What is the Tax File Number (TFN) tax number?

TFN (Tax File Number, (Australian tax number) is a special number used by a group of individuals to help the Australian government to collect taxes. A person will have only one set of tax numbers in his life, and even if you apply for another visa, you will not be affected. Therefore, you should keep this number carefully and let the IRS know when you change your address or name. If you are unable to receive the tax number because you do not have a fixed address, or if you have lost the tax number, you can bring your own passport and go to any of the IRD in Australia to obtain the tax number again

Why apply for a tax number?

According to Australia's tax law, all people working in Australia must have their own tax numbers. Often when looking for a job, employers will also ask for a tax number to facilitate the handling of salaries and taxes. When receiving a salary, the employer usually deducts the part of the tax directly from the salary

Audit time

The tax number cannot be applied until the applicant arrives in Australia, usually within 28 days of the submission of the application. If you haven't received it, you can call 13 28 61, or go to the Australian city tax authorities in person.

Method of applying for tax numbe

Every person who has a legal right to work should apply for a tax number from the IRD in Australia. There are usually three ways to apply:.

- On-the-spot application: bring your passport directly to the local tax bureau to apply for the tax number. For example, Adelaide's IRS address is 26 Franklin St,Adelaide,SA 500.1. Its working hours are from 8:30 to 4:45 PM; from Monday to Friday. AM.

- Internet Application: log in to the IRD website (https://www.ato.gov.au/), tax number can be applied online. (detailed application steps are attached below);

- Letter application: download the tax number application form on the Inland Revenue Department's website. After completion, you can apply by mail according to the correspondence address in the application form.

The editor suggests that students can apply for the tax number directly online, which is convenient and time-saving. Next, the editor teaches you how to apply for the tax number on the Internet.

Online tax number Application step

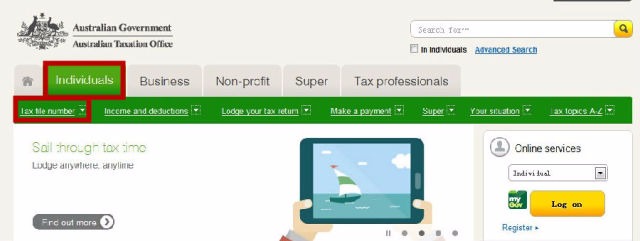

First step:

Please go directly to the Inland Revenue Department's official website (https://www.ato.gov.au/), and click on Individuals, in the upper-left corner and click Tax file numbe

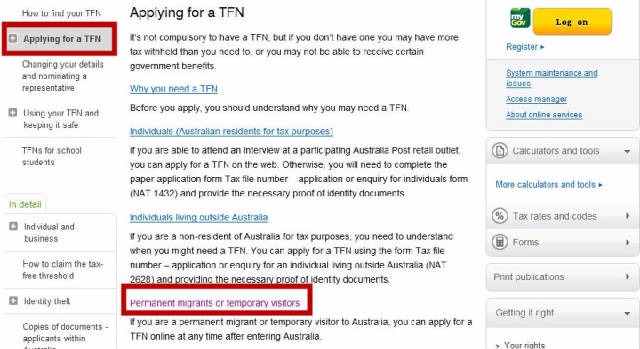

Step two:

Select Applying for a TFN, in the upper-left corner of the Tax file number web page and then select Permanent migrants or temporary visitors.

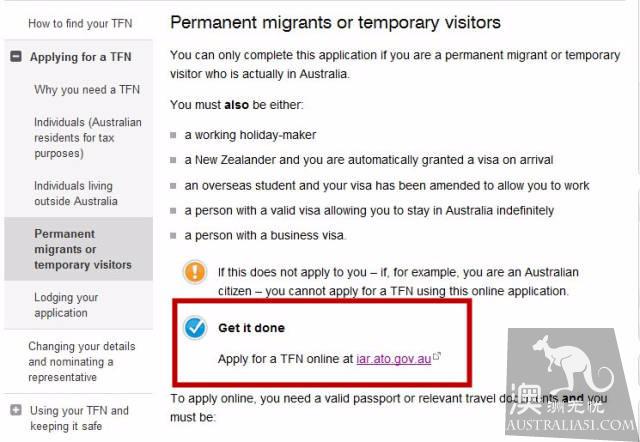

Step 3:

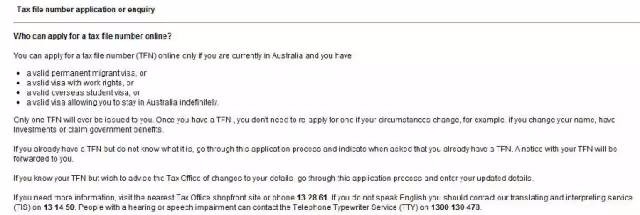

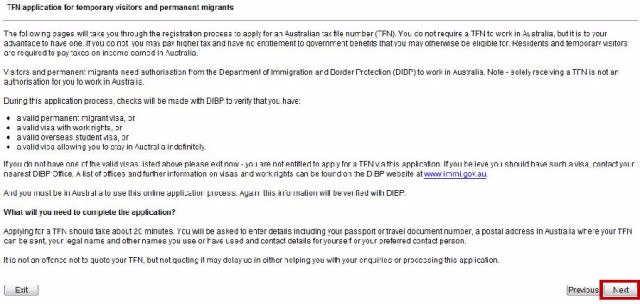

Click on Get it done, and we'll go to the online tax number application page. At this point, we're going to click on Next. twice in a row at the bottom right corner of the page.

