Recently, the National Bank of Australia (NationalAustralia Bank,NAB) abruptly fired 20 employees and imposed pay cuts on 32 other employees, even alerting the police. The reason: these employees have not provided customers with accurate and / or complete information and documents to provide them with home purchase loans.

There were 2300 troubled loans involving home loans from 2013 to 2015, most of which were in Victoria and New York, and many of them were granted to overseas investors.

NAB said it would contact customers of these troubled loans and ask them to participate in a detailed review of their loans. The review may include verifying the documents they submitted when they first applied for a home loan.

If a customer is found to have suffered property losses as a result of a troubled loan during the review, NAB Bank may pay a certain amount of compensation.

However, the specific amount of loans and compensation is how much, NAB did not disclose.

The report also mentioned that these problematic loans came from NAB Bank`s "Introducer Program," and that the operation of the project is that if some business partners-accountants, financial planners, real estate brokers, etc.-introduce home loan customers to NAB Bank, And customers end up lending money in the bank, so the bank will give these referees a commission.

To put it bluntly is to spend money on clients.

NAB Bank said it discovered illegal lending in October 2015 and reported it to the Australian Securities and Investment Commission (ASIC).) in November. Since then, the bank has conducted more than a year of detailed investigation into the problem, eventually identified the problematic loans and punished the staff involved.

tip of the iceberg, a small evident part or aspect of something largely hidden

If the findings of UBS, an investment bank, are correct, then NAB`s "troubled loans" may be just the tip of the iceberg.

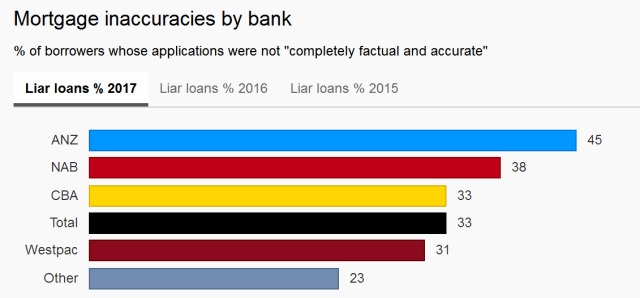

Earlier this year, UBS conducted a survey of housing loans across Australia and found that as many as 1 / 3, with a total of up to A $500 billion in loans, were "liar loan", meaning that when customers applied for these loans, Some of the information provided is inaccurate and untrue.

Only 67 percent of respondents said they submitted "completely true and accurate" information when applying for a home loan, and nearly 40 percent said they overstated at least one item of information when applying for a loan through a loan broker.

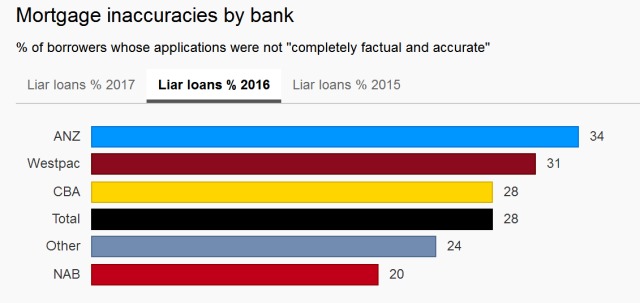

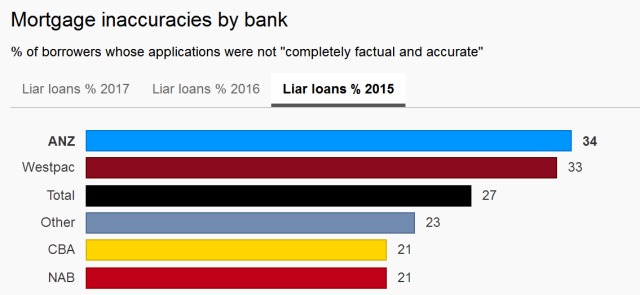

按银行来分的话,ANZ银行连续3年的“liar loan”都是最多的,2017年高达45%的房屋贷款都提供了“不完全真实和准确的信息”;2016年这一比例是34%;2015年也是34%。

NAB was 38%, 20% and 21% over the three years, respectively.

In this way, there is also a housing loan fraud in Australia, and there are a lot of it! And once this risk is detonated, it must also be a thunderbolt for the entire Australian housing market.

Although house prices in Sydney and Melbourne have continued to rise over the past five years, the slowdown in growth has also been evident this year, and the Sydney auction liquidation rate has remained below 70% for several months. Melbourne`s house price rise in the past three months has also fallen below 2%. Will the inflection point in the housing market come and the impact of any of the risk factors affect the whole body? Only the market can give the answer.