In a twinkling of an eye, Australia has another Financial Year, and a year of tax rebate. At this point in time, Australians will always receive an annual income summary from employers to you, which also means that families can start preparing the tax rebate!

Maybe someone will wonder, tax rebate?! What tax is refunded? I don't have any tax rebates out of the country.

NO! This is not a general commodity consumption tax, but the legendary capitalist countries of the highest "personal income tax"! At this time, it is time for someone to question, the individual income tax can still be refunded?! Indeed, in China, this tax is like that splashed out of the water, gone forever. But let's not forget, now we are talking about the world's top happiness index of Australia: an individual income tax far higher than the developed capitalist countries in developing countries!

For new residents or new immigrants who have just arrived in Australia, they may not be well aware of the tax rebate policy at this stage, so at the forthcoming peak period of tax rebate, The kind-hearted editor answers questions as thoroughly as possible-how to retreat personal income tax in Australia's fiscal year.

In particular, this strategy is mainly aimed at the first tax rebate, only fixed salary income / bank interest income, no other excessive asset income (investment in real estate, stocks, self-operating companies, etc.). In other words, if you are ordinary office workers, one year after the end of the tax rebate, then read this introduction right!

At this time grateful to the zero relatives quickly dry tears with the editor to see it!

First, in Australia, the individual income tax can also be refunded?

New arrivals to Australia need to know a lot of things, and tax rebate is a matter of particular interest.

When it comes to taxation, this is the financial basis for the survival of a country's goverment, and personal income tax is one of the important sources of goverment revenue. Therefore, whether it is socialism or capitalism, up to the president / prime minister, down to ordinary people, paying taxes is an important duty and duty for everyone.

In Australia, the largest country in the southern hemisphere, individual taxes are gradually raised on the basis of personal income, reducing the burden on low-income earners while curbing excessive income growth for high-income earners. In fact, the plain is-high income pay more tax, low-income first pay tax rebate!

1. What exactly is "personal income tax Personal Income Tax"?

Personal income tax (Personal Income Tax) is a general term that regulates the social relations between taxation authorities and natural persons (residents, non-residents) in the process of collection and management of personal income tax.

Salary, salary income, refers to salary, bonus, year-end raise, labor bonus, allowance, allowance and other income related to employment or employment of an individual as a result of his or her employment or employment. In other words, as long as the income obtained by an individual is related to employment or employment, regardless of the channel of fund expenditure of his unit or the payment in the form of cash, in kind, securities, etc., it is the object of taxation of income items of wages and salaries.

2. Goverment's tax requirements for individual income tax in Australia

In Australia, individual income tax payers include both resident and non-resident tax payers Residents, as well as non-resident tax payers Non-residents. A resident tax payer is obliged to pay personal income tax on all income derived from Australia and abroad, while a non-resident tax payer pays personal income tax only for income derived from Australia.

BUT! Because Australian bank interest is also involved in taxation, whether you are prepared to work in Australia or not, All must apply for their own Australian tax number, Tax File Number (TFN)-a personal tax number assigned to everyone by the Australian Revenue Service Australian Taxation Office (ATO) for tax purposes. As for the application of the tax number, we can apply on the ATO website on our own. It is often easy for us to apply for the tax number. Here, the editor will not repeat it.

In the new fiscal year 2016 / 17, Australia's goverment made it clear that the tax exemption for individual income tax is less than $18200 per year, and that the portion of annual income exceeding this amount will be taxed at different levels depending on the level of income (see table below). The tax rate on personal income is as high as 45%, mother Wuli. Is it not that people with high incomes pay more tax a year than they do before tax. It also makes people live, work hard for a year, earn all the money and pay taxes. Where to reason.

In addition, Australian residents pay a 2% annual health insurance tax (Medicare levy,), which is not required for non-Australian residents.

