I can't pay cash because the bank card is lost too many times, Xiao Wei became a senior cash user.

Unexpectedly, because of carelessness and personal habits, a year unexpectedly saved a lot of money.

What's going on here?

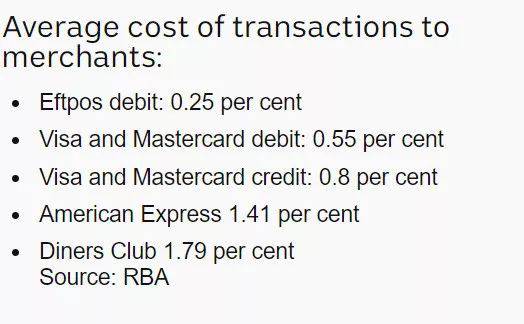

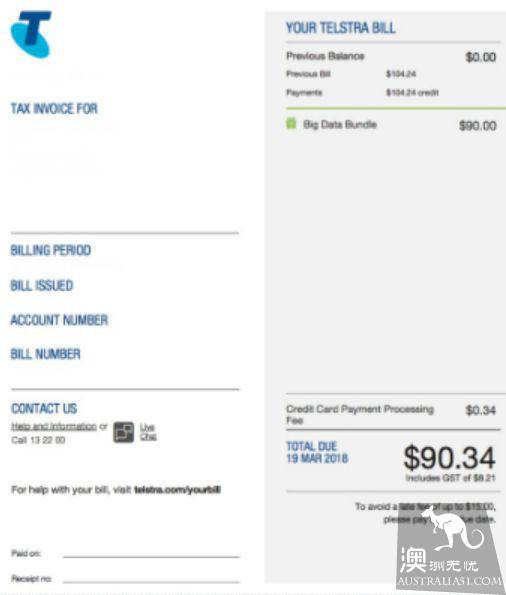

It turns out that most people go to the mall to buy things, or go to restaurants to eat, the use of bank cards may be incurred additional fees.

As for the Chinese restaurant, we usually remind our guests that we will charge a service fee.

In general, charging staff will not remind you that card payment will charge additional fees.

The cue bar is also not very conspicuous.

More importantly, most people are too lazy to see the fees!

But this is actually a large amount of silver!

For example, pay by card three times a day, an average charge of $0.2 a day, a day of $0.6, a year down 219 Australian dollars to the bank for no reason.

(general charges)

If you brush a few more times, buy more snacks, that year can be 300 dollars …

Banks, too, take advantage of people's unconsciousness to benefit from their users.

A plastic bag at the supermarket, only $0.15.

But because it's something you can see and touch, people know more or less: Oh, for money, take a bag next time.

But paying by card is all: ha! Gently I came, heavy I left, a wave of sleeves, who cares about the fees ah?

Consumer psychologist Adam Ferrier reminds us:

If consumers use cash and do not pay by card, most of the time they will spend less.

"our brains are so strange that they don't want to think too much. The brain accounts for 2% of the total body but 20% of the total energy expenditure. "if there is an easy way, we are always willing to use it," he said.

"if you have to touch and count cash, it may make some people's spending appetite disappear."

So, friends who have serious hand cancer, but try to pay manually ~

For now, big retailers such as David Jones, Myer will not charge additional fees for their customers.

But if you buy a new TV at JB Hi-fi, you may be advised to use cash or debit cards, or there will be additional charges.

If you go to the supermarket to find a post-Christmas discount, you will find that if you pay the, Coles, Woolworths with your card, you will not charge a fee.

But Aldi will add a fee to your bill.

Small bakeries and fruit and vegetable shops charge 1% of their consumption.

Coffee shops and restaurants will do the same.

There will be a lot of businesses will be 1% service fees, quietly adjusted to 3% …

If you encounter such a problem in a restaurant or coffee shop, be sure to ask them how much they charge.

Online shopping and telephone shopping are the most frequent places where people contribute fees.

The use of third-party payment tools may result in higher fees.

Of course, in this case, the most profitable is the bank.

Last year, it generated $200 million for Australian banks because of small fees.

Small goals don't have to be fixed ah, just wait to collect money!

You ask Xiao Wei: "then this money, can I save?"

Sure!

Online payments using BPAY, can save extra fees.

Taking cash on the street is a better option than paying by card.

All in all, there is a risk to the mincing hand, which requires caution in spending money.