A year or two ago, the Australian real estate market was a paradise, and now it has become a hot potato! If you can`t touch it, you`ll have nothing to do with it!

In the second half of last year, as Australia`s government issued a decree, abruptly retreating into the housing market, so far, the cold winter in the Australian housing market is still advancing to the depths of the cold.

These days, many Chinese friends thought to themselves: the housing market is not good, to sell the house, the most is to earn less, admit to plant.

But in Australia, the situation is not so easy to earn less, but even forfeited money back! Hundreds of thousands of dollars in vain, in exchange for an empty and a lifetime of lessons!

This happened to a Chinese couple, Lie Lin Zheng (Lelin and Tang Zheng (Zheng Tang.

They have just learned the joys and woes of the Australian housing market.

In recent years, there have been too many Chinese speculation in Australia, and the momentum of Chinese tenants has eased slightly as Australia has enacted a tightening policy specifically aimed at overseas buyers, while at the same time, large property markets such as Sydney and Melbourne, There was an all-out rush.

Undeniably, in the past 10 years, too many of the Australian local Chinese who invested in Australian real estate, and Chinese investors, have experienced huge favors, permanent property rights, real estate value-added cash, high annual growth rates, high rental returns, and so on. These huge benefits, for the "world" of Chinese real estate groups, is so temptation power.

As a result, the couple decided to enter the market, this time by bypassing big cities such as Sydney and Melbourne, where property prices are high and already saturated, to buy a flat apartment in Brisbane.

The 79-square-meter property, a first-hand house, is a The Green high-rise apartment project built by developer Landlease.

The total price of house prices is very attractive, $ five hundred and thirty thousand, and so on before the construction of the two years before the house, according to the normal law, real estate is expected to go crazy value-added, such a low-cost purchase is simply to earn more, and then can carry on real estate value-added cash!

There were plenty of investors with the same ideas as Zheng and his wife, and soon the The Green development sold out. Before the project began, Mark Menhinnitee, the developer`s chief executive, had told people:

"Let`s embrace Landlease`s first comprehensive development project in Brisbane, which is a hard-won opportunity!"

At that time, dozens of crane boom straight above the skyline, day and night tense construction, interest rates fell, this time to buy a house is just too good!

The Chinese buyer who grabs the building flower is lucky to seize such a big opportunity.

No one can imagine that the turbulent Australian housing market allows people to go to hell in heaven every day!

In 2013, the couple bought flowers. In 2015, the project was completed on schedule and did not disappoint anyone. Today, however, three years later, it is reasonable to say that the price of housing prices does not soar out of proportion, but at least it can earn a small sum of money? And it turned out to be a staggering opposite!

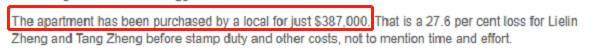

The $ five hundred and thirty five thousand purchase of the building takes five years to sell for only $ three hundred and eighty seven thousand! In other words, the couple not only failed to earn a penny, but also lost $ one hundred and forty eight thousand, or about seven hundred and twenty thousand yuan!

Aside from the stamp duty and other expenses paid by the couple, the real estate investment made the Chinese couple lose the principal, but also lost 27.6%!

Not to mention the time and energy they spent on the property.

Earlier this month, Kylie Rampa, a spokesman for the Australian division of developer Landlease, said: the local inner city housing market is too challenging. Inevitably, the market`s default rate will rise in the short term, she said.

In Zheng Liilin husband and wife to buy a house, buying a house policy is not as harsh as it is now. Clearly, however, uncertain housing market trends, policy uncertainty, but brought unexpected terror "sequelae."

Now, Australia`s domestic banks tighten lending system, property delivery default may occur.

And where there is a default, there will be discounts, this is for all Chinese buyers alarm bell.

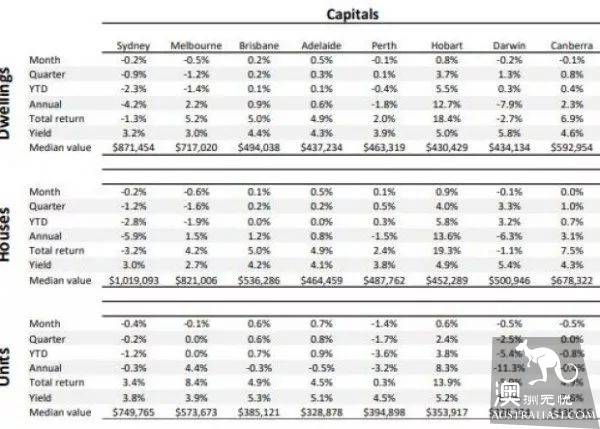

So far, Corelogic has learned from all of the country`s home-purchase data that apartment prices in Brisbane have fallen by an average of 0.3 percent a year, as did Sydney`s.

So far, do you think the Australian housing market is falling? Speak with the facts.

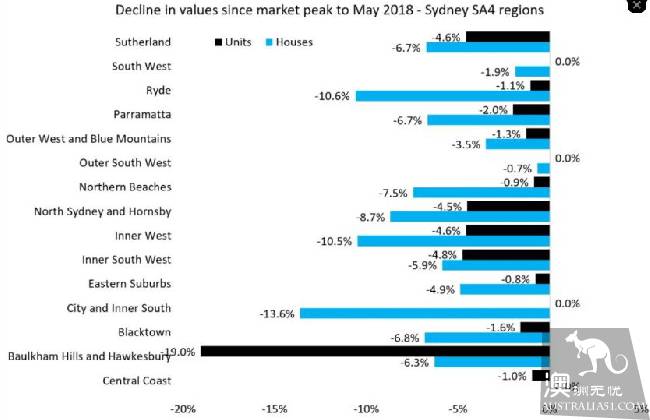

In May 2018, the decline in house prices in various parts of Sydney peaked.

Suntherland: flat units fell 4.6%, while Dokong House fell 6.7%

South West: flat units fell 0%, Dokong House fell 1.9%

Ryde: units were down 1.1% and Dokong units were down 10.6%.

Parramatta: units were down 2% and Dokong units were down 6.7%.

Outer West and Blue Mountains: 1.3% decrease in unit and 3.5% in single-house

Outer South West: a 0% drop in the unit and 0.7% in a single room

Northern Beaches: flat units fell 0.9%, while Dokong House fell 7.5%

Units in North Sydney and Hornsby: fell 4.5%, while those in single homes fell 8.7%.

Inner West: units were down 4.6% and Dokong units were down 10.5%.

Inner South West: flat units fell 4.8%, while Dokong House fell 5.9%

Eastern Suburbs: flat units fell 0.8%, while Dokong House fell 4.9%

City and Inner South: units were down 0%, while Dokong`s units were down 13.6%.

Blacktown: units fell 1.6% and Dokong fell 6.8%

Baulkham Hills and Hawkesbury: units fell by 19%, while individual units fell 6.3%

Central coast: flat units fell 1%, Dokong House fell 0%

Australia`s second-hand housing market this year has seen waves of homeowners scrambling to sell, compared with last year, mainly reflecting an increase in supply in Sydney and Melbourne, the two largest housing markets in Australia.

Home prices in southeastern Australia continue to fall, according to CoreLogic analysis, although prices in a handful of small markets are rising.

Cameron Kusher, an analyst at CoreLogic, said Australia`s housing and house price trends were likely to continue at the moment.

"as the Australian housing market did not meet expectations, the number of properties to be sold in Sydney and Melbourne was on the rise, which also slowed the urgent need for buyers to bargain, and as the supply of property increased, buyers became more assertive," he said. So the seller needs to reconsider their expected selling price and sales strategy. "