TIPS

- We must remember that when the tax number is applied, it will be mailed to the residential address and it must be collected. Because this is the only one, there is no spare! and! When you get the tax number, you must submit it to the bank at the first time. Otherwise, when the bank issues interest on the 1st of each month, you will be surprised to find that the interest is received at the same time that some of it is withheld. That's tax!

- Top priority! No matter how much tax you have made in this fiscal year, even $1 will have to be filed in the fiscal year! Because Australia's laws are sound and strict, individuals will receive a fine notice if they do not file tax returns to the goverment within the prescribed time frame! The amount of the fine will vary, from hundreds to thousands, to tens of thousands of dollars. So guys, don't do anything to save tax. It's possible that the dozens of dollars that could have been refunded could have gone up to a huge fine in an instant, and that's not worth the loss.

3. After all, when can I start to apply for personal tax rebate? Anytime? Absolutely Nott!

Living in Australia, as long as you have a tax number, you need to return tax and tax rebate! Because Tuo O is different from the Chinese, the financial year is 30 June in the middle of the year rather than 31 December at the end of the year, so generally speaking, from July 1 of the previous year to 30 June of the current year, the various tax receipts and payments of individuals, All should be filed after July 1, this year, the Inland Revenue Bureau ATO, also known as tax returns. If you meet certain conditions, ATO will deduct a part directly from the tax you should have paid, which is the legendary tax deduction Rebate; If you actually pay more tax in a year than the tax payable, then you can get the return of ATO, that is, this article focuses on the study of the tax rebate

Since July 1, 2016, you will be ready to submit your tax returns for the fiscal year 2015 / 16, and October 31, 2016 will be the deadline for filing your own tax returns. If you choose to entrust an accountant to file a tax return instead of reporting it through the MyTax, the filing date can be extended to March 31 next year.

Therefore, the family members who need tax rebate, should seize the time ah ~ also hesitated what, quickly follow the editor to play with the Australian personal tax rebate guide!

Second, in Australia, the full preparation required before the individual tax rebate

Personal tax rebate, difficult to say, easy to say and easy to say! "difficulty" lies in the multi-step and complexity of the process of filling out forms online, while "easy" lies in the simplicity of preparing the material and the fact that it will be very Easy~ as soon as it gets started.

Below, the editor will take stock of the preparation and required materials for the general public before the tax rebate.

No ads! Follow me and keep watching!

1. Materials required for personal tax rebate

Prior to the tax rebate, it is best for families to make sure they have the following documents or data in hand:

- PAYG Payment Summary (Annual payroll Summary / tax statement): list of tax payments issued by the employer for each employee after the fiscal year. Once you get the list, you have to make sure your personal tax number and name are correct. If you've done two or more jobs in this fiscal year, make sure you've got all the employer's tax returns.

- All bank interest income for a full fiscal year: since interest paid by banks in Australia is also closely related to taxes, from July 1, 15 to June 30, 16, individual bank interest income, including current, Regular and Cash Management accounts need to be provided at the time of tax rebate. Parents can ask the bank to issue a written certificate, or call the bank to inquire about the figures so that they can fill in the corresponding blanks in the form during the tax rebate process. If there are comrades who are very good at fund management with Netbanking, you can also query their own one-year interest income on the Internet, chicken stir-fried convenient!

- Tax rebate for the previous fiscal year Notice of Assessment: if your friends have refunded personal income tax in the previous fiscal year, then this year's tax rebate needs the Notice of Assessment. sent to you by the ATO last year. If you don't know where to put it for a long time, don't worry! Just contact ATO and ask them to re-post another copy! So easy~~

2.Residents VS Non-Residents, what's the difference?

Under Australia's tax code, however, residents considered in Australia's tax code, whether their income is in Australia or abroad, are required to file their income tax with the ATO.

What are the residents recognized in the Australian tax Code? Generally speaking, if you are going to study or work for more than six months in Australia, you are considered to be a "Residents resident in Australia" and pay taxes and taxes at the same interest rate as Australian citizens; If you study or work in Australia for less than 6 months, you will be regarded as "a non-resident in Australia you Non-Residents", whose income during the year is taxable and cannot obtain the tax number TFN. Such comrades must provide overseas addresses to banks when they start opening accounts in Australia, and banks automatically withhold 10 per cent of their bank interest income.

