Many people before leaving Australia at the airport tax rebate, but also a lot of people take this opportunity to profit. For example, overfiling, or, for example, returning taxes to bring things back. However, Australia`s government recently began to crack down on this behavior! If found, light warning, blacklist! If you are serious, you will be guilty of a crime and even affect your visa!

According to the Australian Business Traveller website reported yesterday, Australia`s government recently began to investigate the departure tax rebate!

It turns out that within 60 days before leaving Australia, you can get back 10% of GST. at the tax refund office at the airport by buying $300 or more in the store. Although the TRS is largely tourist-friendly, the Home Office (Department of Home Affairs) has found that many Australians are also taking advantage of it. Worried that the TRS could be abused by its residents, the Home Office joined forces with Australia`s border authorities to step up inspections of tax rebates for smartphones, computers, jewelry and expensive clothing. Australians can also apply for a 10% refund based on TRS when they leave the country, but must do so again when they return to Australia.

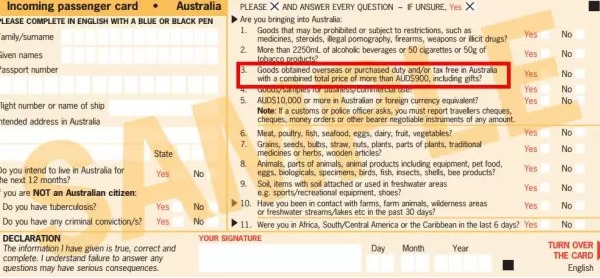

According to the Home Affairs Department`s website: "if you apply for GST, through TRS when you leave the country, then when you return to Australia, if the value of the goods exceeds the value of the passenger`s duty-free permit of $900, Then you must declare these items at question 3 of the inbound passenger card (IPC), and make up the GST upon entry. "

Melbourne resident Craig Reiner has already encountered such a thing when he was questioned by ABF officials in the TRS office at Melbourne airport when Reiner was applying for GST. for the just-bought Apple iPad Pro and keyboard. "they asked me if I would bring them back to Australia," he said. "I said no, because it was for Asian sales representatives."

After that, the staff photocopied Reiner`s passport and told him that his luggage would be marked for inspection when he returned to Australia next week. Although ABF declined to comment on the matter, it revealed that ABF would actively investigate anyone suspected of fraud through TRS and have the right to retain copies of their declaration documents, including passports.

It seems that Australia`s government is serious this time!

Earlier, a young Chinese brother broke the news: "just because of the wrong words, we have to repatriate me!" I almost emigrated to Australia! "

After many years of hard work: studying abroad, NAATI, career year, employer guarantee, and catch the last bus of 457, Martin got to PR., Australia, after years of hard work: studying abroad, NAATI, career year, employer guarantee, and so on. After saving up a sum of money, he decided to propose to his longtime girlfriend and buy a valuable ring for him, but before boarding the plane back home, he almost gave up his career in the tax rebate.

Here is his self-statement:

"I came to Australia seven years ago, studying abroad, NAATI, the year of occupation, and all the time, I finally caught the last bus of 457 to PR, and I got a permanent visa for two months in the first two months of the New Deal, and I cried. I did two things at that time, One thing was to buy a T-house diamond ring from a three thousand Australian dollars saved, and to propose to his girlfriend in Australia, the second is to have a ticket to return home. After all, I haven`t seen the family`s elder for a few years. At the time of his departure, the fiancee asked me to take the ring to the tax refund, and I hesitated. I don`t think it`s a good idea to think of a few thousand Australian dollars, and I`m moving. At the Sydney airport, I`m in charge of a middle-aged local woman that looks serious and bad. I`ll show her the ring, "This is what I want to refund." She asked me very seriously, "Are you sure that the ring will not go back to Australia again? `I said, of course, I`m going to get married. This is a present for me to my fiancee in China. Then she asked me: & # 39; But you`re getting married, and she`s coming to Australia, too? & # 39; I was so obsessed with a lie, and I said, "No, she`s been in Australia for a long time, and the ring is, `she said.` She looked at my eyes, and I entered something on the computer, and let me go, I`ve received three thousand Australian dollars in the return for a few days, and I`m happy to think that`s a good deal. Who knows, the story is just beginning. Three weeks later, I returned to Australia from the country. When I got my bag off, The staff took my passport for a while, and then I did not know what to look at on the computer and saw my hair. After a while, he said to me politely, Mr. I, and come with me. I`ve never been in such a situation, I can only go with them. So, they`re going to search my bags! There`s no doubt that they`re going to the ring. But I never thought they`d search for luggage. They didn`t spend much time finding the ring in my box, And then I called out my exit tax refund, and asked me seriously what was going on? At first, I`d like to argue, but when the staff took the stub and my ring, I had nothing to say, The ring is the right thing you`re buying in Australia? `Yes, it`s a tax for you when you`re out of the country, and it`s not going to bring it into Australia, right?` Yes, that`s the same. Why are you bringing it back? Do you know it`s illegal? `m.` Look at your entry card. It`s clear: Do you carry on duty-free goods worth more than $900 a year in Australia? You`ll fill in `No`. Yes, I thought. I don`t think so. Do you know that you`re a dishonest behavior that can affect your visa status? `I was in the middle of the day, and I didn`t even know what the staff said, and I remember the visa`, my record `,` cancel `, It`s a lie. I think it`s a shame for me to do this for a time, because of this. I`m going to tell her what I`m going to say to her parents because of the cancellation of the visa. What do I do. I was crying, and then I was in a hurry to say that I was wrong. I`m wrong. I`m not going to do it again. Maybe it`s too loud, the custom`s staff seem to be scaring, turning his head and letting me stay calm, and wait for me to control the mood, and he and I have said a lot, I remember, in particular, the goods you bought in Australia, The price includes GST (GST). Australia has received this charge for construction and welfare benefits, and, ultimately, for use on you. If you`re not in Australia for what you`re buying, It`s clear that you can ask for the return of the tax. When you ask for a tax refund for this ring, you say it won`t let it go back to Australia; but now you bring it back. You bring the ring back, And I`m telling the customs that you don`t have the duty-free goods you`ve bought in Australia for more than $900, and you`re strictly speaking to law enforcement officials. "I know you have a lot of money and the tax refund will be back. It`s a temptation. `But, You should keep in mind that this is an illegal act. `You should be a new immigrant? You should take a lot of hard work to get the chance to stay in Australia?` If your behavior is reported, it will be possible to affect your visa status, and you may have to leave Australia, Do you think it`s worth it? `I`ve been told to say that, or when the high school was in charge of a head teacher, but this time my atmosphere didn`t dare come out, and it was so low that there was no self-respect.

