According to the data, the total market capitalization of Chinese real estate is $65 trillion, which is more than that of the United States, EU, Japan combined, which is only $60 trillion; and the market capitalization of Chinese stocks is $6 trillion, only about 1/10 of the US, EU and Japan combined; China's total real estate market capitalization is more than ten times the market capitalization of the stock, far more than the United States, the European Union.

Recently, the Bureau of Statistics released the October 70 city house price data, North, Guangzhou and Shenzhen four first-tier cities second-hand housing prices are down from the whole line, but first-hand housing prices, second-hand housing prices are still in a general upward trend. Recently, a stock property market capitalization overview chart, but also screen. The picture above is as follows.

We can read three messages from the figure. First, the total market capitalization of Chinese real estate is 65 trillion US dollars, which is higher than that of the United States, EU, Japan combined, which is only 60 trillion US dollars; second, the market capitalization of Chinese stocks is 6 trillion US dollars, which is only about 1/10 of the US, EU and Japan combined; Third, China's total real estate market capitalization is more than ten times the market capitalization of stocks, far more than the United States, the European Union.

The total market capitalization of Chinese real estate is 65 trillion US dollars more than the United States, EU, Japan combined

As house prices continue to rise, China's total real estate market capitalisation has risen, but so far there is no very scientific statistics.

China's real estate market capitalisation is about 270 trillion yuan, according to estimates from Davis in August 2016.

A more authoritative data from Evergrande Group Chief Economist and President of Evergrande Institute of Economics Ren Zeping, a member of the academic Committee of the Bozhi Macro Forum, said on January 23 that the total number of houses in the country added up to 300 trillion yuan.

A recent overview of the total market value of a stock property on Weibo has "lifted" the total market value of Chinese property to 450 trillion yuan. China has a market capitalisation of $65 trillion, a rough estimate of 450 trillion yuan at the 6.93 exchange rate, according to the picture.

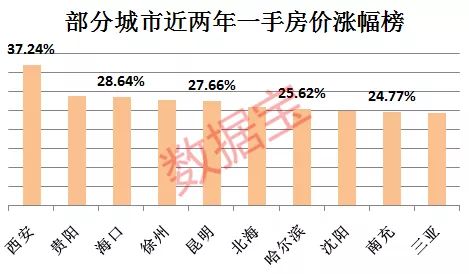

The figures are close to those estimated by first Peace Davis and the media in 2017, although there is a big gap from Ren Zeping's 300 trillion yuan at the start of the year. According to the latest data, the average price of newly built commercial housing in more than 50 of 70 large and medium-sized cities rose more than 10 percent year on year compared with two years ago, while more than 20 cities, including Xi'an, Guiyang, Haikou and Xuzhou, rose more than 20 percent.

It is also worth noting that, according to the figures, the total market value of real estate in China has surpassed that of the United States, the European Union and Japan combined. The total market capitalization is $30 trillion in the United States, $20 trillion in the European Union and $10 trillion in Japan, according to data.

The market capitalization of Chinese stocks is 6 trillion US dollars, only the United States, EU, Japan combined 1/10

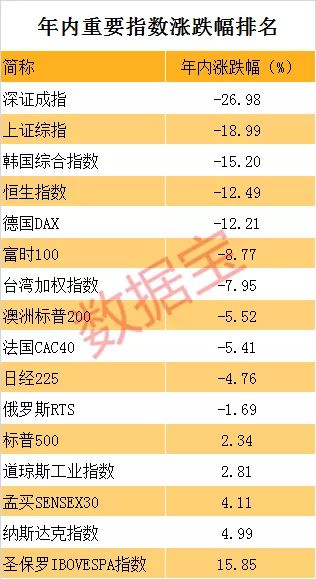

At a time when real estate market capitalisation is booming, China's stock market has been continuously adjusted, and this year the major indices have shown a record low in recent years. As of the latest, the Shanghai index is down more than 18 percent this year, the gem index is down more than 20 percent, and the Shenzhen Composite Index is down nearly 27 percent. In the world, the Shenzhen Composite Index ranked first in the list of declines in the world's major indices, while the Shanghai Index was the second in the list of declines in the world's major indices.