3. What is the way of tax rebate, self-help OR spent things?

In Australia, when fiscal year Financial Year approaches, personal tax rebates become one of the most important things that everyone knows and needs. And how on earth should this tax be refunded? What tax rebate method best suits oneself? It became the most distressing thing for people. In fact, the method of personal tax rebate is nothing more than two-using the MyTax software / fill in the form or find professional accounting to do.

Here, the editor sincerely suggests that if you own a company, own more than real estate or investment income and high-income people, then it is the simplest and most suitable way to get help from professionals! Because if such people DIY, themselves unless they are accounting or familiar, they can only catch them blind and collapse, because too many entries don't know how to do it. However, if you do not want to spend money on professional tax rebate, it will be a good choice to use MyTax tax rebate. Special! Look for the most powerful advantage of accounting tax rebate is-"reasonable tax avoidance"! Needless to say, we all know ~

But if friends like editor are just ordinary people, 9 to 5 middle-and-low-income workers, and there is no too much complex investment and asset returns, then self-help tax rebate is undoubtedly a big choice! Also can save looking for accounting tax rebate Money oh, absolutely very good!

Do-it-yourself tax rebate, must be used is a ATO named MyTax on-line tax rebate program. Friends may have heard about a tax filing software called E-TAX, but since July 1, 2016, ATO announced that MyTax will fully replace E-TAX to provide tax returns for everyone. Claim that this new procedure is a simplified online tax filing application designed for people with simple tax matters! It sounds absolutely faster, taller, stronger.

Below, the editor will fully interpret the high-end MyTax guide for everyone, strive to do novice rookie will learn, personal tax rebate easy to enter the account!

Third, it's not a dream to teach you to play with MyTax, 's own DIY tax rebate.

The full-scale implementation of MyTax this year only needs to audit 10 main pictures can be compared with the previous E-TAX software will be easier to complete the tax returns absolutely no less than!

If you want to use MyTax for tax rebates, you first need to create an MyGov account and associate it with ATO so that you can use the account to check online for tax and pension Super, health insurance Medicare, benefits and other related matters.

It doesn't sound as simple as it sounds. It's not as complicated as it was supposed to be! Below, the editor will teach you how to complete the personal tax rebate by step by point! Our slogan is-do it yourself, with plenty of food and clothing!

Step one to create a MyGov account

Click to enter the https://my.gov.au/, page and click the green Create a myGov account to start creating your own MyGov account.

Once created, the page in the following figure appears, typing your e-mail address as required, and tick the box in front of I accept to indicate agreement to the terms and conditions, and then click Next to proceed to the next step.

After entering the next step, the mailbox will receive a validation email from MyGov, enter the passcode in the message in the space on the way, and click Next to enter the final step of account creation.

The final step is to fill in personal information (cell phone number) and set the account password. The answers to the three questions set up by the password question desk must be remembered because they will be asked to answer these questions on the first login account. Fill in and click Next to complete the account creation ~

Step 2: connect the MyGov account to the ATO

After the account is created, you also need to connect the individual MyGov to the ATO, so that the tax rebate process can proceed smoothly.

After entering the personal account, click the Member Services entry, find the Australia Taxation Office, from the following list of choices and click the far right Link button to complete the connection between the MyGov account and the ATO. (there are other relatives of accounts that need Link to complete the connection on this page, too.)

When the connection is complete, you can see your connected service information at the bottom of the personal account home page. And, on this page, families can start a tax rebate trip "Lodge Tax Return, manages their tax and pension information (after Link's own Super account), and checks and modifies their personal information."

The third step is ready to start the "personal tax rebate trip".

After entering ATO linked service, click the first Lodge your return using myTax, in the Quicklinks category to quickly enter myTax's personal tax rebate program.

