In New South Wales, the land tax mainly consists of two categories, one is the "land tax" (Land Tax), the other is the "land tax surcharge" (Land Tax Surcharge).

Literally, the land tax surcharge seems to exist attached to the land tax, but in fact, the two are relatively independent and should not be confused.

The interesting thing is that it is possible that a person does not have to pay a land tax at all but has to pay a land tax surtax. Why on earth is this? What kind of tax do I have to pay, when, how much, and how much do I have to pay?

Considering that many new and old immigrants and overseas home buyers have similar doubts, we will share with you the current policies of the new state land tax and land surcharge.

1. What is a land tax (Land Tax)?

As the name implies, land tax (Land Tax) is an annual tax levied by government on landowners according to the value of the land they own.

The land tax is managed and levied by the states and territories, which is similar and has some differences. In the case of New South Wales, the land tax mainly depends on the taxable value and use of land.

The use of land is better understood, and the common types are self-occupied, commercial and agricultural land. But the taxable value of land is more abstract. Taxable value is neither the current market value of the land itself nor the value of the real estate built on the land, but the evaluation value of the land owners in addition to the tax exemption (see table below). This evaluation is uniformly evaluated by government.

Owners can decide whether to pay land tax according to their own circumstances.

However, not every owner / landowner has to pay a land tax.

2. Who is exempt from land tax?

In the case of New South Wales, if it belongs to self-housing (Principal Place of Residence), your home (Your Home), the property is not subject to land tax. Note, however, that each family or individual can only have one main place of residence.

In addition, as the main production land farm, can be exempted from land tax.

Also, if you own (or co-own) multiple real estate, but the total taxable value of the land is less than the starting point, you do not have to pay a land tax; (the total land value of 2019 is $692, 000, please note that the starting point may vary from year to year).

3. What circumstances do I have to pay a land tax?

Except where the above land tax is not required, if you hold (or co-hold) the following real estate and the total taxable value of the corresponding land is higher than the starting point specified by government ($692000), you may have to pay land tax.

- Open space, including vacant rural land

- Land used for building (apartment, house, unit house)

- Holiday room

- Investment real estate

- Real estate of the nature of company management

- Residential, commercial or industrial land, including garages

- Commercial real estate, such as factories, shops and warehouses

- Plots leased from government and local government

4. Standard for the calculation of land tax

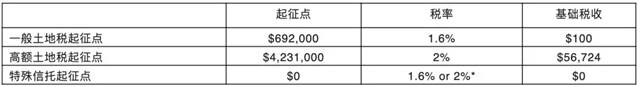

The starting points of the land tax rate vary from year to year. The starting points and tax rates for the 2019 tax year are as follows:

For example, if the land assessment value on December 31, 2018 is $2000000, the land tax for the 2019 tax year (general land tax) = ($2000000-$692000) * 1.6% $100 = $21028.

It is worth noting that government taxes on properties of different values may be different.

5. Other land tax breaks

If your real estate is a boarding apartment, a low-cost apartment, a residential and RV park, a retirement village, a primary production site, a child care center, etc., you may also be able to apply for land tax relief.

To sum up, the standard of land tax and payment varies depending on your land use and land value.

You do not have to pay land tax on your main residence (Principal Place of Residence / Your Home). However, unless your own home is exempt from land tax, you will be required to pay land tax if the total taxable value of the land you own is up to or above the threshold (that is, $692000).

In individual cases, the land value of a property owned by a person does not exceed the starting point of the Government rent, but he has received a notice of payment of land tax. What is the matter?. It is likely that in this case, the landowner will not receive a general land tax bill, but a land tax surcharge (Land Tax Surcharge) bill.

6. who is required to pay land tax surtax (Land Tax Surcharge)?

As of 21 June 2016, in addition to the general land tax mentioned above, in addition to the general land tax mentioned above, overseas persons may also pay an additional tax on land tax Land Tax Surcharge in the event of the acquisition of a New South Wales residential property.

"overseas people" are subject to land tax surtax, including:

A) if the buyer is an individual, that is:

- Australian permanent residence visa (PR) or New Zealand 444 visa holders who do not meet the 200-day residence requirement,

- Holders of temporary visas such as other work visas, student visas, visitor visas, bridge visas, and even those who do not hold Australian visas are considered overseas;

B) if the buyer is a company, that is:

- a company holding a substantive interest (more than or equal to 20%) by an overseas individual, company or government;

- A company in which two or more overseas individuals, companies or government collectively hold a substantial interest (more than or equal to 40 per cent);

C) if the buyer makes the purchase in the form of a trust, that is:

- Trust trustees with substantial interests (more than or equal to 20 per cent) held by overseas individuals, companies or government;

- Trust trustees with two or more overseas individuals, companies or government who collectively hold substantial interests (more than or equal to 40 per cent), foreign government, foreign government investors, general partners in overseas limited partnerships and others who meet the 2015 FAT requirements.

