ANZ Bank recently released a new report aimed at providing the latest insights into the financial situation of Australians.

1,36% of Australians barely make ends meet

The report showed that 23 percent of Australians were classified as below average in their financial practices, with annual income of around A $30,000 after tax and 13 percent describing their current financial situation as "bad." The situation in New Zealand is similar.

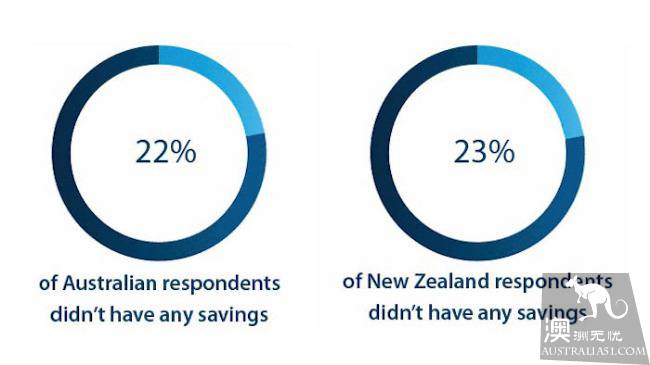

Only half of Australian adults think they earn enough. 1/4 of people have more than six months of wage savings. Meanwhile, 22% of Australians don`t have any savings.

Although the average Australian wage across Australia is about A $80, 000 before tax, according to the SEEK`s Australian wage report. But 36 percent of Australians and New Zealanders are "barely able to make ends meet" financially, earning barely enough to meet their expenses, or about A $45,000 to A $50,000 a year. 1/4 of Australians are still unable to pay their bills even if they receive a final payment notice.

(photo source: ANZ financial wellbeing report)

2. Factors affecting financial behavio

Family factors: according to Elaine Kempson, a financial expert at ANZ Bank, Australian parents` view of consumption can have a profound impact on their children. She thinks it is important for parents to educate their children about frugality from a young age. Many well-off respondents said they had long-term access to financial education and influence from their parents as they grew up, while the vast majority of poor-financial respondents had similar problems with their native families.

(photo source: ANZ financial wellbeing report)

In addition, one of the important factors of age is that the elderly have a high proportion of healthy financial conditions. Because most of these people have their own pensions and properties.

Women are better at managing money than Australian men. According to statistics, 32% of the women surveyed said they had a detailed arrangement after receiving their wages. But by contrast, only 25% of men.

(photo source: ANZ financial wellbeing report)

In general, personal or family financial health depends more on attitude and behavior towards money than income, financial knowledge and experience. High-income earners do not necessarily suffer from economic distress, and those with low incomes do not necessarily make ends meet.

3. There are great differences in the concept of financial management at home and abroad.

As the largest saving country in the world, as early as September 2013, data from the people`s Bank of China showed that the total savings of residents in China exceeded 43 trillion, with a per capita savings of more than 30,000 yuan. As a big depositing country, Chinese people generally like to save money.

There are also great differences in the concept of financial management at home and abroad.

According to the Standard & Poor`s rating (Standard& Poor`s Ratings Services) Global Financial knowledge Survey, Norway is the country with the best financial knowledge in the world, ranking No. 1. However, in previous surveys, the United States, the world`s richest country, ranked only 14th this time.

The top 10 countries in the world are: Norway, Denmark, Sweden, Israel, Canada, the United Kingdom, the Netherlands, Germany, Australia and Finland.

Chinese prefer safe and safe financial management, like to save money, has a deep concept of "inheritance". In addition, addicted to fixed assets, such as real estate and gold is also a major feature of financial management in China.

However, Westerners pay attention to hiring professional financial managers to conduct lifelong financial analysis, guidance, and strictly in accordance with the guidance of financial managers. They are more open-source than deposits, capitalizing limited capital, widening wealth channels and rolling wealth into circulation.