After the MyTax program is opened, the first thing to see is that you know if you meet the requirements for self-service tax rebate using this program. We must see if we have the appropriate qualifications, so as not to follow up unnecessary trouble! Such as operating income or loss Business income or losses, has overseas income Foreign income, real estate rental income will lose Income or losses from rental properyies, and non-legal Australian taxpayer Not an Australia resident for tax purposes and so on are listed in the terms of the Not eligible.

Of course, if the comrades listed a few have nothing to do with their own, then congratulations everyone is qualified to use MyTax for personal tax rebate drops, click on the lower right Start blue button, formally entered the tax rebate process!

The fourth step of the tax rebate process is divided into nine steps, one step must not be less, step by step should be cautious

1. Personal information

After starting the tax rebate, the first step is Your Details. Fill in the correct personal information and contact information according to the form (must be able to find the contact details of the deceased!) And their own account information name, BSB, account number (if there is a tax refund, ATO will transfer the money to this account, so the family must not be wrong to fill out ah.)

2. Summary of annual revenue

Once you have completed your personal information, it is your annual income. First, fill in your career and click on Add Payment Summary.. Then choose the corresponding income categories according to their own situation, generally feel that everyone is the first-income and salary, but if the individual family is receiving goverment benefits, then it is necessary to select the corresponding categories according to the benefit category.

After the selection, there will be a number of information required to fill in the following, the editor will take the wage income categories required by the general public as an example, at this time we need the PAYG Payment Summary (annual salary summary / tax form prepared before). Fill in the web form according to the company information above. This is also about the amount of final tax refunded and underfunded, so remember to fill in the amount on the PAYG Payment Summary, not carelessly.

3. Interest and dividends

When the company information is filled in, the interest and dividends will be filled in. In addition to the interest earned by the Bank of the year, Gross interest (will have to be filled in as long as the total interest in the financial year exceeds $1.) In addition, if there are other relevant interest and dividends (such as stocks, funds, investment dividends, etc.) are also required to fill in their specific amounts in the form, no need to fill in. As for the specific types of the two, you can click on the blue More information on the page to learn more, because individuals vary depending on the situation, so I am not going to go over it here.

4. Sales credits-magical income credits

To put it simply, Deductions is a credit for your tax income (pre-tax income), which is a legitimate and legitimate way to reduce the amount of tax you pay.

A total of 4 Deductions entries can be filled out in this interface:

- Bank interest income credits Interest Deductions-- if friends have bank interest income (generally everyone does), and banks charge account management fees on interest-generating accounts, they can be used as credits for personal tax rebates. In particular, if some partners have Cash Management Account, banks will sometimes charge corresponding management fees, it can also be deducted as a tax rebate. The total annual management fees would be better to consult the bank, or add up from the individual Statement.

- Dividend credit Dividend Deductions-- investment dividend credit similar to bank interest.

- Gift and donation credits Gifts or Donations-- if you have contributed more than A $2 to a ATO accredited charity or registered political party in the fiscal year, the donation can be considered a credit for individual tax rebates.

- Tax attorney / accountant service charge credit to Cost of Managing Tax Affairs-- if you paid for the service in FY 2015 / 16 for hiring a tax lawyer or accountant, the credit can be made in FY 2016 / 17. It is important to note that the service charge delivered after July of that year can only be deducted in the next fiscal year when the individual tax rebate!

TIPS

- When filling in the credit content, friends should be reasonable and reasonable according to the actual situation, otherwise it is easy to be audited by ATO!

- All Deductions projects need to be based on the relevant basis, such as bank bills, checkout vouchers, small notes, etc., in case of ATO inspection, can not be imagined! (however, according to the information received from the editor, it is said that only when the credit amount is more than $300, ATO may ask for a small ticket as a basis. I believe there is no need for editor to say that everyone understands ~).

- All the specific types of Deductions, if you do not know, you can click on the page under each item of blue More information for detailed understanding, this will prevail!

