Most recent topics on international education have focused on the share of Chinese students. But in fact, there are several levels to the story.

First, the data supports the traditional view that concentration in Australia`s country of origin is increasing. Objective centralized measures (using the Herfindahl-Hirschman index) show that this is true. Australia`s international education market is more dependent on the Chinese market than the economy as a whole, with Chinese students accounting for 38 percent of all international students and 28 percent of the total value of international education exports.

Looking at individual institutions, market concentration is much higher and growing. However, not only the high proportion of Chinese students in universities deserves attention, but also the concentration of students from South Asia, mainly from India, but also from Sri Lanka and Nepal. Foreign students from Pakistan and Bangladesh.

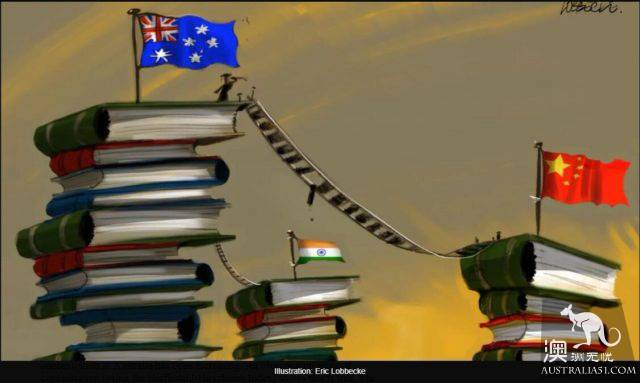

It is important that individual universities become increasingly polarized. Roughly speaking, Australian universities can now be divided into Chinese universities or Indian universities.

There are 12 "Chinese universities" by which Chinese students make up at least 30 percent of international students, and the ratio of Chinese students to South Asian students is between 2:1 and 20:1. Six other universities are close to meeting this definition.

There are also 13 "Indian universities," defined by the opposite-South Asian students make up at least 30 percent of international students, and South Asian students to Chinese students between 2:1 and 24:1.

The 12 Chinese universities include all members of the eight major universities. None of the eight universities in South Asia has more than 10% of students in South Asia. The other four are (Macquarie), Royal Melbourne University of Technology, (University of Newcastle), (RMIT), Newcastle University, and (University of South Australia)., University of South Australia.

The University of India, on the other hand, shares another feature: they are located outside Melbourne or Sydney CBD and tend to have satellite campuses in Melbourne or Sydney. In many cases, it cooperates with another registered or unregistered higher education institution.

There are 11 universities based in Melbourne / Sydney that do not have such campuses, and almost all of them are leaning towards South Australia. Such "Indian universities" include (Federation), Charest University, Federal University, (Charles Sturt), Sunshine Coast University, (University of the Sunshine Coast), Charles Darwin University, (Charles Darwin), Central Queensland University, (CQUniversity),. (Edith Cowan), University of Edith Coven, and (University of Southern Queensland)., University of South Queensland The emergence of this approach partly suggests that many of these universities lack growth options and find themselves increasingly limited to the domestic market.

There are many explanations for this, including the tendency of Chinese students to study in urban areas rather than in rural areas, and a strong preference for top universities, while students from South Asia may be more pragmatic and price-sensitive.

The average tuition fee for the Masters in Accounting at these "Chinese universities" is 38900 yuan, compared with just 26900 yuan for the University of India, according to 5Rs Partnership, a tuition-testing agency. Given that colleges and universities generally offer preferential discounts in price-sensitive markets, the apparent price gap of 45 percent could actually be even bigger.

Of course, there are a few universities that do not conform to this stereotype at all. Some universities have avoided this problem because of the relatively small number of international admissions. In addition, Melbourne`s two universities, (Deakin) at Deacon University and (La Trobe) at La Trobe University, went against the tide, with a high proportion of students in China and South Asia.

Overall, these polarization trends have a broader impact on systemic risks in the international education industry. With South Asian markets shrinking, India-focused institutions face direct challenges. But if China`s growth slows, China-focused colleges and universities may need to target South Asian countries instead and compete aggressively at prices. This, in turn, creates enormous competitive pressure on institutions that are now focused on South Asia.

As Andrew Norton (Andrew Norton) of the Gratham Institute (Grattan Institute) puts it, it is likely that universities are already taking some risks to seize the opportunities of the moment. But this may not always be a clear strategic option for universities that are counting on a long-term continuation of this income trend, or for those that boldly and boldly abandon immediate gains in order to gain market share in the short term. This could be a timed bomb.

Faced with this polarization, universities need to think creatively about how to seek diversified international strategies, not just locations, promotions and prices; As others in the department have emphasized, adopting new approaches to offer products, needs to be part of the solution.

Careful management will ensure that these growing pains do not pose a systemic risk.