What is a bank deposit certificate?

The bank deposit certificate is issued by the bank to prove that you have a specified number of deposits in your bank account, both in English and Chinese. The handling of deposit certificates is very simple. With an ID card and a current / fixed deposit book (deposit slip or bank card), you can handle it at the bank counter. The deposit certificates of all major state-owned banks and commercial banks can also be obtained, as can foreign banks. Be careful not to deal with postal savings, rural credit cooperatives and city commercial banks. Many banks need to have regular accounts to prove that they need to have regular accounts, consult with the bank lobby staff before handling them, because they may need to fill out the form, and the number they take may not be an ordinary personal RMB business (for example, it may be a financial management gold number). You'll know when you ask. A deposit certificate generally requires a certain amount of handling fee.

Why do you have to provide proof of deposit?

The certificate of deposit is to prove the disposable funds of the immigrant applicant. The (Provide proof of unencumbered and readily transferable funds in a convertible currency, deposit can be in renminbi or foreign currency), and there is a historical deposit and withdrawal record. The freeze was for a while to better prove that the money was not borrowed, that the amount of money required for skilled immigrants was modest, and that there was no history of deposits.

How much should I deposit on deposit certificate?

The certificate of deposit may be in one or more accounts in the principal name, or in the name of the principal or deputy application, that is to say, there may be more than one deposit certificate. The main application is not less than 80, 000 yuan, a family of three not less than 120000 yuan.

When does the deposit start?

If there are conditions, please deposit in advance, 3 months fixed term, but to ensure that the deposit certificate at the time of filing is still within the period of validity. Federal skilled immigrants are required to submit applications. The deposit of the time deposit proves to have the historical record, the record good proof that your fund is in good condition.

An immigrant applicant can prepare a planned deposit (with access records) before submitting an application and issue a bank deposit certificate when needed. A deposit is prepared in advance to keep a deposit record, and it does not seem to be a one-off deposit for immigrants.

How can I deposit a deposit certificate? How long?

It is recommended to deposit regularly and casually (for example, 3 months, half a year can also be one year).

Freezing period: a three-month freeze at the time of issuing a deposit certificate may also specify a longer freezing period (unnecessary), during which deposits cannot be drawn, and the freezing period is not directly related to the deposit period.

About the current deposit certificate and other: some customers do not deposit funds for regular financial management, so that they can also issue a current point-of-time deposit certificate; You can also open a deposit certificate, freeze 2 to 3 months, so that the deposit on the certificate of deposit on a relatively long time. Of course, it is recommended to have part of the time deposit certificate. Other things, such as stocks, fund delivery orders and properties, can be supplemented, not necessary, and not required if there are enough deposits.

The most convenient way is to bring documents and passbooks to the bank branch counter to ask personally.

Special case: if the applicant only has the fund certificate, the stock delivery list, the wealth management product, the real estate certificate and so on other financial proof material, may also provide, serves as the bank deposit certificate auxiliary material, or replaces the bank deposit certificate.

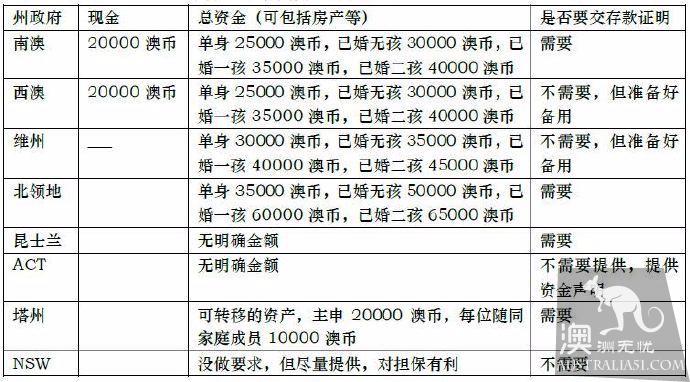

Australian state government guarantees independent skilled immigration, state government requirements for applicant's financial certification (subject to change from time to time, for reference only):

Methods for issuing deposit certificates of major banks in China

Industrial and Commercial Bank:

- Method of drawing up: according to my identity card and ICBC's unfrozen deposit certificate (including fixed deposit slip (discount), current savings passbook, voucher-type treasury bond). If the agent is entrusted to another person, the identity document of the agent shall be presented at the same time;

- Fee standard: issue a personal deposit certificate, charge 20 yuan per copy; relieve the payment of personal deposits in advance, each fee of 20 yuan;

- Validity: ICBC's certification period is more flexible: the shortest day, the longest year, customer order. After issuing a deposit certificate, the bank will freeze the deposit for the same period as the deposit certificate;

- Types of deposits: current, regular deposit and withdrawal, deposit and interest collection, zero deposit and treasury account can be handled.

