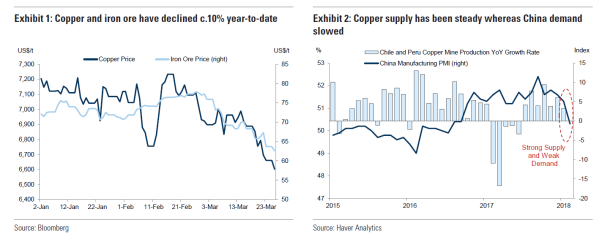

Copper and iron ore prices have fallen about 10% since the start of the year. They are mainly affected by the following three factors:

China market supply, demand imbalance (weak demand side, strong supply side) (Exhibit 1, Exhibit 2)

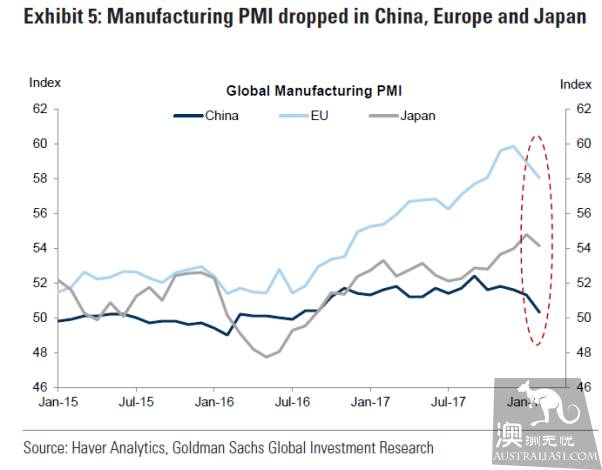

Manufacturing PMI declines in eurozone, Japan and China (Exhibit 5)

Trade issues

On trade issues:

So far, there has been some relief. China and the United States are now in contact with the negotiations, and the specific details may be released one after another from mid-April to May. Previously, we wrote articles on March 24 and March 22:

March 24: what is the impact of the A-share market under the coming risk? Why does the United States provoke trade protection at this time?

March 22-Trade conflict heats up-Analysis on the impact of weak Copper Price and Chinese and American Steel and Aluminum

The main purpose of the US this time is for the mid-term elections, even though the initial version of "$60 billion" will have limited impact on both China and the United States, but with regard to the shift in China's industrial policy, in particular, the nationalization of chips, artificial intelligence, bio-medicine, Quantum computing and other emerging technology industries will have "good policy support" expectations.

As for the impact of the decline in copper and iron ore prices, the most important commodity currency in the foreign exchange market is the Australian dollar, which has been hit by the current "trade problems" as well as the decline in copper and iron ore prices. The Australian dollar has fallen more than 3%, or more than 270 points, since mid-March.

[AUD/USD] Australian dollar / US dolla

Technically, the Australian dollar has entered a drop in wave C since January 26, 0.8135, and a drop in wave C on Feb. 16. 7988, as shown in the figure, relying on the measurement space of two segments of the falling wave. The Australian dollar focuses on the support of the 0.7550 / 0.76 level area of the daily line. The short-term resistance is 0.768 0 / 0.7699.

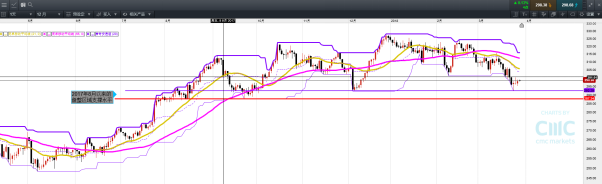

American refined coppe

Technically, the copper has been a horizontal level since August 2017, with a support area of 287.34 / 292.29 and a short-term resistance level of 303 / 304 in the last six months.

Author: Ren Zhenming Leb Ren

Ren Zhenming joined CMC Markets, in December 2017 as a market analyst for Greater China. He has more than ten years of experience in securities industry, specializing in securities proprietary direction, good at building stock β portfolio.

Mr Ren, who entered the foreign exchange OTC industry in 2015, has worked at several foreign exchange brokers and holds a Bachelor of Science degree from Fudan University. From 2015 to 2017, Ren Zhenming published a number of research articles covering euro, gold, crude oil, renminbi, Australian dollar and other media articles in Huishang magazine, Sina, Sohu, CICC online and other media.

During 2016, Ren Zhenming served as a special guest on FX168, and was named Sina's Best popular Finance Manager in 2017, appearing on NASDAQ electronic screen.

Investment derivatives are risky and do not apply to all investors. The loss may exceed your initial investment. You do not own the underlying assets and their related interests. We recommend that you consult an independent consultant to ensure that you are fully aware of the risks that may be involved before the transaction. This review only provides general information and does not take into account your specific objectives, needs and financial position. Therefore, when you decide to trade or continue to hold any derivative products, you should consider your personal objectives, needs and financial position. For Australia and New Zealand, product disclosure statements are available on our website, cmcmarkets.com/zh/legal. As for Singapore, you can obtain our business terms and risk warning notices at https://www.cmcmarkets.com/en-sg/legal-documents. For our services and any charges, all details are included in our Financial Services Guide, through which you can also obtain our Financial Services Guide. Before you decide to trade or continue to hold any financial products, be sure to read our product disclosure statements and other relevant documents.

CMC Markets Asia Pacific Pty Ltd (ACN 100 058 213), AFSL No. 238054

CMC Markets NZ Limited Company Registration Number 1705324

CMC Markets Singapore Pte. Ltd. (Registration No./ UEN. 200605050E)