In the near future, there has been no such thing as a rise in oil prices in financial markets.

In fact, international benchmark crude oil prices have risen more than 70 percent since June last year because of OPEC production cuts and tensions in the Middle East. More and more analysts are beginning to focus on the impact of higher crude oil prices on the global economic outlook.

The impact of rising oil prices on the global economy

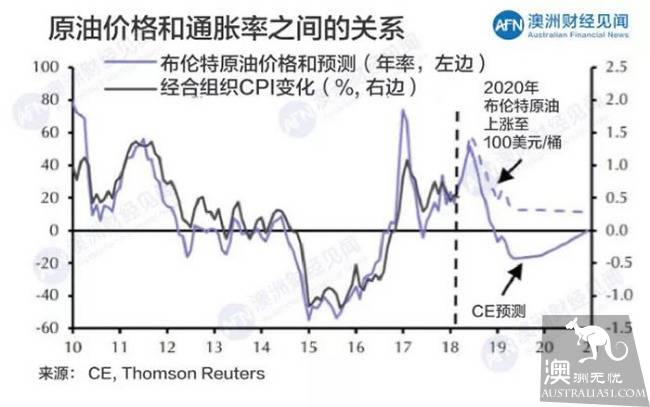

On the one hand, high oil prices push up inflation. If oil prices hit $100 a barrel by 2020, global inflation could rise by about 0.5 percent, said Cathay Capital macro (Capital Economics) analyst Andrew Kenningham.

Rising inflation is bound to put further pressure on interest rates.

According to the Kerringham, as capital shifts to oil-producing countries, the prospect of a decline in global economic activity is likely. A shift in revenues from big consumer powers such as Europe and the US to oil producers such as Saudi Arabia and Norway could have a drag on global economic growth.

"consumption by oil-producing countries is relatively low relative to big consumer countries such as Europe and the United States, which in turn can lead to a reduction in global demand," he said.

The impact of higher oil prices on Australia

Morgan Stanley (Morgan Stanley) analysts said rising global oil prices are gradually leading to higher domestic gasoline prices in Australia, potentially offsetting the benefits of tax cuts for low-and middle-income groups in the government`s new budget.

Low-and middle-income tax cuts are reported to be equivalent to a maximum of A $10 a week for individuals and a maximum of A $530 for the full year. The rise in oil prices, coupled with the depreciation of the Australian dollar, could be offset by the federal government`s tax cuts.

Morgan Stanley analyst Chris Nicol said Australia`s wage growth rate continues to slow, rising 1.3-2.1 percent year-on-year. By contrast, our necessities rose 3.1% year-on-year. The rise in oil prices will only "make the situation worse." Currently, the price of standard unleaded gasoline has risen from 1.33 Australian dollars per litre in early 2018 to 1.46 Australian dollars per litre. If this continues, it could push up inflation by 0.3 percentage points, which would offset the A $3.7 billion tax cut.

As shown above, when oil prices and retail sales grow inversely. In other words, higher oil prices and slower growth in retail sales.

Overall, the result of the rise in oil prices means a rise in pressure on countless households in Australia. Meanwhile, Morgan Stanley analyst Chris Nicol said the rise in oil prices would also cause GDP growth to fall short of expectations.

"excluding inflation, the real wage growth rate of Australians is negative," he said. So we will find that 2018 consumption data may be significantly lower than expected, which in turn affects GDP growth below market expectations of 2.7 percent and Ausbank`s forecast of 3.0 percent, or about 2.0 percent. "