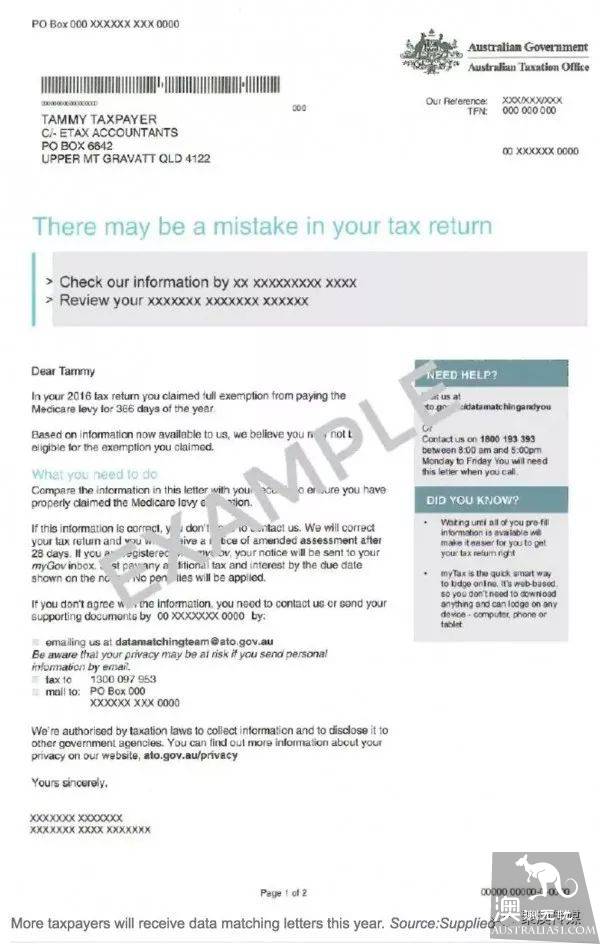

A lot of people recently received a letter from ATO's Australian tax Authority, and some thought it was a fraud message and ignored it, officially reminding you that it was a data match letter from ATO.

According to the Australian News Corporation, the purpose of the letter was to emphasize that after changing jobs in the course of the year, taxpayers forgot to aggregate the "pay-as-you-go" amounts, or that bank interest, allowances and Centrelink payments classified as income were not declared. This gives rise to the suspicion of tax evasion.

Etax Senior tax Agent Liz Russell said: "when you receive this letter, do not panic first. This means that someone has filed a tax return that ATO believes may not contain all of the information or may contain incorrect information. ATO obtains information from different agencies and then matches the data with the tax return. "

Although this is a reminder letter, ignoring it can have a bad effect.

If taxpayers do not open the letter or ignore it, they may lose "hundreds of Australian dollars, or even thousands of Australian dollars," assuming they are adjusted "for tax rebates.

Not all tax returns are data-matched. ATO uses high-tech data analysis to compare tax returns with those submitted by people in similar situations to identify suspicious returns.

"if the tax rebate seems reasonable from their point of view in terms of occupation and scope, they may not spend much time searching for something," Russell said.

Russell said that the fact that more people received letters did not mean that more people had made false declarations, but that ATO's improved technology had expanded its coverage. Many taxpayers do not know that ATO can audit their tax returns within a month or even a couple of years after filing them. If they receive a "data match" letter, they usually have 28 days to reply, so they need to call immediately.

(photo source: news Corporation, Australia)

If the situation is too serious to require a fine, ATO uses one of two methods to determine the fine. They either use the current penalty unit of A $210 or use a statutory formula based on the severity of the violation.

Under the formula, a 25 percent fine would be imposed without reasonable caution, a 50 percent fine for recklessness, and a 75 percent fine for deliberate disregard.

Russell said taxpayers could provide evidence that their declaration was correct and that the evidence required was "fairly standard". Income-related items can be supported by "pay-as-you-go" documents, private health statements or bank statements, while deductions require receipts or records.

"if you make an inadvertent mistake, such as typing the wrong number or forgetting the pay summary for a second job, it usually goes unpunished," she said. However, if this mistake results in a larger tax rebate than the tax payer is entitled to, they will have to repay the overpayment and possibly pay interest. "