For Australia's government, foreign investment is an important guarantee for the development of the country's economic and the improvement of people's living standards. As mentioned in the official government document of the Commonwealth, foreign investment has many benefits to Australia, such as the creation of new jobs. Encourage innovative thinking and enterprises, introduce advanced technology, develop overseas trade and enhance the competitiveness of the industry and so on.

These criteria have also become important considerations in Australia's judgment of foreign investment, and foreign investment bills that meet these criteria will be more popular with the Federal government, and, on the contrary, those that do not meet these conditions limit the development of Australia's economic. Even foreign investment in the national interest of the threat will be rejected in rigorous scrutiny or subject to a number of restrictions.

The approach taken by the government in the process of reviewing foreign investment proposals is to make a professional and comprehensive assessment of whether the investment will affect, or even jeopardize, the development of Australia's economic system, on a case-by-case basis and on a case-by-case basis. Such an assessment takes into account even the social problems of the country in which foreign investors are located.

Foreign investment review system

Australia's foreign investment regime is based on the Foreign Capital acquisition and receiver Act 1975 and its related law (FATA), and Australia's foreign investment policies, which regulate the behaviour of investors in Australia. It forms what we call Australia's foreign investment regime. Strictly speaking, the system is not law, but it is still very binding because compliance with its requirements directly affects the entry of foreign investment. Decide whether a foreign investor can obtain the regulatory review and investment approval necessary for foreign investment.

First of all, Australia's foreign investment regime provides for the Federal Department of Finance as the main regulator of foreign investment. The Fata Act regulates the fiscal minister or its client as the rights reviewing foreign investment proposals through the Division for Foreign Investment and Trade Policy. If the investment proposal involves limiting the development of Australia's economic, or even the threat to national interest, the fiscal minister has the right to reject, or to control the implementation of the proposal through restrictions without potential harm. Fiscal minister has the authority to decide whether to approve the foreign investment proposal or not, and also has the obligation to listen to the foreign investment review committee's views and recommendations. The foreign investment review committee, a non-statutory body consisting of five part-time staff and a full-time executive director, plays a crucial role in the decision of the fiscal minister.

Secondly, the foreign investment regime provides for foreign investors, who have two types of individuals (corporations) and foreign government, in which individuals (corporations) are required to meet the following definitions:

1. Non-Australian permanent natural person;

2. A company in which control is held by a non-Australian permanent natural person or foreign company;

3. A company with combined control by two or more non-Australian permanent natural persons or foreign companies;

4. Trustee of trust property not held by a permanent natural person or a foreign company in Australia;

5. Trustee of trust property in which two or more non-Australian permanent natural persons or foreign companies have a combined substantive interest.

For China, Chinese government investors, including Chinese state-owned enterprises and other state-owned enterprises that meet these conditions, are generally required to apply for investment, regardless of the value or nature of the investment.

Foreign Investment Review Committee

The Foreign Investment Review Committee (the "Committee") is a non-statutory body established in 1976 to advise the fiscal minister and government on Australia's foreign investment policy and its management. The function of the committee is advisory, and the responsibility for making decisions on policies and proposals lies with the fiscal minister. The Department of Foreign Investment and Trade Policy of the Ministry of Finance, as the secretariat of the Commission, is responsible for the day-to-day management and organization of the Committee.

The role of the Commission, including through its secretariat, including:

1. In accordance with policy, the Foreign mergers and acquisitions Act 1975 ("the Act") and the Auxiliary legislation review Australia's foreign investment and make recommendations to the Treasury minister and Treasury on these proposals;

2. Advising the fiscal minister on the implementation of the policy and bill;

3. Raising awareness and understanding of the policy and bill within and outside Australia;

4. Provide guidance on policy and law to foreigners and their representatives or agents;

5. Monitor and ensure compliance with policy and law;

6. Advise fiscal minister on policy and related matters.

Notification obligations of foreign investors

Although not all foreign investments require the prior approval of the government, foreign investors still have an obligation to notify the government in advance and obtain their investment approval, which not only has the potential to liberalize foreign investment by the fiscal minister, It will also avoid future scrutiny because of voluntary notices. The Fata Act requires government approval for foreign investment and acquisitions, otherwise there will be criminal sanctions, investments in certain areas, such as media and residential real estate, regardless of the value of the investment. Foreign investors are required to notify Australia's government in advance of their nationality. These investment projects are as follows:

1. All unused non-residential land;

2. (B) all residential real estate (notwithstanding the existence of exemptions);

3. Shares or units in Australian Urban Land Corporation or trust property;

4. All direct investment by foreign government and its associated entities;

5. Plans to establish new businesses or acquire land interests in Australia;

6. Foreign investment in the media industry in the way of stock investment and control of more than 5%.

At the same time, if the target value of an acquisition or investment is greater than or equal to the value set by FATA, notice must also be given in advance.

Review of Investment residence real estate

According to Australia's foreign investment framework, before Australia buys a residential real estate, foreigners usually need to apply for foreign investment approval. Government's policy is to channel foreign investment into new housing, as it will create more jobs in construction and help support economic growth. Foreign investment can also promote economic growth and increase government revenue through stamp duty and other forms of tax. As a result, applications for foreign investment usually need to be considered on the basis of an important principle that the investment should increase Australia's housing stock (at least create a new home). According to this goal, whether the type of real estate purchased is to increase the housing stock of new homes or already built house, will apply to different factors. It is important that foreign investors understand and comply with Australia's foreign investment framework. Violations of law may be subject to severe criminal and civil penalties.

