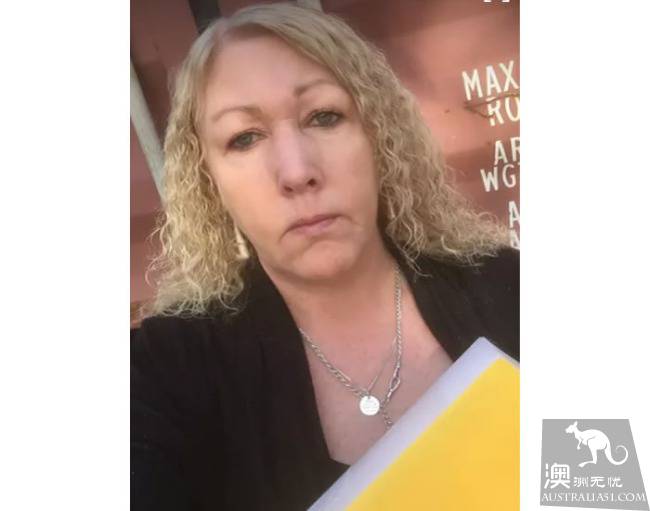

From Suz, Tata. Birch (Suzi Burge) left most of her belongings in containers, lost her business, lost her marriage and her home, after the federal bank withdrew her commercial loans.

Ten years ago, she and her then husband owned about A $3 million in assets and owed about A $ eight hundred thousand in two loans to three properties. The 53-year-old needs to live on a disability pension.

In 2008, she and her husband wanted to apply for a commercial loan to renovate and expand their business premises in Launceston, as well as expand their handicraft business.

Burch said they had originally applied for a 30-year investment loan and had been granted conditional approval. But a few weeks before the final approval, banks said they had to apply for commercial loans over a 15-year period at an interest rate of 9.5 percent, not 7.5 percent of investment loans.

The couple, whose commercial premises are already under construction, think they should be able to afford to repay the loan if the bank approves the loan.

They already have a mortgage in their house, and another investment home is borrowed from another bank, and the couple have been instigated to put the loan in the new bank.

But when they defaulted on commercial loans, debt swelled rapidly.

Financial Commissione

Birch found a financial ombudsman in 2012, who found that bank workers had "mismanaged loans". As a matter of fact, banks should not lend to the couple, they belong to the "financially disadvantaged" population.

Birch said the bank approved the loan because they owned mortgages on the couple's three properties. She offered to sell her investment home to pay off her commercial loan debt, so that she could retain commercial property and her business income. But the bank refused.

Instead, in 2013, her commercial property was forced to sell at a price well below the bank's valuation and insufficient to pay off its debt.

"I complained to the Monetary Commissioner about the bank's refusal to treat me fairly, but they responded that there was nothing they could do about it, and that was beyond their control," Birch said.

And as corporate revenues dwindled, the bank took away her investment property in early 2016.

Birch accused the bank of acting unjustifiably. But a federal bank spokesman objected, saying the bank had reduced her debt.

The bank further pointed out that Birch had begun a series of lawsuits against the bank to ban the bank from owning and selling her property, but all of these efforts failed.

The spokesman said that in times of economic hardship, the federal bank would contact clients to discuss options and address any obstacles that might arise in fulfilling their obligations.

Post-traumatic stress

Birch was diagnosed with post-traumatic stress disorder, she said. "I was living a happy life, and now I cry every night. I'm not the only one, and there are a lot of people who have been hit hard by the bank's actions. "

While the bank has questioned some of the details, the story also highlights the risks of guaranteeing commercial loans, as well as the risk of using home property as a guarantee.