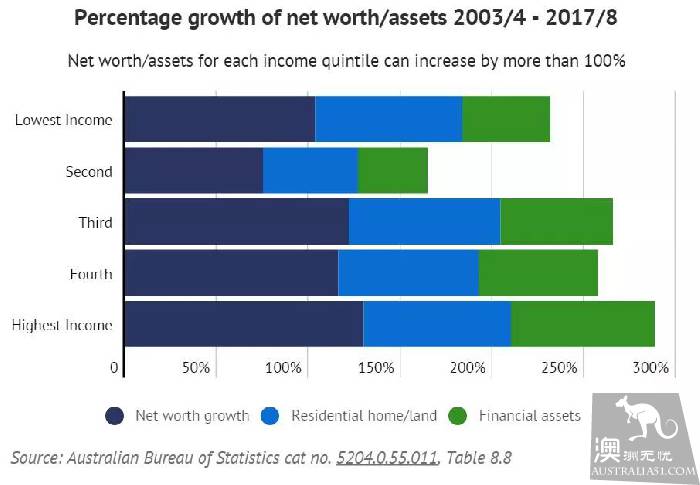

The wealthiest 20 percent of households in Australia rose 130 percent between fiscal year 2003 and fiscal year 2017, while the poorest 20 percent rose just 50 percent, according to the latest (Australian Bureau of Statistics) data from the Australian Bureau of Statistics.

Huh? Doesn't it sound like a lot?

For example, if a rich man had an income of A $1 million in 2003, he would have earned A $2.3 million in 17 years and a cumulative income of A $1630-33.2 million over the past 15 years.

(NAB CEO's salary was A $6 million last year. Well, poverty limits my imagination.

At the same time, if a poor man had an income of A $30, 000 in 2003, he would have earned A $45,000 in 17 years and a cumulative income of A $46.5-A $ six hundred and sixty thousand over the past 15 years.

Yes, the rich earn a year's income from the poor in a week or two.

Experts warn that class consolidation in Australia is becoming more and more serious.

Social inequality has increased in Australia since the mid-1970s, and recently the rich have increased their wealth at the expense of the middle class.

As the overall wealth of society grows, the wealth of the middle class increases, but their share of the total wealth becomes smaller and smaller.

"in particular, the wealthiest 1%, their share of social wealth is increasing, but the number of middle class is decreasing."

"as inequality intensifies, there is a growing gap between classes and the impact of heredity on the future is growing."

"Today, wealth inequality is increasing; tomorrow, equality of opportunity will be more difficult to achieve."

After all, these years everything needs money, food, clothing, housing is the basic, investment can not be broken.

To strive for a better life, go to the gym to exercise, read a good book, improve your mind, expand your network of people, travel and regulate your work and life. What doesn't require money??

Having children is less money to use: good schools, cram classes, interest and love, higher education.

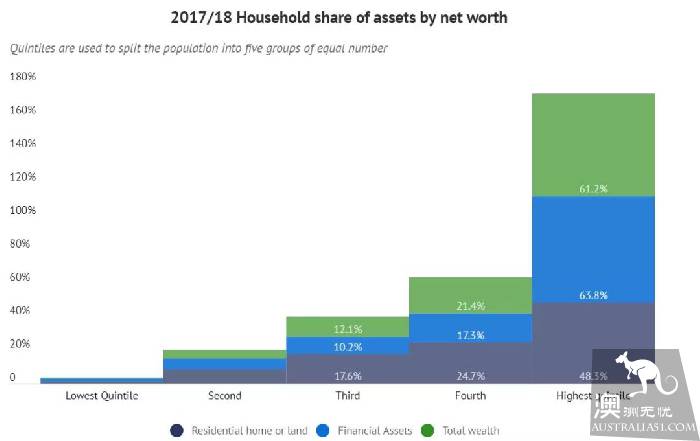

Australian households' net wealth in 2017-2018 was A $10.3 trillion, an increase of A $4 trillion in just eight years, according to the latest ABS data.

Of these, the richest 1/5 have 61% of the wealth, while the bottom 1/5 account for only about 1%.

What widened the gap between rich and poor?

Dr Ilan Wiesel of the University of Melbourne told us that Australia's wealthiest 20 per cent of people over the past 15 years have used the real estate and stock markets to make money frantically, which has led to a surge in housing costs that has seriously affected the lives of low-income people.

Does the real estate market make money? The answer is yes. Why else so many people go on and on.

In the past few years, it seems that every time a real estate opens, the buyers must be Chinese faces.

Prices in Melbourne and Sydney, Australia's two largest cities, have more than tripled since 2002.

We often see news of Chinese speculation in Australia, pushing up house prices and angering locals.

They said: it is the Chinese people's fault!

In fact, the biggest beneficiaries of the housing market, or the rich local.

Australia's poorest 20% accounted for less than 1% of total social housing between 2017 and 2018, while the richest 20% had nearly half (48%), according to the latest ABC data.

And the most important reason for the problem is that many of the tax incentives originally intended to help younger-generation homebuyers have in fact failed to give them real benefits, but have been cheaper for the rich.

