Australia`s debt levels are higher than the warning that the Reserve Bank of New Zealand issued a sharp correction in house prices.

The Reserve Bank of New Zealand warned in its annual report Thursday that a sharp correction in home prices would pose serious risks to the stability of the financial system and the economy as a whole.

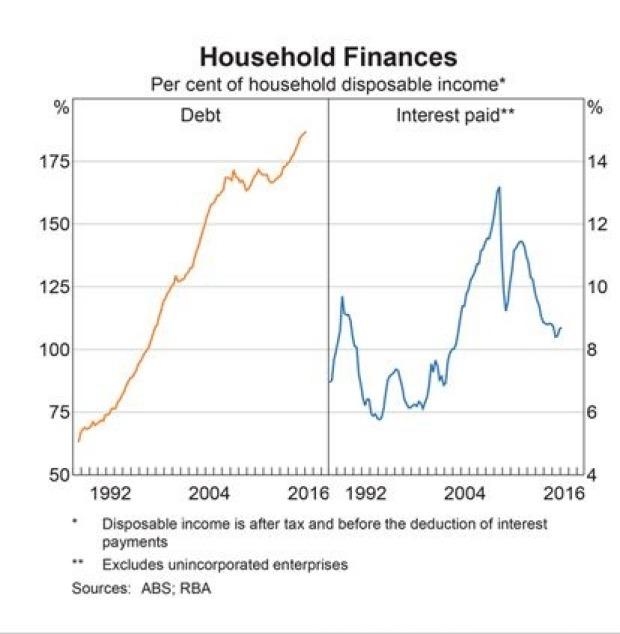

Banks are overexposed to real estate, with residential mortgages reaching 55% of their total assets. Household debt reached 163% of household disposable income, a record. "

Compared with New Zealand, Australia`s household debt-to-disposable income ratio is more than 180%. Residential mortgages account for 62% of Australian bank assets.

Glenn Stevens, the former Reserve Bank president, recently said he was "a little uneasy" about house prices in Sydney.

Philip Lowe, the current governor of the Reserve Bank of Australia, said this month that while official interest rates had fallen, the risks in Australia`s housing market were lower than a year ago, thanks to limited investment loans.

Despite these statistics, most, but not all, economists say the housing bubble is wrong.

"prices are a little high, but high prices don`t mean market bubbles," said Market Economics`s Stephen Koukoulas.

"several determinants of price are sensitive. There may be an excessive rush to some extent, but the buyer is not an unjustifiable snap-up. "

"population growth is significantly higher than average. One of the best clues is the vacancy rate, which is now close to 2 percent, not 3 percent, "CommSec economist Craig James said.

Most economists and experts say Sydney`s real estate fundamentals are solid.

There are two reasons for high prices: low supply and high demand.

Demand is high because interest rates are low and Australia, as an immigrant country, is growing.

Supply of new homes, by contrast, has been unable to keep pace with demand because of slow development and the reluctance of sellers to sell high-priced assets. Bubbles don`t mean to burst.

The key to the bubble, says SHane OLiver, chief economist at AMP Capital, is that it will burst. But there was talk of the Sydney bubble in 2003.

"the bubble may have started in 2003, and the discussion is still going on."

"just because Sydney has a bubble doesn`t mean it`s going to collapse."

"the bubble inflation has been slow, with four bubbles rising in the past 13 years, but we haven`t crashed yet. A crash must be preceded by high interest rates, high unemployment and a sharp rise in supply. "

"it may never burst, maybe it`s not a bubble, maybe the fundamentals are solid."

But economist Steve Keen, a staunch supporter of the bubble theory, said the level of debt described by the Reserve Bank of New Zealand was the most obvious sign. He also said the bubble would burst within three years.

"is there a bubble in Sydney? Absolutely. This is the most obvious bubble on the planet except for China and Canada. "

"it was not the level of debt, but the level of change in debt, that punctured the high-priced bubble."

"at the current rate, our debt-to-income ratio is extremely high. We will reach the debt-to-gross national product ratio of 170 percent, and the rest of the world has not reached the highest level of 140 percent. "

Looking back, Mr Keen says Australia has formed the subprime mortgage crisis of 2007 in the United States.

"(like Glenn Stevens), in front of Congress in 2006, Greenspan said there was no housing bubble in the United States, when the index was already several standard deviations above the long-term average."