Refund for what?

GST is short for the goods Services tax (Goods and Services Tax), and when shopping in Australia, most goods are subject to about 10% of the goods and services tax (GST) or 14.5% of the wine duty (WET),. And TRS (Tourist Refund Scheme) is where tourists who shop in Australia and bring enough goods to leave will be able to return GST benefits.

Remember, if you have to take your goods out of Australia, you will not be able to bring them back to Australia. For higher-value items such as high-end computers, jewelry, luxury goods and so on, customs officials may record the tax rebate on the occasion of the tax rebate. The next time they are brought back to Australia, they may be found and face heavy fines.

Tax rebate condition

- The date of purchase must be 60 days before departure, subject to the tax invoice issued by the merchant;

- For one or more purchases at the same merchant, the corresponding valid invoice value (including GST/WET) accumulates to be A $300 or more;

- The goods that have paid GST/WET, without paying tax at the time of purchase can not handle the tax rebate;

Tips:

- Valid invoice must contain: "Tax Invoice" word, merchant name, merchant code namely ABN, commodity price, commodity description, and purchase date;

- A tax invoice of A $1000 or above must show the buyer's name and address at the same time.

What is the tax rebate process?

Airport tax rebate counters are open 24-hour, can arrive in advance on the day of departure for processing.

According to the size of the goods purchased, whether the liquid capacity meets the requirements of airport security, the tax rebate process is roughly divided into two types:

- If you can carry on the plane with you, you shall handle it at the tax rebate counter in the waiting hall after security check.

- Large size goods that must be shipped, such as liquids (fish oil, cosmetics, propolis, wine, etc.) in excess of 100ml, are required to arrive at the airport first at the tax rebate service counter (before entering the customs) and checked by Australian customs staff. And the relevant valid tax invoice on the original seal, can be checked in and check-in formalities. After the security check, go to the tax rebate counter in the waiting area with a stamp to handle the tax rebate.

Upon arrival at the TRS counter, the following is required to be shown to the staff:

- My passport;

- Boarding pass;

- Relevant original tax invoice and commodity, or stamped original invoice

Tips:

- Please note that before and after entering and leaving customs there is a TRS counter oh, the former is the staff to check the tax rebate items that need to be checked and then stamped on the invoice, and after the customs counter is used for the tax rebate;

- It is recommended to carry around the best not to check in, lest handle tax rebate, the staff will spot check the goods;

- According to industry practice, tax rebate counter will stop 30 minutes before flight departure, we should reserve time to avoid delay travel.

Can I return the cash directly?

At present, there are three options for refund after applying for tax rebate:

- Credit card / debit card (Amex,Diners,JCB,MasterCard,Visa);

- Australian bank account;

- Checks (can be paid in different currencies)

Tips:

- Tax rebates will be completed within 60 working days, usually refunds to credit card / debit card processing time is relatively short, more convenient than mailing cheques.

Quick tax rebate using mobile phone App

Some small partners may find that there are two tax rebate teams, one of which is obviously much faster. Why?

Here, the editor strongly recommends tax rebate artifact: with it, mobile phone tax rebate App, you can avoid the time to check invoices on the scene, farewell to the long team, quick and convenient tax rebate.

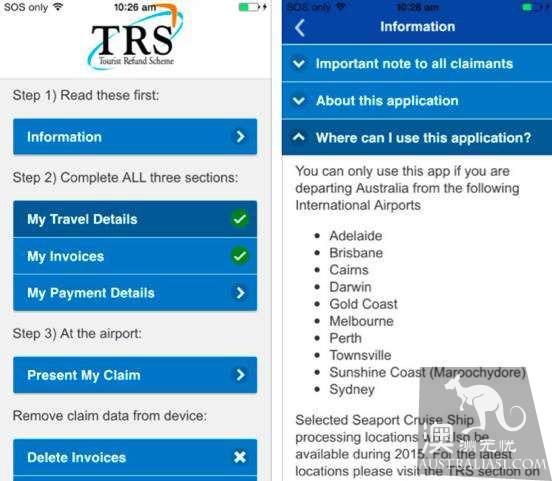

The full name of the App is the Tourist refund scheme, acronym TRS, Android and the iPhone market can be downloaded directly. After installation, the editor will interpret the use of this artifact.

When you open App, to accept all the terms and conditions, you will see a lot of information about tax rebates.

Fill in your personal information and save it in My Travel Details my Travel details.

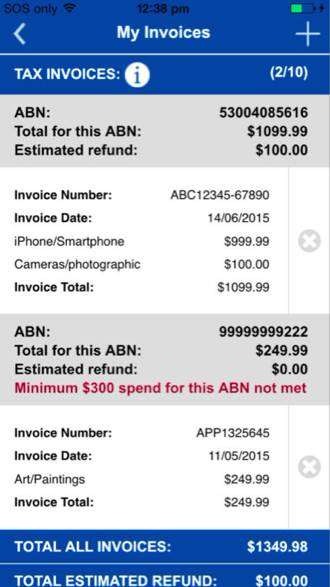

Add the invoice to the "My Invoices my invoice" and fill in the item category and amount for which the tax rebate is applied (this information can be found on the invoice for the purchase).

In My Payment Details my payment details, choose a tax rebate: credit card, Australian bank card or check.

After agreeing to all instructions in My Claim my Application, the QR code will be generated. Then take this QR code through the TRS counter shortcut, together with passports, boarding passes and related invoices, you can quickly complete the tax rebate!