Friends in Australia are believed to have seen ATO-assigned staff visiting businesses in major cities such as Sydney, Melbourne and Brisbane "no difference" on cash revenues and employee benefits on major media platforms. The tax office has indeed begun to act. IRS staff will talk directly to the shopkeeper or store manager and expect them to answer some of the tax-related questions. IRS staff will also ask questions such as whether businesses install posses, whether there is a "cash only" cash-only slogans, whether there are registered GST and on-time declaration of BAS; employees wages in general; Whether correct tax returns, employee pension payment and other related issues.

If, during the inspection, ATO staff found that the shopkeeper had clearly deliberately evaded the tax, the staff would be responsible for reporting it, and the merchant would be subject to audit investigation. So, if the ATO staff didn't question it on the spot, would it be all right?

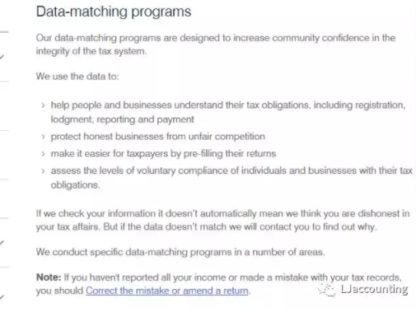

No! This leads to the fact that ATO's "data matching program" the (data matching program), Taxation Office checks against other third-party information if the filing data is incorrect, and encourages everyone to report businesses that do not report or understate their cash revenues around them. They will accept all reports, identify problems and deal with them seriously.

What third party can the tax bureau get the information to match?

- Credit card and savings card

- Payment systems, such as pos account pipelining

- Company bank running wate

- Online sales information

- Vehicle registration information

The following is an example of a ATO release for a data matching project:

Case 1: understatement of revenue

A clothing retailer with multiple stores apparently underreported sales, and ATO found that they reported an annual corporate tax discrepancy of eight hundred and seventy thousand Australian dollars from BAS (Business Activity Statement). Businesses later volunteered to admit that between 2010 and 2013, the company reported 36 errors in the BAS, resulting in an understatement of 248851.00 of the (GST), 's goods and services tax, which the IRS did not fine in view of the vendor's co-operation with the censorship.

Case 2: cash only to avoid payment of GST

When a merchant who sells chicken soup sells income, it reports a lot of income without GST, such as selling raw chicken, but when ATO plain clothes pretend to be a customer to buy raw chicken, the merchant says that the store does not sell raw chicken, only sells it. Good chicken soup.

The audit found that the merchant understated revenues of at least three hundred and thirty thousand Australian dollars and paid its employees in cash. The merchant was eventually sentenced to pay 103371.00 of GST and fined 77528.00.

Case 3: use the industry standard "Industry benchmarks" to calculate undeclared income

A cleaning company only accepts cash and their reported income is below industry standards. Cross-referencing the information, the IRS found that not only did the company's director receive more salary income than he had declared, but also that there was often a large amount of cash withdrawals in the company's frequently used accounts, which the IRS suspected was paying employees and contractors wages or commissions, and, in addition, The tax bureau also found that the company held undeclared bank accounts.

Because businesses do not retain enough accounting materials, the IRS is unable to complete the industry standard information comparison. But as far as businesses are concerned, they understate at least 156179.00 of GST,283602.00 's employee advance tax and end up with a $156096.00 fine. Finally, in the face of this kind of situation, the editor suggests that we should act carefully in tax matters, and do not feel lucky that we will not be able to find your head. Sometimes, in case of being found out, the matter will not be remedied until the end of the day. Things may get out of your control!

Forgetting to declare taxes, underreporting, underreporting. Go and get the accountant to make up the report.