Australia's big tobacco companies have been supporting their profits by surreptitiously raising cigarette prices, and the biggest reason why cigarettes are so expensive is not that the government has raised the tobacco consumption tax.

Pre-tax profits for a pack of Winfield cigarettes have soared nearly 150% since 2010, according to a study by the Cancer Control Council (Cancer Council). For JPS smokers, the increase is more than 180%. Consumer price inflation, by contrast, was only 6% of (CPI) during the period.

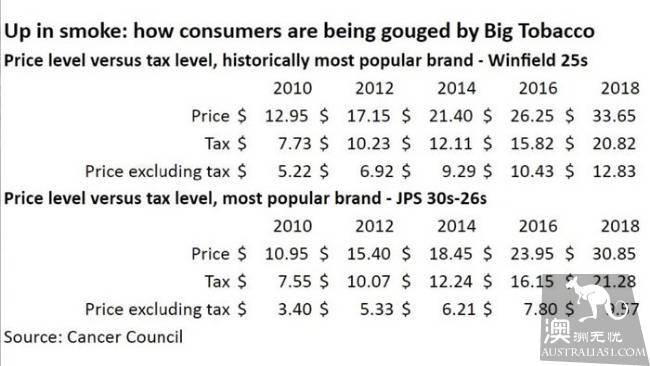

Winnie Blues prices are now up from 12.95 yuan a decade ago to 33.65 yuan.

As we all know, tobacco taxes have been soaring-Winfields has risen from 7.73 yuan to 20.82 yuan, but even excluding excise taxes, tobacco prices have soared.

Total revenue per pack for tobacco retailers and manufacturers British American Tobacco Australia (BATA) has risen 146 percent from 5.22 yuan to 12.83 yuan, according to the Committee for Cancer Prevention and Control.

If the pre-tax price increases for cigarettes were consistent with the CPI, the Winnie Blues would be 7 yuan cheaper than it is now. In other words, smokers who smoke a packet of Winnie Blues every day earn an extra 2500 yuan a year by BATA.

The price of JPS rose to 30.85 yuan from 10.95 yuan in 2010, during which time, Imperial Tobacco Australia (ITA) 's profit per pack of cigarettes rose from 3.40 yuan to 9.57 yuan, up 182 percent.

If the pre-tax price of the JPS is the same as that of the CPI, smokers can pay 5.50 yuan less than they are now. On the contrary, people who smoke a pack of cigarettes a day have to pay an extra 2000 yuan a year.

"it's a dirty trick for these companies," said Grogan (Paul Grogan), director of public policy at the Australian Cancer Council. "they're smart at raising margins, far outpacing the increase in the excise tax."

News Corp.'s analysis of Australia revealed how these ultra-high prices have strengthened the bottom line for big tobacco companies amid a sharp drop in smoking rates.

Financial statements obtained from corporate regulators show:

: BATA made more money in 2017 and 2016 than in 2011 or 2010;

: ITA 2016 made better profits than in 2010 or 2011; and

* Philip Morris Australia's revenue in 2016 was only 5% less than in 2010.

Overall, net profits for the three big groups in 2016 were stronger than in 2010.

In the past year alone, their bottom line has fallen significantly, in part because more smokers are turning to cigarettes with lower prices and lower profits. Even so, the three companies earned eight hundred and sixty one million nine hundred and ninety nine thousand nine hundred and ninety nine yuan in 2017, compared with 930 million yuan in 2010.

Big Tobacco also benefited from an increase in the number of men migrating to Australia from countries with "high smoking rates," Grogan said.

The Australians are slowly giving up smoking

Australia's goal of reducing smoking rates to 10% is at risk of not being met. The world's largest cigarette company said that unless "e-cigarettes" were legalized, the goal could never be achieved, as in many parts of the western world.

In 2012, federal, state and territorial governments pledged to reduce smoking rates to 10% by the end of the year.

While Australia's smoking rate has fallen significantly, the problem is that it could hover around 12.5% or 12% in a few years.

Experts also said the decline could accelerate if nicotine-containing e-cigarettes were legalized.

As many as 500000 of the country's 2.4 million smokers could turn to the so-called "better alternative."