Australia`s personal bankruptcy reached its worst level in eight years. Experts warn that heavy debt, wage hikes and falling house prices are bad news for citizens in Australia`s east coast cities.

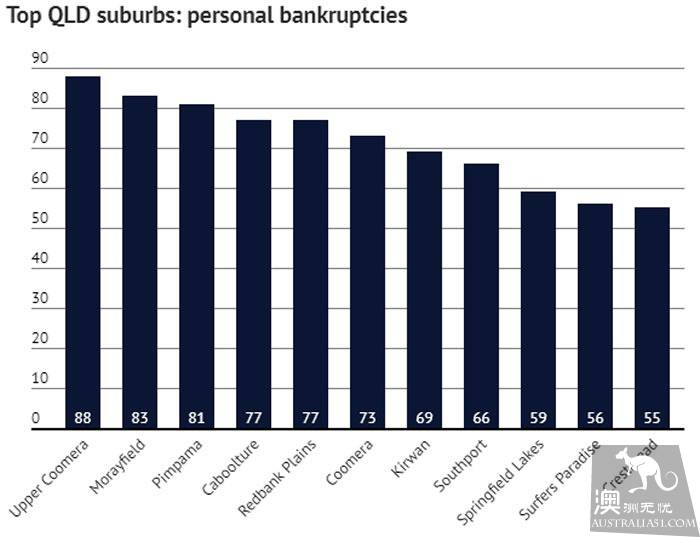

According to illion, a data analysis firm, more than 32,000 Australians declared bankruptcy in fiscal year 1718, and personal bankruptcy data rose 4 percent. Western Australia and the Northern Territory were hit hard, with breakdowns rising 11.7 percent, the biggest year-on-year increase. Private bankruptcy in the Northern Territory rose 10.6%. Kunzhou had the largest number of individual bankruptcies, with 9415 declaring bankruptcy, and the state`s personal bankruptcy growth rate slowed to 1.5 percent.

The company, CEO Simon Blei (Simon Bligh), said that while the economies of Queensland, Western Australia and the Northern Territory had gradually improved from a recession in the energy sector and a cooling down in the real estate sector, the latest figures showed that they still faced considerable difficulties. He warned that heavy debt, wage hikes and falling house prices were bad news for citizens in Australia`s east coast cities.

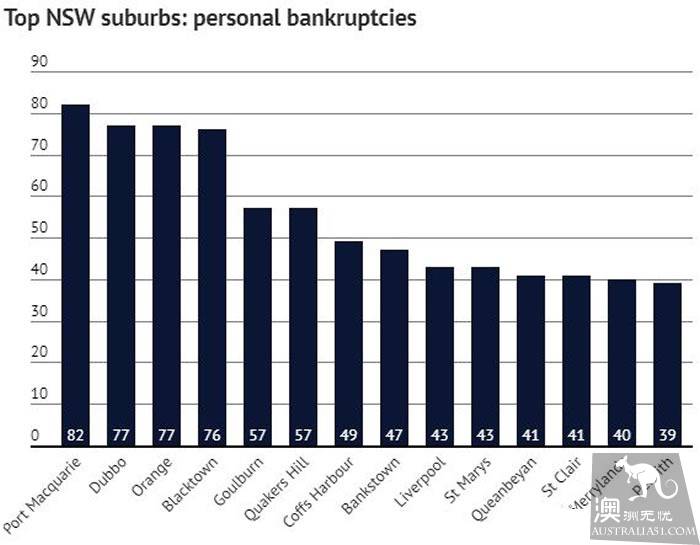

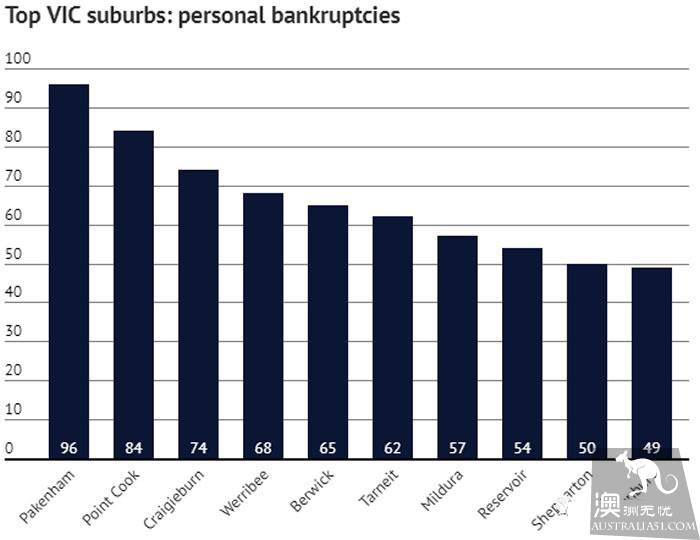

In the previous fiscal year, nearly 6000 people in the new state declared personal bankruptcy, up 7.8 percent from last year. Over the same period, 5809 people in Victoria declared personal bankruptcy, down 2.2 percent from last year, the only state in Australia with a drop in broken rates.

Market economist Stephen Kulas (Stephen Koukoulas) said that although the data did not provide an explanation, there is still a close link between the real estate market and personal financial performance in terms of the economic performance of the states or territories. "from a macro point of view, there is no doubt that when the economy is strong, the rate of personal breakdown is very low. And vice versa. " "many small businesses want to ensure the security of mortgages through commercial borrowing," he said. Banks are less likely to expand lending when the real estate market begins or is going downhill like Paz, Darwin and Sydney now. "

Kukulas noted that Australians living in remote areas could also face increasing financial pressure due to dry weather.

Bly expects the number of individual bankruptcies in the new state and even Melbourne to rise as the real estate market declines further. "with consumption rising, several parts of Australia should turn on red lights." "as the Morburn housing market has shown signs of falling, the city may face an expansion in personal bankruptcy gains in 1819 [fiscal] years," he said.