preface

Australia`s real estate industry is as large as $7 trillion, and a market of $7 trillion is enough to affect Australia`s economy as a whole. Given the size and falling prices, many are beginning to question whether the current Australian housing market is "a normal cyclical adjustment" or a "nightmare after the bubble has blown up".

One, two, Ireland?

Martin North, head of (Digital Finance Analytics), an Australian data and financial analysis firm, said Australia could become the second Ireland in the next 12 to 18 months.

Back to the outbreak of the financial crisis, Ireland was in crisis because of the housing bubble, banks were dragged down by uncollectible home loans; some newly built towns have become ghost towns because of unbought homes; Many workers from Eastern Europe and Asia have fled because of falling wages and benefits. Forced by helplessness, Ireland had to send requests for assistance to the European Union and the International Monetary Fund.

Devoy, managing director of global professional fund giant Fidelity (Fidelity) Australia, has lived through the collapse of Ireland`s housing market.

At a recent event celebrating the establishment of the company`s emerging markets fund, Devoy said Australia`s wealth was overconcentrated in the housing market, whether through direct housing investments or through major bank retirement funds. "all indicators, including debt-to-income ratios, home-to-income ratios, and so on, indicate that a huge bubble is forming in Australia`s housing market," she said.

However, Devoy believes that despite the housing bubble in Australia, there was a significant difference from Ireland`s then situation. Ireland`s central bank, for example, pursues monetary policy in European countries such as Germany and France. At the time, Irish loans cost close to zero, leading to almost everyone being developers and borrowers. The actual construction rate is twice the demand. But this is not the case in Australia.

Martin North, head of (Digital Finance Analytics), an Australian data and financial analysis firm, said that although there were some differences between Australia and Ireland, they were largely similar.

"if you compare the various factors that occurred in the first two years before the housing bubble in Ireland to the current Australian housing market, you will find that the similarities between the two markets are much greater than the differences," he said.

First, Ireland is implementing a very loose monetary policy and lending policy. Similarly, the Bank of Australia has maintained a low interest rate of 1.5 per cent for 25 consecutive months. Although lending policy has been tightened, it is still relatively loose.

Second, Ireland`s construction industry experienced a significant period of growth. At the time, first-time buyers chose lower-threshold new apartments directly, followed by an oversupply of apartments, which in turn triggered a crash. Similarly, in Australia we are seeing significant risks in the current number of new apartments. We see a lot of new apartments that don`t sell, and many developers face the risk of a broken capital chain.

Colm Harmon, an economics professor at the University of Sydney, Ireland, shares a similar view of the risks of the current Australian housing market, which is very similar to that of Ireland.

At present, the biggest risk in Australia`s housing market is the problems exposed by the Royal Commission, namely, low loan costs and easy loan terms.

"despite the tightening of interest rates, the affordability of home buyers is critical," he said. In particular, when a large number of interest-only loans maturing into principal, interest and repayment of the case, the loan buyers can afford. "

A large number of new homes may be a sign of a country`s economic boom, but the danger behind it is a huge bubble. Figures show that between 1996 and 2006, Irish house prices rose by an average of three or four times, and the ratio of house prices to household income rose from 4 to 10 per year, while in Dublin, the ratio of house prices to income was as high as 17. 5 per cent.