"at last, the staff member exhaled and said,`I`ll give you one more chance, you pay the fine and make up the tax. However, you remember, if you are the next time you are found this kind of fraud tax rebate behavior, and then be looked up to have such a record, will not necessarily have such a chance again`. I was still frightened when I walked out of the airport. Looking at the blue sky in Australia, I was a little dazed. I used to feel like I was law-abiding and I didn`t expect to face Australian law enforcement officers for the first time. I want to tell my compatriots, in the face of Australian law enforcement officers, do not try to pass the border with`I said something wrong`. The other party is not an idiot, and I can tell what is wrong and what lies. I want to tell my compatriots. Don`t be greedy for such a small bargain, because for a while temptation, sacrificed their hard work to earn the opportunity, really not worth it. "

In fact, a lot of friends may have tried a similar tax rebate routine-buying a large piece in Australia, returning a tax on return home, bringing it back to Australia for use, nearly 10% of refund in bags, laptops and mobile phones can also have hundreds of dollars. Not to mention jewelry. It`s a big subsidy.

. However, as Martin told us, if you want to bring back tax rebate items back to Australia, then you must: re-declare! Pay the corresponding GSTs! Pay your taxes again! Otherwise, fine! More serious, as the customs officer said. Report, even affect your visa!

You think it`s alarmist? All of these friends have experienced it!

Netizens A:border security let go a paragraph. A girl, bought a diamond earring. 20 W. She said she had bought gifts for others. Because the price is very high, so the customs special remarks. When she re-entered the country, the customs officers went out of the box to find her earrings. I couldn`t find it by turning over the cabinet. The customs people still do not believe, keep looking for. None of them. The woman, impatient standing beside her, gathered her hair behind her ear, and the nail came out. Be punished for making up for taxes.

Netizen B: go to Japan for a week, by the way exit tax rebate more than 1000 Australian dollars, the staff check very closely, one by one, also asked me whether PR or citizen, also warned Australian residents can only bring 900 Australian dollars of goods into the country. And ask me if I buy these things and bring them back? I said no, he asked what he bought for? In response to a gift to Japanese relatives, he also asked relatives what they were doing in Japan. Finally, he asked another staff member to press on the keyboard and finally gave me a tax refund certificate. He warned me that if the items were brought back to Australia, he would be punished and frightened the baby. The first time I met, would another staff member come over and record mark to me? Why call another staff here?

Netizen C: recently customs check is very tight, as long as you apply for tax rebate, then you re-enter Australia with Smart Gate scanning entry will not be passed, because the system has your tax rebate records. If you go to the counter for entry, the customs officer will put a T-word on your entry form, which is to check if you have brought the tax rebate into Australia again. It`s already been put in place. Be careful!

There are netizens bags were turned over to look up the number! Ipad was checked column number!

Some netizens even revealed that in the process of cross-examination, the sister-in-law was more introverted, and was very nervous by the border inspection personnel under the situation is even more unable to say a word. Her sister-in-law answered a few questions for her. As a result, the border inspector asked what visa the sister-in-law took, and the girl-in-law said it was a student visa. `Why don`t you answer your own questions, `said the border inspector. We doubt whether you have the ability to study in Australia. And then it went up to the question of canceling student signatures!

Here, once again, you will be reminded of the coming home friends, the return of tax rebate must pay attention to the following points:

1. (GST), if you do not use this product or service in Australia, you will not have to pay tax, so there will be a tax rebate when the airport leaves the country. Therefore, those who bring gifts to domestic relatives and friends, can enjoy the tax rebate. On the other hand, if you bring the goods back to Australia, you have to pay the GST, in accordance with the regulations or the customs can confiscate or fine according to law.

2. Australian law provides that adults over the age of 18 can carry tax-free goods with a total value of not more than 900 Australian dollars per person, and minors under the age of 18 can carry tax-free goods with a total value of not more than 450 Australian dollars. If you carry no more than this number of tax rebate items, it is no problem to bring them into and out of Australia, and there is no need to make up for the tax after the tax rebate.

3. Not all items can be brought back to Australia. According to the Australian tourist duty-free right, (TRS) stipulates that goods that are used abroad and have possession for more than 12 months will be exempted from customs duties if they are brought back. However, items such as jewelry and watches, or more than $900, will be required to pay excise tax should they be found back in Australia.

Finally, I remind you that now Australia`s government wallet tight, of course, the tax rebate not only do not make money, but also the less money is better, and the tax rebate staff will naturally check very tight. We must pay more attention to the tax rebate when we leave the country, as far as possible, do not be small because of the big!