Across October, November arrived as scheduled, and there is no "absent" tradition of new rules on every new moon.

Recently, the State Council tariff Commission on the adjustment of import duties on imported goods related to the issue of new regulations issued, the notice says: all the new regulations will be on November 1, the official implementation!

The emergence of new customs e-commerce regulations makes many overseas purchasing agents scared. So:

What does this new customs rule mean for people living abroad?

What will be the impact of the new regulations on the overseas purchasing industry, which is the focus of global attention?

This tax is under the new regulation. What are we gonna do?

Tariff skyrocketing?

Many overseas friends because of November 1 implementation of the Customs New deal can be said to be unable to sleep at night. Time line, such as the following, has also aroused worries among major purchasing agents, who have said: "tariff increases, this time it really gets cold."

But is it true?

Today, the editor is going to refute the rumor for everyone: actually, the tariff has not risen, but has fallen! Yes! You're right: it's down! Down! Down!

September 30, the State Council tariff Commission issued a notice, since November 1, 2018, reduce import tariffs of 1585 tax items.

The tax cut, which covers a wide range of goods such as industrial goods that people need to produce and live, fell from an average of 10.5 percent to 7.8 percent, or about 26 percent, on average.

A total of four categories of tariff-lowering items were involved:

Reduce import tariffs on goods that have considerable production capacity and level at home. Including textiles, building materials, base metal products, steel, etc., a total of 677 tax lines, the average tax rate fell from 11.5% to 8.4%.

(2) reduce the import tariff of some mechanical and electrical equipment. Including textile, light industry, engineering, general purpose, metal processing and power machinery, agricultural machinery, transmission and transformation equipment, electrical equipment, instruments and related equipment parts and components, a total of 396 tax lines, the average tax rate from 12.2% to 8.8%.

(3) reducing import tariffs on some resource commodities and primary processing products. Including non-metallic minerals, inorganic chemicals, wood and paper products, jade, etc., a total of 390 tax lines, the average tax rate from 6.6% to 5.4%.

(4) reduce import tariffs on goods that are conducive to promoting trade facilitation. The main is to integrate some of the same or similar goods tax rates, appropriate reduction of tax rates. Too many tax bands will create some difficulties for companies. The consolidation or reduction of the tax rate, a total of 122 lines, has dropped the average tax rate from 12.3 percent to 8.5 percent.

In addition, tax rates on imported goods (commonly known as stamp duties) have been adjusted synchronously as the tax rates on these consumer goods have been lowered.

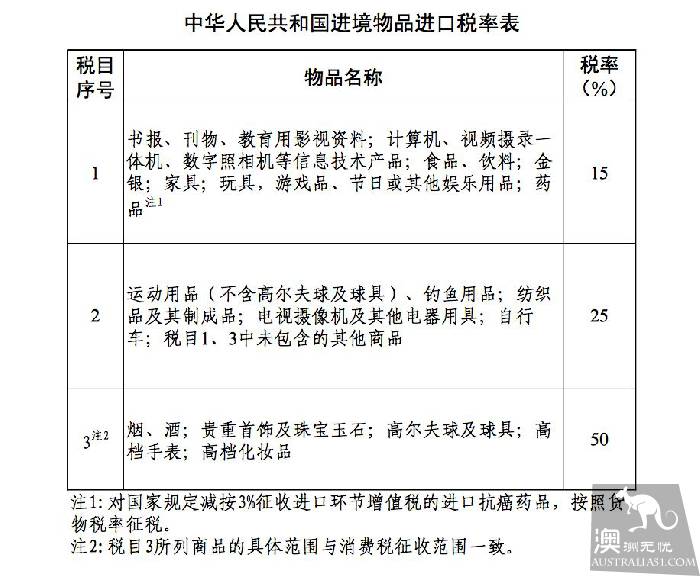

According to the circular of the tariff and tariff Commission of the State Council on issues related to the adjustment of import duties on imported goods, it is indicated that:

First, the medicine is included in the import duty item 1, the tax rate of 15% shall be applied. Among them, import anticancer drugs, which are reduced by 3% according to state regulations, shall be taxed according to the duty rate of goods.

Second, the import duty on imported goods is adjusted to 25% and 50% respectively.

Third, the above-mentioned adjustment will be implemented from November 1, 2018.