Money generates money, which is what existing tax and housing policies do-lower taxes on real estate holders' capital gains.

This allows the rich to increase their wealth by investing in housing. Only by reforming the policies around capital gains and negative tax deductions can the status quo of change be change.

In fact, the younger generation's jobs are not stable, savings are limited, and the cost of entering the real estate market is even higher. As they grow older, the wealth gap deepens, and it becomes harder for young people to buy a home in the future.

Australia's rich masters.

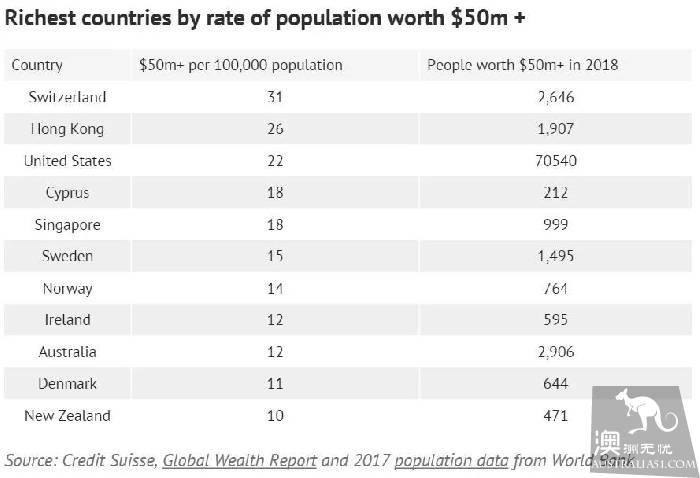

In 2018, Australia had 2906 multimillionaires worth more than A $50 million, 12 out of every one hundred thousand, ranking ninth in the world.

At the same time, rich Australians are also among the fastest in the world.

"Australia's wealthiest 10 percent are doing better than those in any other country," said Professor Peter Whiteford of the Australian National University. They are not as rich as the top 10% in the United States, but they are running faster in terms of growth. "

He said the government has been giving "very generous tax breaks" to high-income families, while the richest 1/5 receive tax breaks that burden the budget by half of all benefits payments.

These include: pension contributions, pension profits, negative tax deductions, capital gains tax discounts, and so on.

According to a March report, families who rely entirely on benefits earn A $810 a week, with one high-income full-time job and another part-time family receiving A $1400 a week in tax benefits and government benefits payments.

Such high-income families can also profit from pension payments and pension, worth nearly A $35, 000 a year;

Capital gains tax exemption for self-housing (nearly A $20,000);

And investment housing tax (more than 9000 Australian dollars).

"We need to address the reform of tax incentives for high-income people, especially pension, negative tax deductions and capital gains tax discounts."

By fiscal 2017, the lowest-income 1/5 households would have to spend 63% of their disposable income to meet basic needs such as rent, transportation and food, up 3% from 2009.

At the same time, the top 20 percent of income requires only 27 percent of disposable income to meet these needs, up just 2 percent from eight years ago.

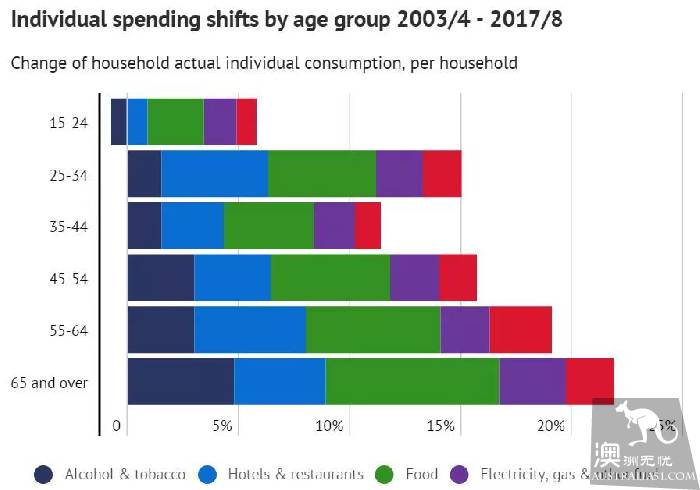

Australia's elderly are particularly struggling, with total spending rising four times as much as those aged 15 to 24 between fiscal year 2003 and 2017.

Many elderly Australians are forced to enter the rental market and share rents with others to save money because of post-retirement financial difficulties, according to The Conversation.

Last year, the share of GDP in wages fell to a record low of 47%.

Dr. Jim Stanford, director of the Australian Institute's Future work Center, said wealth accumulation focused on the wealthiest 1 to 2 percent, rather than 20 percent.

epilogue

The widening gap between the rich and the poor is now a problem facing the world.

Australia has also been discussing the widening gap between the rich and the poor in Australia this year, but from a global point of view, the situation in Australia is generally more optimistic!

According to the latest Gini coefficient data (the index that measures the gap between rich and poor, the lower the better), Australia's Gini coefficient is only 0.337, which is relatively low.