- Other instructions: the deposit certificate matures, the personal deposit is automatically released from payment. If you want to cancel payment in advance, you must return the original deposit certificate, deposit certificate power, and present the original deposit certificate, personal identification document and fill in the personal deposit in advance to release the payment order.

Agricultural Bank of China

- Method of opening: the applicant shall carry his valid identity certificate, deposit slip, passbook, bank card, national debt certificate, to any branch of Agricultural Bank of China to handle the business, and fill in the Application for proof of Deposit of Agricultural Bank of China;

- If I am unable to come for some reason, I can also authorize others to do this business on behalf of others. In addition to carrying the above-mentioned documents, the agent shall also hold the authorisation letter of the authorized person and the valid identity certificate of the agent himself;

- Fee standard: the applicant at the same savings point, several accounts in different currencies can issue a corresponding number of deposit certificates according to the requirements, each deposit certificate charged a fee of RMB 20;

- Valid term: the date on which the bank issues the deposit certificate is the date on which the client carries out the business, and the deadline for the termination of the deposit in respect of which the application for the deposit certificate relates shall be determined by the applicant. And the applicant notes on the application that if the date of completion is the same, the closing date shall be the date on which the certificate is issued;

- Type of deposit: the deposit slip used to handle the deposit certificate business is the customer's own deposit in each branch of the Agricultural Bank of China branch, foreign currency, current deposit slip, passbook, all kinds of bank card deposits (except Jinsui International debit card), Voucher-type treasury bonds can handle deposit certificates;

- Other instructions: customers must first return all original deposit certificates to the bank before the expiry date of the deposit certificate is reached and cancel the deposit certificate formalities.

China Construction Bank 公司总部所在地:中国 主要业务:银行

- Methods of opening up: the applicant's request for a personal deposit certificate can only be made at the original deposit office, and the agent shall carefully examine the original valid identity certificate of the applicant and his savings deposit voucher (including deposit slip and discount) in the Construction Bank. Card) original and other relevant information;

- Personal deposit certificates may be processed and received on behalf of a person other than the applicant (hereinafter referred to as an agent). The agent shall issue the original valid identity document of the applicant and the agent when handling the personal deposit certificate or obtaining the deposit certificate on behalf of the agent;

- Charging standards: a bank issued a deposit certificate, regardless of the amount of money, each business charge of RMB 20 yuan, in the handling of the account accounting. When the amount of the personal deposit certificate you apply for is less than RMB 100000 (or RMB 100000 in foreign currency), as long as you pay RMB 20, without special circumstances, The personal deposit certificate of China Construction Bank can be obtained on the same day;

- When you apply for a "personal deposit certificate" with a deposit amount of more than one hundred thousand yuan (or one hundred thousand yuan in foreign currency), as long as you pay 20 yuan, without special circumstances, after two working days of our bank, The personal deposit certificate of China Construction Bank can be obtained by holding the application form of personal deposit certificate to the deposit office for the second time.

- Type of deposit: the deposit certificate that CCB can apply for personal deposit certificate must be the deposit slip, passbook and savings card of CCB in foreign currency and local currency according to the law. Personal deposit certificate is divided into personal time deposit certificate and personal time deposit certificate:-personal time point deposit certificate refers to a written document certifying the depositor's deposit at a certain point in the CCB. You must have a current deposit or term deposit at CCB.-A personal time deposit certificate refers to a written document certifying the depositor's deposit at a given time in the CCB. You must have a term deposit with CCB (if a current deposit is to be converted into a term deposit).

- Valid term: the term deposit corresponding to the proof of deposit shall not be drawn in advance (except that you return the original deposit certificate within the date on which the deposit certificate is certified) within the date on which the deposit certificate starts and ends.

China Merchants Bank

- Opening method: you must hold a card or passbook, deposit slip and my identity certificate (the agent must also issue the identity certificate at the same time) to open an account in the same city any China Merchants Bank branch, fill in the "China Merchants Bank to open deposit certificate application" for processing;

- Charge: 20 yuan per copy. Type of deposit: deposit certificate contains a variety of;

- Types of deposits: except for frozen deposits, depositors may apply for certificates of deposit in respect of all deposits deposited in our bank, denominated deposits in each currency;

- Valid term: flexible choice of time period: according to the needs of depositors, depositors can open deposits at any time and during the period of time.