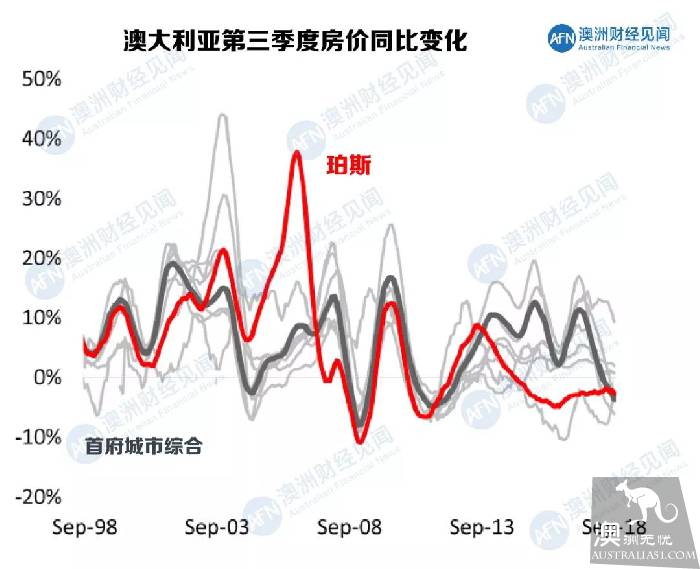

Second Australian house prices in the third quarte

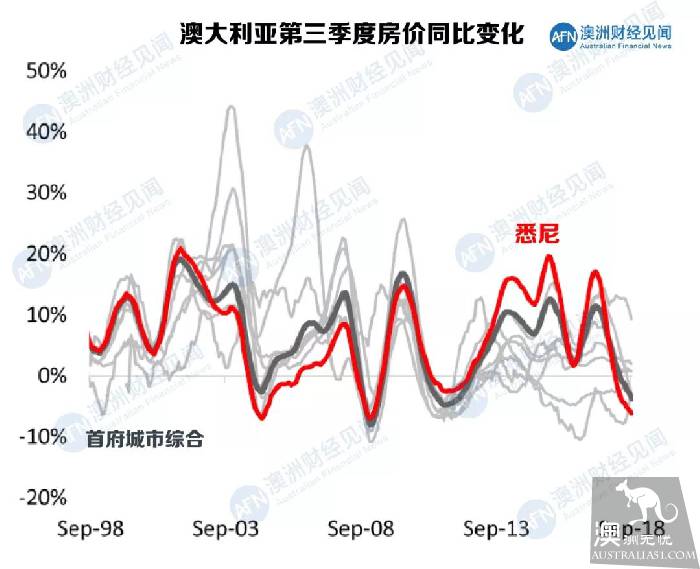

In the third quarter of this year, house prices in Australia expanded from a month-on-month decline. Among them, Sydney recorded the largest year-on-year decline in Australia, down 6.1%.

In the third quarter of this year, house prices in Sydney fell 1.5% from a month earlier, down 6.1% from a year earlier. Among them, single-family houses and apartments fell 7.6% year-on-year and 2.6% respectively.

Mohr.

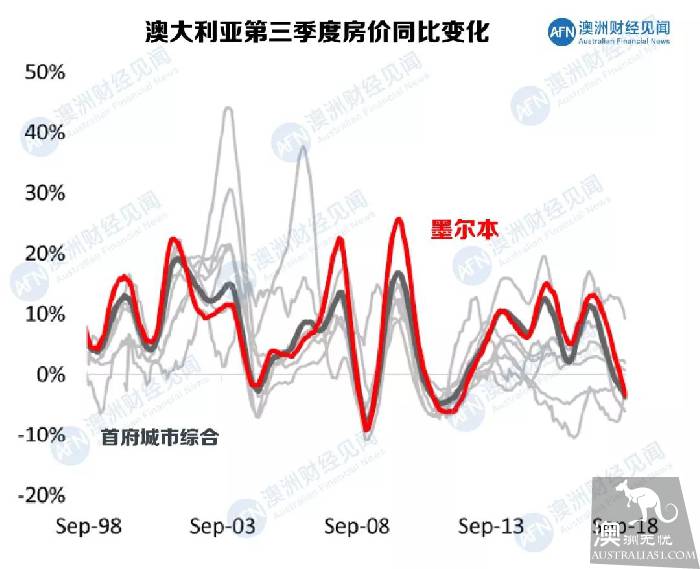

Prices in Melbourne fell 2.4 percent in the third quarter from a month earlier, 3.4 percent lower than a year earlier, and 4.4 percent lower than their November 2017 peak.

Brisbane [英格兰人姓氏] 绰号,骨折残疾人或凶残的人,来源于古法语,含义是“折断”(to break)+古英语,含义是“骨头”(bone)

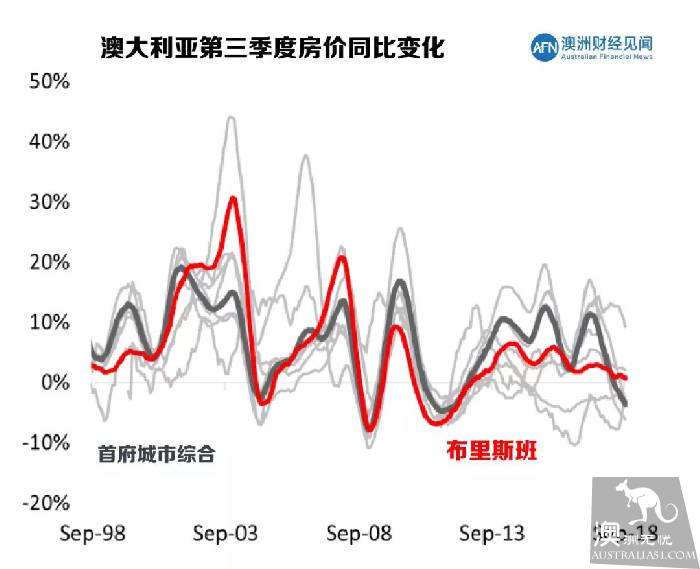

In the third quarter of this year, Brisbane prices rose 0.1% month-on-month and 0.8% year-on-year. Among them, single-family houses and apartments rose 0.8% and 0.7% year-on-year respectively.

