Many readers have recently consulted on land taxes and hope this article will help you.

The problem of real estate tax and fee encountered by the new owner Tom

The other day, Peter received a phone call from Tom, a former student at the University of Sydney, who told Peter that he had just bought a $800000 apartment in April and had received a local tax bill from the state tax bureau the other day.

Tom was granted an Australian permanent residence visa in 2015, but because of his job, Tom2016 has been in China all year long.

Didn't Tom complain to Peter that the apartment had no land tax?

It's not that apartments don't have to pay a land tax, Peter explains, but that the land price of a single apartment is often lower than the starting point of the land tax. This year's (2017) New state land tax levy was in the Australian dollar 549,000. It is true that the apartment Tom bought is entirely exempt from land taxes.

At the same time, he reminded the Tom, to pay attention to the issue of the land tax surcharge.

Land tax (Land Tax)

Let's see what a land tax is.

Land tax, as its name implies, is a national tax on the value of land. The land tax is levied once a year, with December 31 of each year as the node.

What forms of house are subject to land taxes?

- opening

- Villa and apartment space

- Holiday house

- Investment real estate

- Condominium land managed by the company

- Civilian, commercial or industrial land, including parking spaces

- Commercial real estate such as factories, storefronts and warehouses

- Land leased to state government or local government

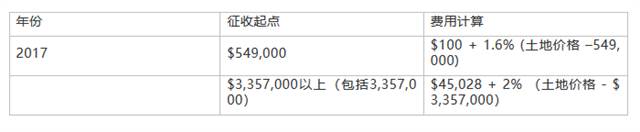

How do you calculate the current land tax in the new state?

In the case of Tom, if Tom buys house land worth less than $549000, then Tom can waive land taxes (whether or not it lives permanently).

But if you exceed that figure, for example, the apartment has a land value of $600,000, Tom would have to pay a land tax of $100, 1.6% (600000-549000) = A $916.

Who determines the value of the land?

Valuers provided by the General valuation Administration (Value General) calculate the value of the land on July 1st of each year and then provide it to the State Revenue Office for use.

Property management apartment, the land value of each apartment is calculated according to the strata share ratio.

If the owner questions the price of the land, the owner may, within 60 days after receiving the estimate of the value of the land, ask the land valuer to estimate it and to question it to the General Administration of valuation.

Who can waive the land tax?

In general, owners of the main residential real estate can be exempted from the land tax. And only one real estate can apply for a land tax exemption. It is worth noting that if real estate is wholly or partly owned by the company, the owner cannot claim an exemption from the land tax on behalf of the main residential address.

Land tax surcharge (Surcharge Land Tax)

What is a land tax surcharge?

In fact, the added value of the land tax has been proposed as early as 2016 in the new state budget, and since 2017, overseas owners of properties in the new state will have to impose an additional 0.75% additional tax on compliance with the land tax policy.

The new state's normal land tax exemption in 2017 is five hundred and forty eight thousand nine hundred and ninety nine (foreigners also enjoy the exemption), but 0.75% of the land surcharge is not exempt, starting from the first dollar;

Who is required to pay a land tax surcharge?

- Personal an individual

- Company a corporation

- Trust a trustee of a trust

- Government Division a government

- Government investor a government investo

- Partner a partner in a limited partnership

It is important to note that non-Australian nationals, even if they have permanent citizen status in Australia, will be considered "overseas" if they do not often reside in Australia.

So what is the case of absenteeism in Australia? How long does it take to live in Australia? There are two conditions to be met:

- 200 days of residence in Australia during the past year (not counting within 200 days of arrival and departure);

- You can live in Australia for a long time without hindrance.

How is the land tax surcharge calculated?

There is no exemption from the land surcharge, calculated as land value * 0.75%

In the case of Tom, where Tom bought house for $800,000, assuming the land value was $600,000, the flat's land tax surcharge was $600000 * 0.75 percent = A $4500.

If Tom fails to live in Australia for 200 days in 2017, he will still have to pay a land tax surcharge for the apartment in 2018, in addition to a land tax (A $916).

Land tax payment certificate

Land tax clearance certificates usually indicate whether there is still outstanding land tax on the property. Therefore, proof of tax payment is also helpful to buyers to know if the seller has an outstanding duty to pay taxes.

Generally speaking, the seller's lawer or real estate trader applies for a tax payment certificate to prove that there is no unpaid land tax obligation prior to the delivery of the house, Buyers' lawer or real estate traders will also apply for tax clearance certificates to see if they still have any outstanding taxes.

Land tax knowledge, quick questions, quick answers.

q. Can self-housing be exempted from land tax?

a. Yes, there is no land tax on self-housing.

q. If Tom's property is not used for self-housing, will it also be subject to a land tax?

a. Yes, if the land is worth more than $549,000.

q. If Tom holds permanent residence in Australia, but has not lived in Australia for more than 200 days in the past year, will it be necessary to pay the added value?

a. Need, Tom will be regarded as "overseas people".

q. If Tom joins Australian citizenship in the future, will he be required to pay the added value of the land tax?

a. Australian nationals are not required under any circumstances.

q. Do non-main residential properties without income also pay a land tax?

a. Right。 Whether the property generates income or not.

q. What if the information on the tax returns is not correct?

a. Please contact the State Taxation Office for change immediately.

q. Does the buyer / seller need to apply for a tax payment certificate on his own?

a. The seller's representative, lawer or the trader, is generally provided to the buyer's representative.