Some of Australia`s top economists recently warned that the federal government should consider adjusting the (GST) for goods and services from 10 percent to 15 percent. They urged Australia`s tax system to adjust its tax on goods and services as well as individual income taxes in an effort to ease economic pressure on low-income households.

1 long-term tax reform

Josh Frydenberg, the Treasury secretary, made such a call three years ago, and now the proposal has undoubtedly triggered another battle between the states` government and the federal government over the division of the GST. Government, for example, which split GST into fewer states, wants the federal government to ensure that "none of the states will be worse off" in the new legislation.

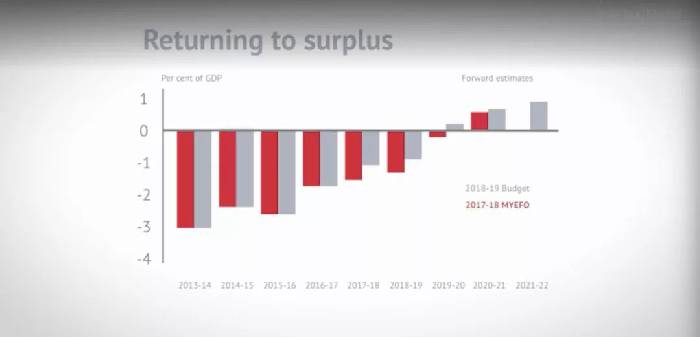

At the same time, some businesses and welfare organizations have called for a national debate on tax reform. They warned that adding to Australia`s GST, fiscal surplus for the first time in nearly a decade would not take into account the interests of workers, social security beneficiaries and many businesses.

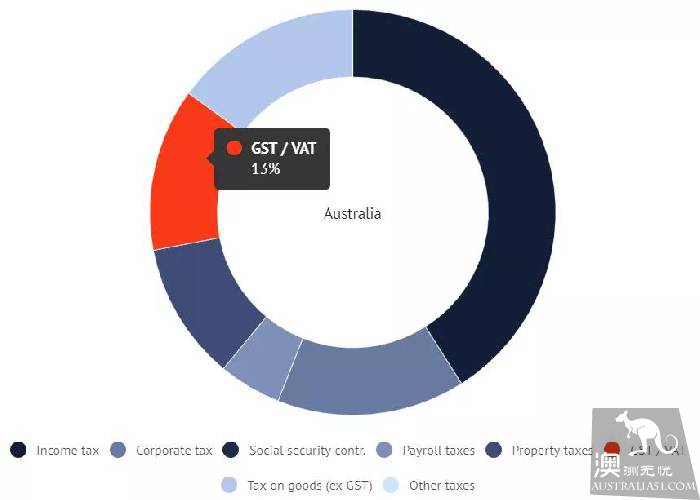

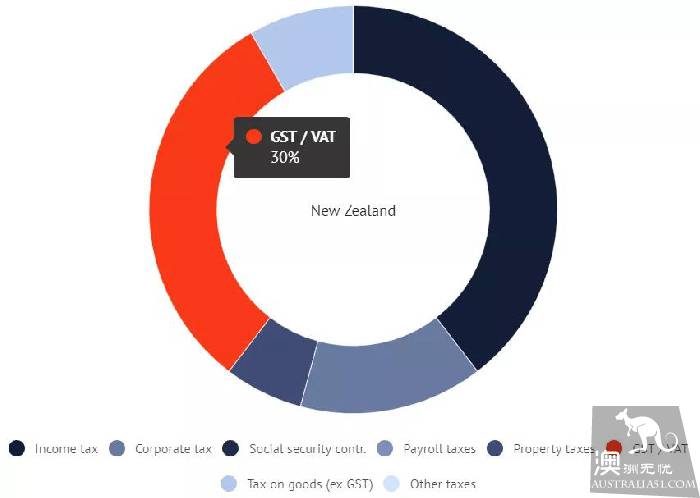

Australia`s tax revenues from the GST have fallen to half that of New Zealand and only 2/3 of the average in developed countries, according to OECD (OECD). Australia`s GST revenues are largely dependent on personal and corporate taxes.