5. Personal income assessment

This requires truthfully filling out the number of children in the family, because the number of children directly affects individual tax levels, so it is important for families to fill in the number of Dependent Children accurately and truthfully. There is no child to write 0, must not be filled out! Fill in and click to move on to the next step.

6. Spouse information

Managers of existing spouses or de facto marital partners need to accurately fill in the other half of their personal information, annual income, additional benefits Fringe Benefit, and pension Super amounts.

7. Tax offsetting Offsets and Debug Adjustments

Unlike Deductions, Offsets is a credit for its own taxes, which, in other words, is deducted directly from the tax paid until the tax is not paid.

In this interface, you can see that Offsets eligible groups include Senior and Pensioner Offset, for the elderly and pensioners, as well as Zone or Overseas Force Offsets. for specific regional and overseas labour forces. If you are aged in Australia, you can apply for this waiver and choose your own Tax offset code and Veteran code. correctly For people working in remote areas or overseas, they can also apply for tax breaks depending on their own conditions.

In short, this entry is subject to personal circumstances. If you do not meet the above criteria, you do not need to fill in this page!

8. Medical insurance

This applies to both Medicare and non-Medicare recipients. In other words, if you do not have an Medicare, you can enjoy a full-year exemption from health insurance, and you will not be able to enjoy a full-year exemption if you enjoy public health care throughout the year.

2016 / 17 Financial Year is required to pay 2% of Medicare Levy for parents with pre-tax income of more than $21335, or vice versa. But, Medicare Levy will also vary according to the number of children, so in the previous Income Test list, we must write down the number of children!

Therefore, the people who can be exempted from medical insurance can be divided into three types, see the detailed introduction to the three categories that appear on the page, and relatives who meet the conditions can select Yes, without paying medical insurance tax.

Generally speaking, once you submit a PR application, you are eligible for the Medicare, and from then on you will have to pay the Medicare Levy. But before the moment you delivered PR, you didn't have to pay the money at all!

For example, Xiaoming submitted the PR, on January 1, 2016, with an annual income of 40, 000 after the end of the fiscal year. If you don't apply for an Medicare Levy Exemption, you will be charged $800 by the Inland Revenue Bureau for Medicare Levy, but if you apply for an Medicare Levy Exemption, you can just pay it in half. Xiaoming did not need to pay the PR before it was submitted (July 1, 2015 to December 31, 2015). It was only after the submission of the PR (January 1, 2016 to June 30, 2016) that Medicare Levy. was levied by the Inland Revenue Bureau.

So, here's the question, how do you avoid being charged by ATO for Medicare Levy when it comes to personal tax rebates in the fiscal year?

The specific steps are as follows:

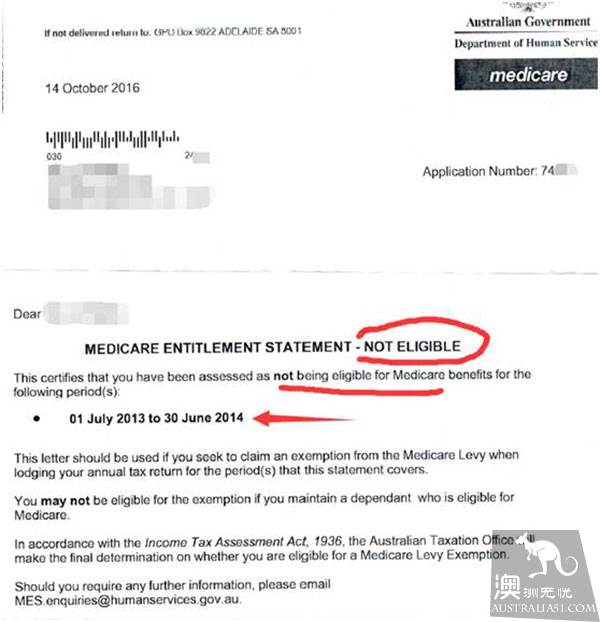

- First, friends need to apply for the Medicare entitlement statement, application form and download it here: https://www.humanservices.gov.au/customer/forms/ms015. Also, in addition to filling out the application form above, you need to provide the corresponding materials (both the list of materials and the form of application are written on the last page of the application form).

