It's the annual personal tax rebate season, you know? Dogs, bags and sunscreen can be refundable! With the budgets of Australia's states hot, the old fiscal year is about to pass, there may be some small partners do not know the tax rebate process or tax rebate projects, the times here to provide you with some personal tax rebate strategy.

First of all, how to apply for personal tax rebate?

Preparation of tax filing materials

There are a variety of documents for tax returns, including tax returns group certificate or last year's tax record tax return orassessment notice; Payroll, all other income records, such as pensions, benefits, stock sales, rent, all vouchers of expenditure related to work, business, and financial investment (receipts, invoices, airline tickets, bills, private health care numbers, etc.) Income and expenditure documents for spouses and children, valid notes, etc.) A breakdown of the books of a company or small business.

If you have some expenses without vouchers, such as train tickets, as long as there is a reasonable calculation method, the Inland Revenue Department is also approved.

All tax returns will be kept for five years, as the Inland Revenue Department will conduct random checks every year.

Generally speaking, work-related expenses, less than $300, generally do not require vouchers, can be recorded on their own to obtain a tax rebate.

E-tax delivery method

One of the easiest ways to submit online tax returns is to use online e-tax (electronic tax filing software).

E-tax is a free-of-charge electronic tax filing system on the Australian Inland Revenue Authority's website, available 24 hours a day.

As long as you search for E tax on the ATO website, you can download E tax. The greatest benefit of using E-tax is that you can immediately see how much tax is refundable or how much you need to make up for it, but only if you have basic tax knowledge, so as not to be unable to get back the amount you deserve because you don't know how much Claim you can get. Or Claim too much to be censored by the ATO.

With E-tax 's own tax returns, the information to be prepared includes: the annual salary summary of PAYG Payment Summary (provided by the employer); the tax number; the bank account number (if you choose the method of directdebit); Medicare card number (if any); the annual bank interest; Dividends on investing (if any) in stocks; rental income and expenses for investing in houses (if any).

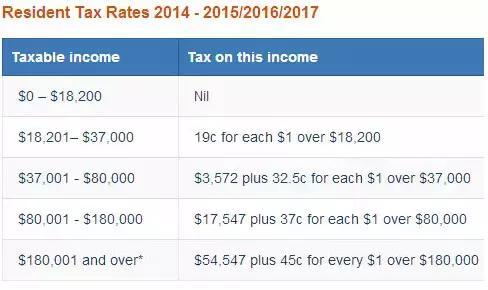

Current individual income tax rate in Australia

James Solomons, an accountant for Xero, revealed that Australians can legally claim that dog maintenance, sunscreen, handbags and electricity are deductible fees that can be deducted from income to the purpose of underpaying taxes. If you have a dog, this dog plays a role in protecting your small store. You can report your dog's food, veterinary and purchase money to the deductible. Given the dog's role in protecting you, of course, a German shepherd must be more persuasive than a poodle. At the same time, if you buy this package for work purposes, and the price of the package reflects your income situation, the package can also be included in the tax rebate. If you earn A $ one hundred thousand a year, it doesn't make sense to report A $3000 Prada, but a A $200 handbag is fine.

If you work outdoors, you can declare sunscreen, and truck drivers can declare sunglasses!

See the above tax rebate information and strategies do you have a general understanding of the individual tax rebate in Australia? From the above information, it is not difficult to find that the high-income people almost half of the money to the tax Bureau, so we should study well, do a good job of investment, financial management, tax rebate oh!