Considerations to be taken into account in foreign investment reviews

Foreign investment review is a two-way security process, the fiscal minister has the right to prohibit or relax foreign investment, and investors are also obliged to notify the government and provide formal written documents. In the process, there are many factors that need to be considered, which determine whether the foreign investment can be implemented or not.

Country: does this investment affect Australia's strategic and security interests? Will this investment affect Australia's economic

Market: will this investment affect the market pricing and production of a product or service in Australia? Will it have a negative impact on relevant industries around the world and on market competition?

Society: will this investment affect Australia's relationship with business? For example, shareholders, employees, creditors, etc. Will investment affect Australian taxes? Will it affect the environment?

Investors: are investors subject to comprehensive and transparent regulation and supervision? Do you have the ability to meet the investment requirements? Is the investor's business and financial situation normal?

Target company: is the target company and assets in normal condition?

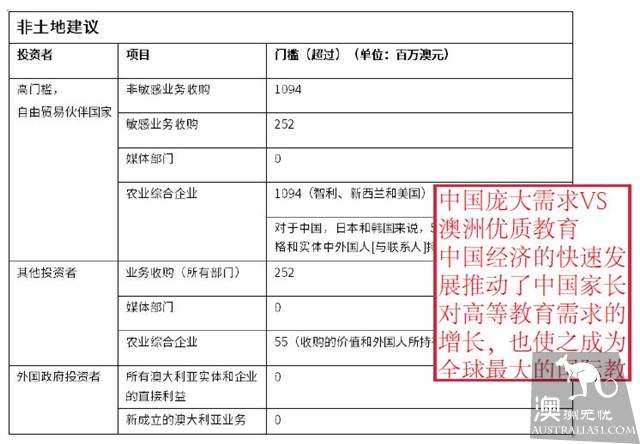

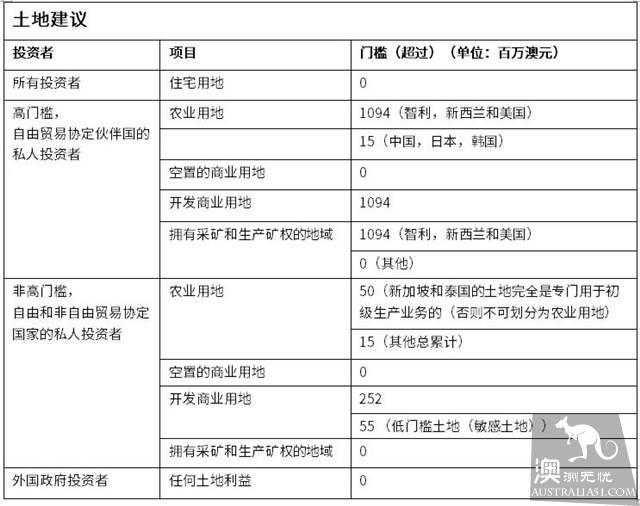

Foreign investment review exemptions and thresholds

According to Australia's foreign investment framework, the government requires certain investment projects to be notified prior to investment and to issue non-controversial certificates. The notice requires variations based on a number of factors, including whether the investor is a foreign government or non-government investor, the type of acquisition, and whether the acquisition is subject to monetary thresholds and free trade agreements. Unless there is immunity, a foreigner must notify and receive a no-objection certificate when the purchase exceeds the threshold for currency screening.

According to the FATA bill, a test of whether an investment meets the threshold for currency review will affect the committee's decision on whether to take judicial action. If the amount of interest paid or the value of an entity or asset exceeds the threshold amount, the threshold for currency screening is reached, also depending on the type of behavior (see table below). Investment in agricultural land is not included. The currency test threshold is indexed with the GDP implied price deflator (which is not indexed) with the exception of the $15 million agricultural land threshold and the $50 million land threshold for Singapore and Thailand investors on January 1 each year. As this year's GDP implied price deflator did not rise, the currency threshold in the following table remained unchanged in 2017.

Application for foreign investment review

All applications for foreign investment should be submitted through an online system. The online system can be accessed by clicking the "request now" button on the right side of the Committee's website. Applications for foreign investment related to commercial, agricultural or Australian enterprises will be processed by the Treasury. Applications for foreign investment related to residential real estate will be processed by the Australian Revenue Authority. The applicant should carefully determine the type of application. Requests submitted will have to be resubmitted if the information is incorrect, which may result in delays and additional costs. A list of the documents and information required to submit the application can be found on the Committee's website.

Foreign investment review reform

Government has refined Australia's foreign investment framework to make it more modern, simple and effective, and to ensure that investors comply with the rules. Reform measures include:

More severe penalties are imposed on violators, including the introduction of civil penalties.

Using their expertise and information matching systems, ATO will now regulate foreign investment in the real estate market.

Application fee: used to improve services and ensure that Australia's taxpayer no longer needs to fund the costs of managing the system.

Strengthening oversight and transparency of foreign investment.

These reforms are not intended to discourage investment, but to improve the integrity of the framework and to ensure that the rules are properly enforced.

Rules-abiding investors will enjoy many benefits: through clearer legislation, clean-up systems and better foreign investment review committee services will make applications easier.