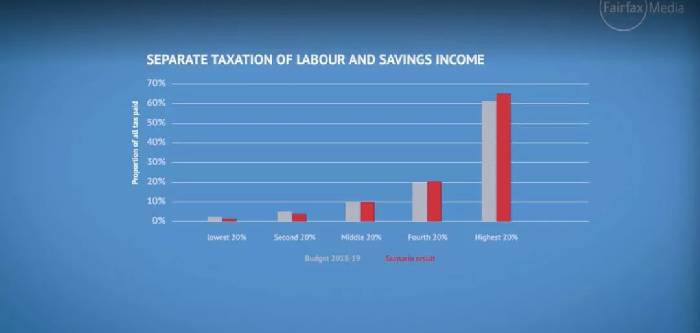

If the GST of most products were adjusted to 15 percent in 2015, GST revenue would double to A $130 billion in fiscal year 2017, according to estimates commissioned by Unionparty Congressman David Gillespi to the Congressional Budget Office in 2015.

In July, then-Treasury Secretary Morrison (Scott Morrison) announced that the federal government would allocate an extra A $9 billion to states and territories to ensure that no state would suffer losses in the GST split plan. But there was a long debate between the states` government and the Union over the plan. For more information, see GST for major reforms! The federal government has allocated A $9 billion, and the states that have benefited most have been.

2 experts call for higher taxes on GST

Australia`s top economists, including the Ken Henry, Chris Richardson, Miranda Stewart, John Freebairn and Richard Highfield, are calling for a wider range of GST charges.

Now, Treasury Secretary Frydenberg said, "the GST is set up and we have no plans to adjust it at the moment," but in 2015, he also supported the new state governor Mike Baird`s proposal to "raise the GST tax rate." At the time, the Baird warned that Australia had missed one of its most effective taxes, and that other countries were moving forward on that front.

GST is considered a valid tax because it is difficult to effectively avoid taxes and has very little impact on productivity. Because GST will not kill ordinary people to gain more income, or the company`s business expansion enthusiasm.

"it`s a welcome thing to see the new state taking the lead in discussing state tax reform and hoping to raise the GST tax to 15 percent." Frydenberg, then assistant finance minister, said in 2015.

"government and I are very eager to explore the future of the tax system and the GST,. Fundamentally, we, as a country, need to make the right reforms to the economic challenges that we will face."

3. Tax reform has been put on hold for a long time

However, the dialogue fell apart in 2015 after Tan Bao government shelved its tax white paper. Three years later, economists remain negative, tax reform has not progressed further, and the GST problem is still standing still.

"in my opinion, GST is a mediocre and underutilized form of taxation," said Richard Highfield, former Australian tax commissioner and chairman of OECD`s tax administration.

Miranda Stewart of the tax and transfer Policy Institute (The Tax and Transfer Policy Institute) says GST revenues have been cut a lot by tax-free policies for some goods, such as men`s condoms and women`s tampons, which have been exempt from taxes since October.

"collecting GST is a benefit for everyone," Professor Stewart said. "GST`s tax policies need to be broadened, strengthened, not eroded."

Economist John Freebairn warned a decade ago that New Zealand had increased its GST to 15 percent, exempted a small number of products, and had shown Australia how to properly implement the GST policy.

"how to better help the poor is not through more food supplies, but by increasing social security and an advanced personal income tax system," he said.

Pete Calleja, a tax officer at PricewaterhouseCoopers Australia, says an increasingly digital tax system means that different goods can be taxed at different rates, such as some basic consumer goods that charge 5% of GST,. And some luxury goods can charge 15% of GST..

"by extending the base, you can get a completely different perspective." He said。

4. Raising GST tax revenue should also be cautious

, Per Capita, one of Australia`s most advanced think tanks, has made it clear that it is opposed to any GST growth. But he also said he could learn from New Zealand`s tax policy.

"I`m not saying that the GST can`t go up anyway, but we shouldn`t support it in the absence of compensation for policy changes," he said.

Chris Richardson, a former Treasury official, said Australia`s tax system was at a critical turning point and was in urgent need of reform.

"We had a very bad conversation with ourselves. If you ask us what we can do, I can only say, pray. " The Deloitte Institute of Economics, (Deloitte Access economics) `s economic adviser, told the Melbourne Institute meeting last week.

"I tried to bring Australia and the world in a better direction through my career. We don`t know, we`re going to change direction so much. This shift will be designed to protect what we already have. " He said。