As the stock market continued to adjust, its market capitalisation also shrank sharply, with the total market capitalization of A-shares in Shanghai and Shenzhen at 47 trillion yuan, more than 10 trillion yuan lower than at the end of last year (without considering the impact of the listing of new shares). Compared with the rest of the world's major economies, China's A-share market capitalization is also low. According to the figure, the total market capitalization of the US stock market is as high as US $ three hundred thousand, the total market capitalization of the EU stock market is US $ two hundred thousand, the total market capitalization of the Japanese stock market is US $6 trillion, and that of the Chinese stock market is just over 1/10 of the three major economies.

Are Chinese houses too expensive and stocks too cheap?

The figures do not take into account the market value of overseas listed stocks, but are still shocking. And all this data seems to point to the fact that Chinese homes are too expensive and stocks are too cheap. A general perception is that China's total real estate market capitalisation is more than ten times the market value of the stock market, far more than the United States, the European Union's double. From this point of view, the relative value of the stock highlights.

On a itemized basis, house prices in China do not seem to be cheap. Beijing rents and sells more than 55 years, or 660 months, to recover costs, according to China's house price website. In the international community, the rent-to-sale ratio is generally defined as 1 / 200 / 1 / 300. If the rent-to-sale ratio is less than 1: 300 (that is, 1: 400, 1: 500, according to the ratio of monthly rent to total house price, it takes 500 months to recover the purchase cost in the case of 1: 500), which means that the real estate investment value is relatively smaller and the, real estate bubble has emerged. If it is higher than 1 ≤ 200 (that is, 1 ≤ 100), it shows that the investment potential of real estate in this region is relatively large and the rent return is higher.

And other first-tier cities, too, too. For example, Shenzhen's rent-to-sale ratio reached 59 years, Shanghai 56 years, Guangzhou 53 years. Xiamen, recently rumored to have plummeted house prices, has a rent-to-sale ratio of up to 83 years.

On stocks, as of the latest, the Shanghai index is trading at just 11.74 times rolling price-earnings, well below the Dow Jones index's 21-fold price-to-earnings ratio and India's 23-fold price-to-earnings ratio. As of the latest, more than 1600 stocks were trading at a rolling price-to-earnings ratio of less than 30 times, or nearly 47 percent.

In the 1990s, Japan's real estate value had exceeded $20 trillion. Think of the purchasing power of $20 trillion at that time, how many times is it now?

This is twice the market capitalization of all the stock markets in the world at that time. In addition, the United States is 25 times the size of Japan, but the total real estate market capitalization is only 1/5 of Japan's. The land price per unit area is 125 times higher in Japan than in the United States.

Japan could buy the whole of the United States with Tokyo and California with royal land, the media joked at the time.

Since then, however, the Japanese property market bubble burst, real estate collapse. The economy has since collapsed.

In the 25-year period from 1990 to 2015, residential property in Japan fell 90 per cent from its peak. Commercial property fell 99%.

In other words: if the unit price million houses, 25 years later the market capitalization is only 10,000 yuan.

Looking back, why is the total value of China's real estate so high? It is said that the reason for maintaining it is simple, because the property market is the largest "sponge", which absorbs a large amount of "economic water" released in recent years.

If the pressure on housing prices is too strong, the absorbed "water" will inevitably flow out, causing a fatal impact on the national economy, especially the real economy.

Interestingly, however, there is still controversy over whether there is a bubble in the property market.

Pan Shiyi believes that China's total real estate market capitalization is seven times the total number of state-owned assets. Is housing prices higher, or is there less state-owned assets, or is there a bubble? I don't know. You judge.