- Then, scan the material as above and e-mail it to [email protected] for application. (of course, you can also apply by mail or fax in the lower-right corner of page 1 of the application form)

- Finally, in about a month and a half, your mailbox (not Email) will receive a copy of the paper Medicare entitlement statement that clearly states your not being eligible for Medicare benefits,. That means you're not eligible for Medicare (meaning you don't have to pay Medicare's money, don't see Not Eligible as a failure).

With this sheet of paper, families will be able to tick MedicareLevy Exemption and enter exemptions for 365 days when they file their taxes. Note that if you submit a PR, you can only apply for Medicare Levy Exemption (for the period prior to the submission of the PR. Please refer to the previous Xiaoming example.

So, if I had been charged by the Inland Revenue Department, could I have it back? The answer is yes! But it can only be returned within the last 2 years (this 2 year refers to the two years of date of issue on Notice of Assessment)!

First, it's important to get the Medicare Entitlement Statement (as above!) Second, log in to your own MyGov account and you will see the Amend button there in your tax rebate record, as shown below:

Click on the Amend button to change the Medicare message to the correct one (you don't need to upload that Medicare entitlement statement, ATO will contact you if you need it). Then, the family just sit and wait for ATO to return the money to you ~ so easyy!

High-income people who earn more than $90000 a year before tax and who do not have a private health insurance Personal Health Insurance are required to pay an additional health insurance tax, Medicare Levy Surchange. So MLS depends on whether the taxpayer himself has private health insurance and different family circumstances, that is to say, when filling out the form, you need to make sure that you and your family have Private patient hospital cover,-specific! You have to cover the hospital Hospital Cover!

In addition, be sure to write down your own private health insurance Private Health Insurance information as required at the end of the day. Complete it all and click to go to the last step.

9. Estimate the amount of tax rebate, complete the "personal tax rebate trip"

After entering the final step, the system will estimate the amount of tax refund based on all the information and amounts you have previously filled in. After careful confirmation of the figures, check the Declaration Box.. If ATO volunteers Tax Help Volunteer help to complete the tax rebate process, then the ID number should be filled in the last space, if not, do not need to fill in.

After all checks are complete, click the blue Submit button at the bottom of the page to complete the entire self-service tax rebate process. Now you can wait quietly for the tax to enter the bag! And it's not as complicated as it was supposed to be.

TIPS

Some instructions for reporting related work expenses during the tax rebate process are as follows:

- The reported expenditure must be the expenditure of the financial year.

- All reporting credits must be job-related, not for private expenses, and may not be restated in tax rebates if the individual has previously reimbursed the employer for such expenses.

- If the amount of the program is more than A $300, it will need to be maintained to provide a record of related consumer expenditure as a voucher.

- Of course, in order to avoid the loss of paper vouchers, ATO website has a list of "acceptable records" for you to refer to when the tax rebate. Grey often humanized does not have!

So many words, this "individual income tax rebate topic" will soon come to an end in this, the editor as far as possible to provide the majority of the masses with the most comprehensive tax rebate strategy guide, if there are mistakes, but also hope that you will forgive ~

Financial year has passed, I believe that we have recently received tax returns issued by employers, what are we waiting for! Follow the steps of micro Sydney editor, start a perfect tax rebate trip!

PS. With respect to high-income and income-rich family members, small editors are unable and unable to answer questions and questions, but the most pertinent advice for such relatives is to find professionals to help complete the tax rebate. After all, this is what people do, and I am only a code. Knowledge is limited. Besides, you have a high income, and you don't have any money at all! Haha ~

Finally, I wish you all in the new year, the source of money rolled in, the cause of steaming up!

Author: micro Sydney, original address: http://www.wesydney.com.au/personal-income-tax-return-guide