The main points of the editor are as follows:

1. Import duty on imported goods item 1: a 15% tax rate is applicable

2. Import duties on imported goods 2, 3: the tax rates are adjusted to 25% and 50% respectively.

3. Implementation of the New deal on 1 Novembe

Among them, tax serial number 2 includes some: sports goods, and tax serial number 3 products include: tobacco and alcohol, cosmetics and other items.

According to the chart above, the duty rate on sporting goods is 25%, while the duty rates on cosmetics and high-end tobacco, wine and jewelry, which are most popular overseas residents, have changed by 50%.

So. Is the 50% tax rate going up?

It is understood that the original tax rate of import duty item 3 on imported goods is 60%, and the change policy on November 1 actually lowered the tariff rate to 50%.

How do you calculate the customs duty?

Under the implementation of the new regulations, many purchasing agents said: from Nov. 1, China Customs has taken an out-of-the-box inspection of all overseas postal parcels and recipients, whether gifts or self-effects need to pay taxes! You'll be fined $ five hundred thousand if you're serious!

First of all, the editor would like to clarify:

The so-called rigorous investigation, that is, we have not been examined before. There are different ports of entry for China, but it is really impossible to check them out of the box. There are so many packages to and fro each day, it is impossible to check them out of the box 100%.

And the Customs out-of-the-box inspection requires the agent (carrier) to open the box on the side, and the whole process is watched.

As a matter of fact, there are three forms of immigration tax payment, of which overseas parcel mailing is only one of them:

B2B

Business to business, business to business. According to the cargo channel, formal cargo declaration, need to entrust formal customs declaration company.

The tax rate is tariff VAT excise tax.

B2C

Businessmen to individuals, the Ministry of Finance announcement the biggest impact is this type, documents are simple to deal with.

C2C

According to the current regulations, only self-use reasonable quantity of goods can be applied to postal duty, with the nature of "trade" things must be counted as goods, should be applicable to B2B regulations (such as purchasing agents).

In C2C, the tax rate calculation is also more troublesome, its tax collection standard can be divided into: passenger channels, is their own human transport, not much, the other is a package channel, that is, from overseas individuals sent back things, Or foreign trans-shipment companies sent back and logistics is not connected to customs.

People are worried about purchasing meat, or overseas to help relatives and friends bring gifts home tax standards are actually calculated according to the stamp tax.

Take a look at the allowance.

In fact, for overseas travel to bring gifts to the domestic, customs is very loose, here we hope you can understand the "tax allowance" this rule.

It is understood that if you are a passenger who brings goods purchased overseas through their own channels of human flesh, then the Customs rules:

On the basis of keeping the tax-free limit of 5000 yuan for residents entering the territory, they are allowed to increase a certain amount of duty-free shopping at the port entry duty-free stores, together with a total of no more than 8000 yuan of tax-free goods from overseas.

According to the regulations, if you purchase items that do not exceed the 8000rmb limit, then when entering the country through customs are tax-free! Duty free! Tax-free!.

For example: if you buy 5000 yuan of goods in Australia, and you can't resist the desire to buy at Shanghai Nippon Airport when you return home, then you will still be exempt from duty-free purchases of goods in 3000.

However, there are some exceptions to the domestic mailing situation, it is reported that the domestic parcel tax is not more than 50 yuan, are tax-free. But generally, they are more than they are.

In short, there was a random inspection of the package. You'd better pay your taxes. Well, not every package gets picked up anyway, is it?

How is the tax calculated? Seeing that some friends here will ask: the goods with them are not included in the tax allowance, and unfortunately they have been randomly checked by the Customs and Excise Department. How exactly is this tax calculated?

The tax is calculated in the same way as that of postal parcels. The amount of tax paid can be calculated through: customs price * postal duty.

Note: an integral tax is levied on items that are indivisible in excess of the allowance!

epilogue

Every new deal in the country, everyone abroad is always a riot, we always think: is this a policy directed at those who live abroad, or who travel abroad? Is this a policy to crack down on overseas purchasing agents? Does this mean that all the goods brought into China will be taxed in the future?

Speculation stems from ignorance of the facts and hopes that awareness of the new customs policy will be based on official policy rather than some grandstanding on the spread of high-click-rate news and their own baseless guesses.

In this new deal, the tax rate on inbound goods has been rising and falling. We only have to abide by the rules and regulations, "believe that the money should never be late" the theorem is sufficient.