In addition to overseas people mentioned above, Australian citizen and Australian permanent residence visas (PR) and New Zealand 444 visa holders who have resided in Australia for a cumulative period of 200 days in the same calendar year (January 1 to December 31) are not required to pay land surtax.

7. How to calculate the Land Tax Surcharge tax rate?

Land tax surcharges (Land Tax Surcharge) do not have a tax-free threshold, which is different from the land tax. At the same time, if there are two or more owners in the same property, the obligations of their land tax surtax are also different due to the different visa status of their owners.

There is no tax exemption threshold for land tax surcharges, with an additional tax rate of 2 per cent starting on January 1, 2018; for example, on December 31, 2018, a land assessment value is $5000000, so the surcharge for the 2019 tax year is $5000000 * 2% ≤ 1000000.

If you buy real estate with others and you account for only 50% of it, you only have to pay a surtax on the value of your share of the land; not the entire real estate;

As with the land tax, some people are also exempt from an additional tax on land tax Land Tax Surcharge, which include:

Starting in 2018, if New Zealand citizen, who holds a 444 visa and holds a temporary visa for a spouse (subcategory 309 or 820), can stay in his or her main residence for more than 200 days in a calendar year, you do not need to pay a surtax on your main residence; however, you must complete the declaration by 31 March of each year;

In addition, if your land is used for boarding apartments, low-cost homes, accommodation parks, retirement villages, primary production sites, childcare centres, etc., there is also an opportunity to apply for additional tax relief.

in a word,

The land surcharge (Land Tax Surcharge) is mainly aimed at overseas people who hold residential real estate. There is no starting point. Government is based on 2 per cent of the value of the land.

To collect. Changes in the nationality of landowners, changes in visa categories and length of residence in Australia are all factors affecting the payment of land surtax. People who propose to hold property in the new state,

Learn more about law and obligations to professionals to reduce unnecessary economic losses.

8、Q & A

Q1: why are you talking about "land value" instead of real estate value? How do I know what the value of land is?

A: The land tax is the value of the land.

Value), instead of the amount of the purchase contract or the current market value of real estate. To know if you need to pay a land tax and the amount payable, the easiest and quickest way is for you to tell the Taxation Bureau in a timely manner about your real estate and hand over this complex evaluation to government. If you need to pay land tax and / or land tax surtax, the tax bureau will send you a tax notice early next year, the amount and information of the tax will be clear at a glance.

Q2: how can I send real estate information to the tax office?

A: there are two steps: step 1: pre-declare https://www.apps08.osr.nsw.gov.au/customer_service/forms/landtax; step 2: formally declare https://www.apps07.osr.nsw.gov.au/mars-online/pages/landTax/. You can repeat step 2 directly by buying and selling real estate, in the future.

Q3: is there any consequence if I don`t pay the local tax or I don`t pay the local tax on time?

A: unpaid land tax will accumulate year by year, and may result in fines, or even become your bad tax record. At the same time, the land tax follows the land itself rather than the individual, which means that if you buy a set of real estate, that does not pay the land tax, remember to require the seller to settle the land tax before paying the house, otherwise, you will become the person who has the obligation to settle the land tax after paying the house.

END

For property owners, land tax and land surcharge are often faced with problems, in addition to understanding the necessary law regulations, owners also need the guidance and cooperation of accountants and lawer. Each person`s resident status, financial situation is different, the responsibility and amount of tax will also be different. The new state land tax and land surcharge information mentioned above hope to answer your doubts on a practical level.

For overseas people, another issue that must be considered in the new state is that if (Vacancy Fee), does not live in Australia for a cumulative period of 183 days a year and fails to meet other exemptions, it must also pay government a substantial property vacancy fee each year. For the law of vacancy fees, please pay attention to John Information social app official account information.

Because the specific situation of everyone is different, if your "identity" has recently changed, it is not clear whether you need to pay land tax or land surtax; or you do not know whether your existing real estate is subject to land tax and surtax; or if you are considering buying a house but do not know much about the land tax, please contact us in time.