The latest figures show that Australia is becoming the first choice for the rich in the world. In the past year, the number of millionaires in Australia has soared to 7260, with a total investment of $billions of dollars.

Earlier, the Home Affairs Department said Australia's high tax rates would deter international investors. But Asian-led millionaires have proved to be another wave of investment in Sydney and Melbourne.

In 2016-17, the number of (Business Innovation and Investment Programme) visa applications for business innovation and investment projects (including investors with more than A $1 million in business assets) increased from 5781 to 9051, an increase of 74 percent.

As of March 2018, as many as 2000 "major investor visa (SIV)" under the project had been approved, injecting A $10 billion into the Australian economy. This category of visas allows government to exchange residency for foreign funds for local projects, granting visas for at least 40 days. Applicants are required to invest up to A $5 million in Australian bond, equity and venture capital projects, but are exempt from tests on education, English proficiency and job qualifications. However, after the real estate industry was removed from this category in 2015, the number of applications fell slightly.

The New World Wealth (New World Wealth) report found that educational opportunities, a pleasant climate, women's safety, political security and proximity to Asia are all reasons for rich immigrants to Australia, according to a survey of high-net-worth people.

In 2017, Australia's net inflow of millionaires reached 10000. John Daley, director of (Grattan Institute) at the Gratham Institute, a think-tank, said: "Australia's highest marginal tax rate is relatively high (45 percent) and only relatively low-income people can get a cut. Curiously, Australia's number of rich immigrants is also higher in absolute terms than in any other country. Singapore, which is known for its 15% tax rate, attracts only 1000 wealthy people. "

The report also found that political instability caused by Brexit was another incentive for millionaires to emigrate to Australia around the world. Other factors included a better local health system than the United States and the absence of inheritance taxes.

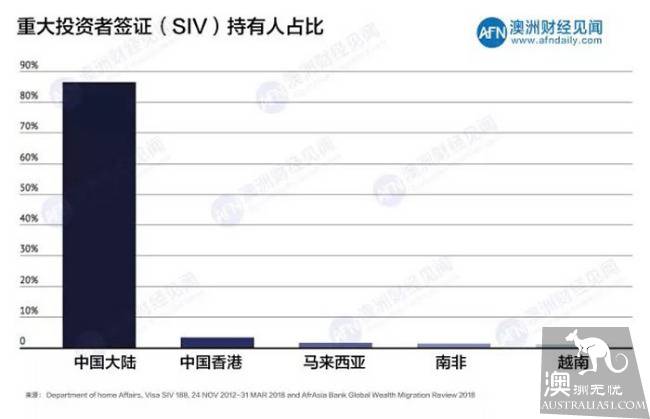

Moreover, political tensions between China and Australia appear to have had no impact on Chinese immigrants, and China's mainland remains Australia's largest millionaire country, followed by Hong Kong.

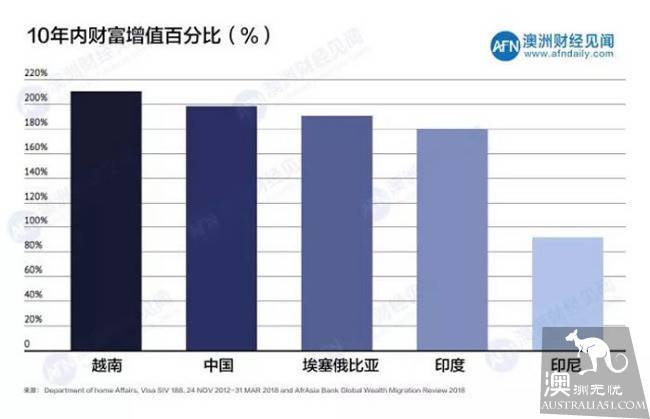

Over the past decade, China has become the cradle of a millionaire thanks to strong growth in high-tech, manufacturing, construction and healthcare.

In particular, in the context of manufacturing and financial services, Chinese accounted for 90 percent of Australia's high net worth investment migrants in 2016-17, with the rest made up of Malaysian hot, South African and Vietnamese. Australia has become a home for the rich overseas, with wealth rising by 200% in 10 years.

In general, Chinese consider investing in education, allowing their children to study in Australia, and then slowly moving Chinese assets abroad. And the "major investor visa (SIV)" accelerated the transfer of assets and value-added speed.

"Australia has fresh air and pleasant living conditions and is only two hours short of China, so many Chinese choose to invest in Australia to diversify their investment risk," said Mark Ryan, immigration manager at LRG. "this visa is the most attractive to shrewd Chinese businessmen.

"if you have A $5 million, why don't you do it? All you have to do is stay in Australia for 40 days. " "the advantage of this visa is that investors don't have to come to work and have the flexibility to invest A $5 million, and then their children can go to school in Australia," Ryan said.

Investment direction of SIV's 5 million funds

This 5 million investment will no longer be allowed into government bonds;

At least A $ five hundred thousand, or 10 percent of total investment, is invested in eligible Australian venture capital or growth private equity funds dedicated to supporting startups and small private companies. Australian government will raise this standard to A $1 million over the next two years, based on market feedback;

At least 1.5 million Australian dollars is invested in a management fund that invests in the shares of new-type companies in a small listed company in AFC, and at least A $1.5 million is invested in a qualified management fund or in (List Investment Companies), a listed investment company. Specifically used to support emerging companies listed on the Australian Stock Exchange;

Up to A $3 million can be invested in managed funds or listed investment companies through which they make 'portfolio balanced investments'. Eligible investment asset classes include: other Australian Stock Exchange listed companies, corporate bonds or notes, pension funds, And real estate funds, etc.;

Limiting investment in civilian real estate, and the proportion of civilian real estate invested in managed funds should not exceed 10%, and will continue to allow some funds to flow into commercial real estate through managed funds;

Direct investment in Australian real estate is prohibited. It is strictly prohibited to engage in direct investment in real estate, such as personal purchase of housing.

The writer: cultural scene Shelley