Adelaide [女子名] 来源于日耳曼语,含义是“高贵的+世系”(noble+kind) 昵称&L[Ada]

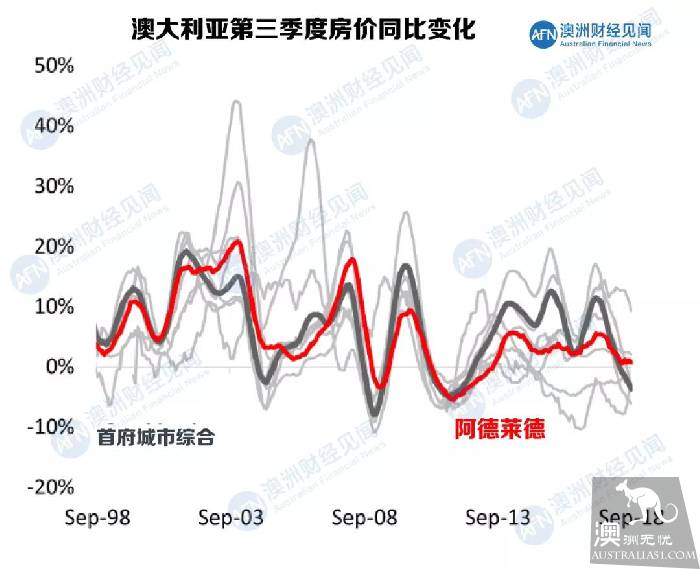

Adelaide house prices were flat in the third quarter of this year, up 0.7% year-on-year. Among them, single-family houses and apartments rose 0.6% and 1.2% year-on-year respectively.

[人名] Perse

Perth house prices fell 2.0 percent in the third quarter from a month earlier, 2.8 percent lower than a year earlier, and 13.2 percent lower than their June 2014 high.

Three good VS

As mentioned earlier, the focus is whether the housing bubble in Australia will gradually shrink or will it burst directly? In other words, what are the advantages and disadvantages of the current Australian housing market?

bull

In fact, before the surge, Australia`s housing market suffered a long period of decline, the worst two of which were linked to the global recession in the early 1990s and 1930s. At the same time, the recovery process is long and painful.

In addition, most of the time, Australia`s housing market has experienced a normal cyclical adjustment, falling by about 10 percent, followed by a marked recovery.

Thus, the "good" conditions that underpin the market`s belief that this is not a bubble crash but a normal adjustment include:

Represented by the United States, the global economy is strengthening;

Employment in Australia continues to be strong;

Australia`s economy grew steadily, growing 3.4% year-on-year in the second quarter of this year;

The Australian dollar fell to 0.7000 against the US dollar, helping to secure the local economy;

Ausbank is unlikely to raise interest rates in the coming year.

However, in support of the market adjustment, housing prices further downward negative factors also exist.

The tightening of credit led to a fall in house prices. Less cash available to borrowers means less demand for housing, which in turn affects the decline in house prices.

The cost of financing has risen. The Fed has raised interest rates eight times in the past few years. As Australia`s major banks rely on overseas financing, rising financing costs are a general trend.

In addition, the real estate market faces the largest threat is unemployment. While employment growth has been good so far, what happens if falling property prices on the east coast cause the housing boom to stagnate?

There is no doubt that unemployment will rise sharply. This means increased default on home loans and further pressure on property after forced sales. Under such circumstances, home prices across the country are bound to fall well short of the 10 percent decline most people expect, which in turn has left many buyers insolvent over the past two years.

When will you be able to enter?

When the housing market is weak and there is plenty of negative news, people may think twice about buying a house.

As of September, Australian-wide home prices had fallen 2.7 percent year-on-year and the auction clearance rate had fallen below 60 percent, according to data from CoreLogic, Australia`s leading real estate agency.

Under the influence of pessimism, some investors will think that due to the accumulation of growth in the real estate industry in recent years, the next few years will inevitably underperform. Most of them predict a 10%, 15%, or 20% drop in home prices.

Indeed, many believe that prices are still beyond their affordability even as house prices fall. The market needs to be corrected once it is overdone, and so does the current market performance. In particular, under the influence of tighter credit and the Royal Commission`s investigation, many potential buyers have further lowered the standards for home-buying budgets.

But market figures point out that not all gains are accompanied by declines. At the same time, a large number of people believe that the current Australian housing market has not reached the state of a bubble.

The reason is simple. In their view, fundamental support factors, such as sustained population growth, strong national economy and sustained low interest rates, did not happen to change.

Moreover, the demand for housing in Australia is still high, and we do not have enough new housing to meet this demand. As long as the mismatch between supply and demand continues, the downside risk of real estate prices will be relatively low.

But does that mean we should go to the market?

From an investment point of view, housing investment should depend on the individual capabilities of investors, not all of the market.

If investors understand that real estate investment is a long-term investment, and choose the right investment assets, you can smoothly avoid any market volatility.

Is this a good time to enter the market? If you want to get a big capital gain in 1-2 years, then this is obviously not a good time. However, in the long run, high-quality property has a good return on investment. The reason is simple, the demand for high-quality assets is large and relatively scarce. Especially in the bad market conditions to start with also in line with the rules of the market.

END

Any investment is risky, the greater the risk, the higher the return on investment. The same is true of home investment, where the days of buying and making money are over, and investors` patience and choice are more tested in times of market volatility.