First Next

Second Next

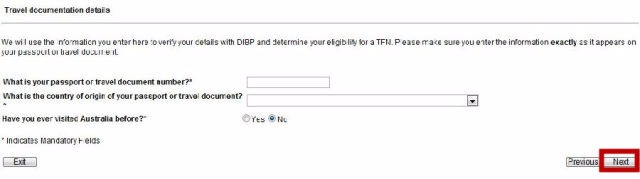

Step 4:

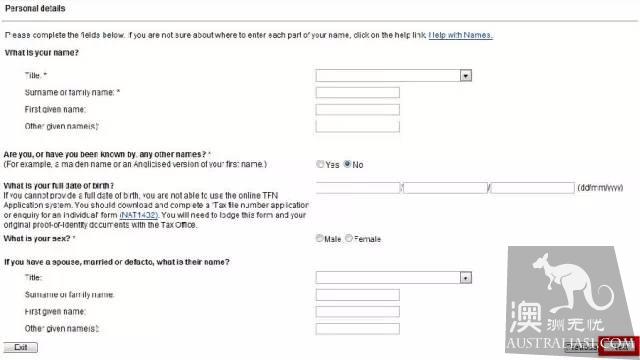

Next, you need to fill in your personal information according to the question, and then click Next in the lower-right corner of the page to enter the next page to continue filling out your personal information. First fill in the passport information, have you ever been in Australia before, press Next

And then personal information, including names, birthdays, gender, and so on, by Next.

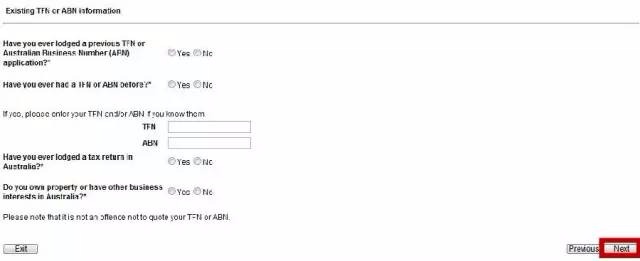

Then I asked if I had ever applied for ABN (Australian Business Number), and if I had any business in Australia, according to Next

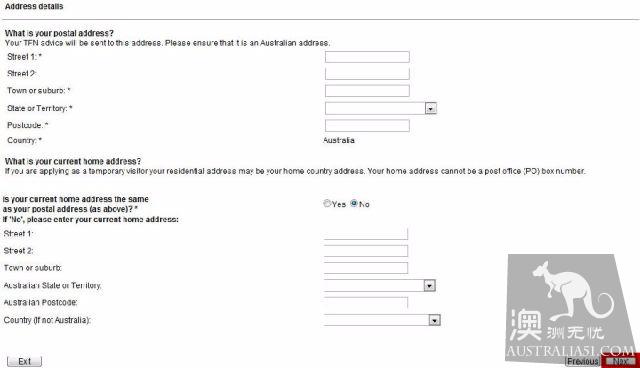

Fill in the address by Next

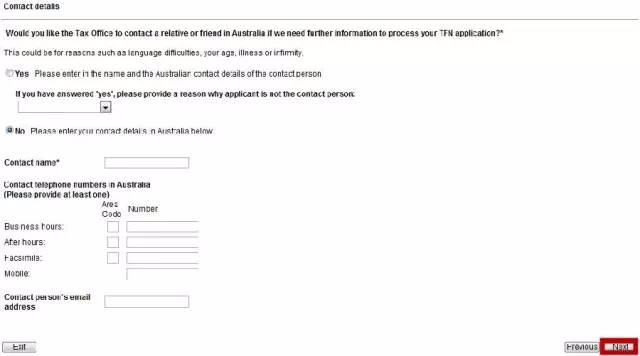

This question asks contact information (select someone else's agent; because of poor English, illness, or other reasons), fill in information about your agent if you choose Yes, and fill out your own information if you choose No.

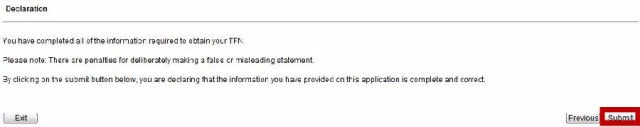

Step 5:

After confirming the accuracy of the above personal information, please click Submit. So far, we have successfully completed the online application for the tax number. Friends should receive the tax number within 28 days, if not, you can call ATO to inquire.