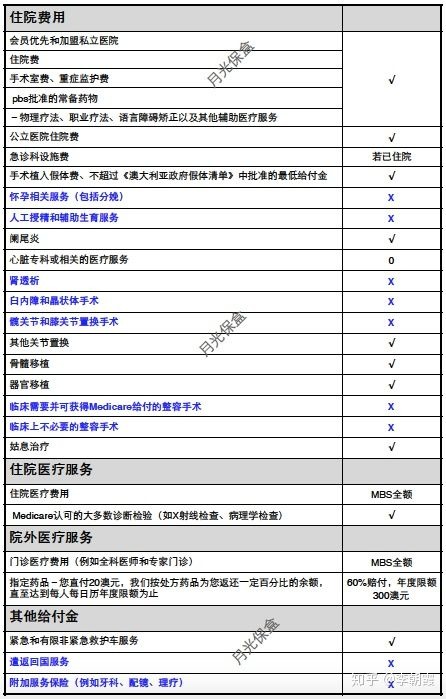

(III) Product liability

1. Hospitalization protection: full compensation in contractual institutions

- Hospital accommodation in contractual institutions

- Operating room and intensive care fees

- Equipment fee for emergency department

- Hospitalization common medical service

- The drugs listed in the PBS directory for hospitalization

two. In-patient diagnosis guarantee:

- Inpatient medical diagnosis costs: 100 per cent of MSB fees

- In-patient diagnostic examination: 100 per cent of MBS fee

3. Outpatient diagnostic security:

- Medical services in private clinics or medical institutions: 100 per cent of MSB fees

- Public hospital clinic: 100 per cent of MSB fee

- Medicine: single person insurance $300 yuan

4. Emergency ambulance and other protection

Note:

- MBS: Australian National Health compensation catalogue

- PBS: Australian Drug compensation Scheme

(IV) waiting period

- Past illness related to mental illness: 12 months

- Other past diseases: 12 months

- Pregnancy-related services and delivery: 12 months

(v) conventional exclusion services

- Surgery that Medicare doesn`t admit.

- cosmetic surgery

- Non-emergency ambulance transport

- Artificial indoctrination and assisted reproductive services

- Experimental treatment

- Escort home

- Hospice care service

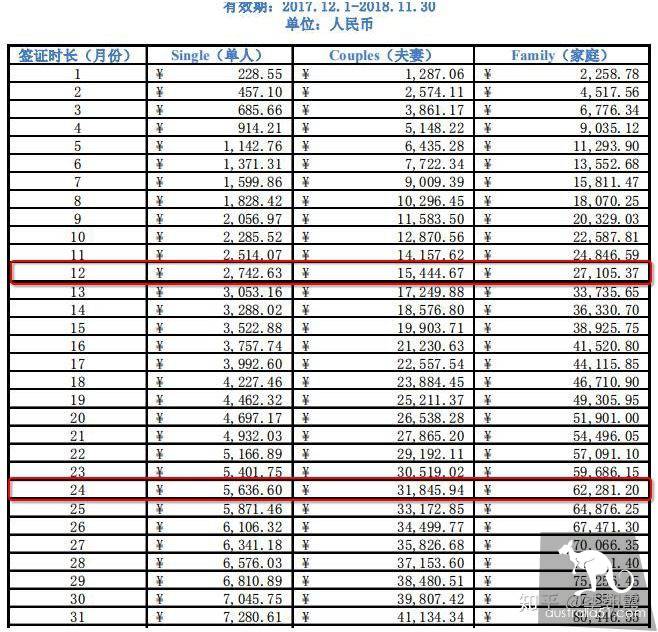

(VI) rates

II. Overseas visitors Medical Insurance OVHC~ work Visa

During the insurance period, according to the visitor`s itinerary to Australia, the principle is that visitors need insurance to take effect from the same day they enter Australia, and the insurance shall take place on a monthly basis. The maximum period of insurance is 1 year, and after the expiration of the insurance, apply for renewal at the latest rate.

(I) the insured and the insured

- Insured: Chinese Adult citizen applying for Australian work Visa

- Principal insured: Chinese citizen applying for Australian work visa

- Associated insured: legal spouse, non-independent children (under 21 years of age; or full-time education in primary and secondary schools, colleges or universities in Australia and under 25 years of age)

(2)Type of protection.

- Single person protection: insurance protection without joint and several insured

- Double Protection:Coverage of the primary insured and the legal spouse listed on his work visa only.

- Family security: protection of the principal insured, and the children listed on his or her work visa, (and / or) the legal spouse

- Single parent protection: insurance for the principal insured and the non-independent children listed on his or her work visa

(III) responsibility to safeguard

(IV) waiting period

- Past illness with mental illness, rehabilitation and palliative treatment: 12 months

- Past medical history: 12 months

- Pregnancy-related services and delivery: 12 months

(v) conventional exclusion services

- Services not included in Medicare

- cosmetic surgery

- Bone marrow transplantation or organ transplantation

- Artificial indoctrination and assisted reproductive services

- Experimental treatment

- Hospice care service

(VI) rates

3. Overseas visitors Medical Insurance OVHC ~ non-working Visa

During the insurance period, according to the visitor`s itinerary to Australia, the principle is that visitors need insurance to take effect from the same day they enter Australia, and the insurance shall take place on a monthly basis. The maximum period of insurance is 1 year, and after the expiration of the insurance, apply for renewal at the latest rate.

(I) the insured and the insured

- Policy holder: Chinese adult citizen applying for an Australian non-working visa

- Principal insured: citizen of China applying for non-working Visa in Australia

- Associated insured: legal spouse, non-independent children (under 21 years of age; or full-time education in primary and secondary schools, colleges or universities in Australia and under 25 years of age)

(2)Type of protection.

- Single person protection: insurance protection without joint and several insured

- Double protection: insurance for the principal insured and the legal spouse listed on his or her non-working visa only

- Family security: protection of the principal insured, and the children listed on his or her non-work visa, (and / or) the legal spouse

- Single parent protection: insurance for the principal insured and his or her non-independent children listed on his or her non-work visa

(III) responsibility to safeguard

(IV) waiting period

- Mental illness and rehabilitation: 12 months

- All past diseases: 12 months

(v) conventional exclusion services

- Services or treatments not included in Medicare

- Pregnancy (including delivery)

- cosmetic surgery

- Artificial indoctrination and assisted reproductive services

- Experimental treatment

- Escort home

- Hospice care service

(VI) rates