The new state takes the longest for first-time home purchases, but the most time-consuming urban area for first-time home purchases across Australia is Perth`s Peppermint Grove. (AP Photo)

According to the Australian Broadcasting Corporation, according to the Australian Bureau of Statistics, (ABS), real estate research firm CoreLogic and the Bank of Western Australia (Bankwest) data, Australia`s east-west coastal housing market contrasts clearly: Sydney`s first-time home buyers take twice as long as Dappers to save 20 percent of their down payments (based on local median home prices).

The survey calculated how long it took for two people aged between 25 and 34 to save 20 percent of their pre-tax income in a high-interest savings account, based on the Bureau`s income data (the average income of two people aged between 25 and 34). The results of the survey revealed a significant gap between the local goverment districts of (LGA).

Perth has become the most affordable capital city in the interior, with first-time buyers saving A $103046 in down payments in just 3.9 years, the survey found.

Sydney buyers will need 8.2 years to save up to A $215133 in down payments, well above the national average of 4.6 years.

Five years ago, the situation in the two cities was the opposite. Prices in Perth fell 4.3 percent in the previous fiscal year alone as a result of the decline of the mining boom, while Sydney prices rose 11 percent over the same period.

Two cities: Australian Housing affordability: great differentiation between things and things

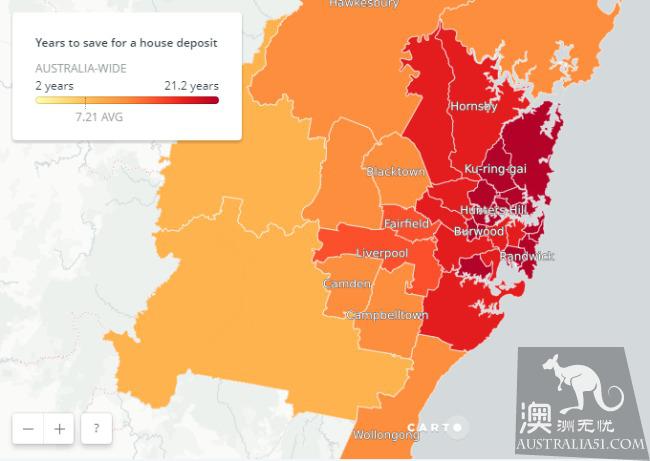

Sydney has enough down payment years, the darker the color, the longer it takes. (Australian Broadcasting Corporation Photo)

Two cities: Australian Housing affordability: great differentiation between things and things

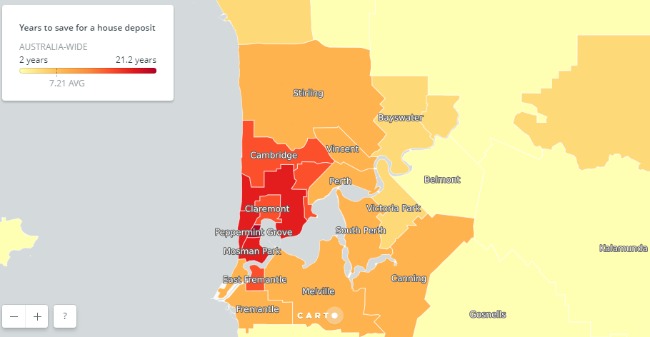

Perth has enough down payment years, the darker the color, the longer it takes. (Australian Broadcasting Corporation Photo)

Melbourne, Australia`s second-most expensive city, takes 6.4 years for first-time buyers to save A $153008 in down payments, eight months more than last year. Despite strong house-price growth and weak wage growth, the number of first-time buyers rose 3 percent in the year to August 2017, thanks to the introduction of the property stamp duty waiver.

Brisbane buyers need to spend 4.5 years saving up to A $105950 in down payments;

Adelaide buyers need to save A $90665 in 4.2 years;

Hobart buyers need 3.8 years to deposit enough 77812 Australian heads of state to pay.

New state accounted for eight of the top 10 places where first-time buyers had the longest down payments in Australia. In fiscal year 2016, the state had the lowest number of first-time buyers, accounting for 8.1 percent of all property market transactions. Perth`s first-time home buyers account for more than 1 / 5. Still, the most expensive area, the goverment district, still falls in Perth, where first-time buyers in (Peppermint Grove), the mint forest, need 21.2 years to save up to A $ six hundred and seventy two thousand nine hundred and ninety nine in down payments.