Australia is a welfare paradise, I believe few people in the world will oppose. After all, tens of thousands of people choose to emigrate for Australia's welfare every year. That number has been rising in recent years.

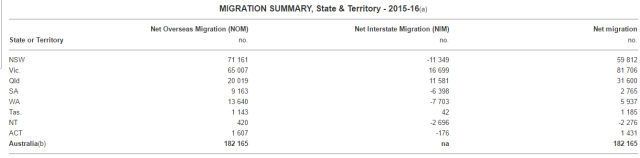

(photo source: ABS. Gov.au)

Australia accepted more than one hundred and eighty thousand immigrants from around the world in 2015-16 alone, according to the Australian Bureau of Statistics.

For many, Australia means poetry and distance.

Many knowledgeable and capable young people in the country have more or less moved the idea of emigrating to Australia.

Some people lucky to realize their dreams, others for various reasons put aside, give up, forget.

As to why they want to emigrate to Australia, most people's answers include this: "High welfare."

Is Australian welfare really so good? The answer is yes, both in terms of type and amount.

So emigrating to Australia is an early retirement? Sorry, wake up.

A look at Australian welfare

Australia's welfare system is mature and humane globally. In principle, no matter what age you belong to and what your current status is, there are benefits available as long as it's not "trench inhumane." The waiting period for new immigrants is excluded. (we will elaborate on the actual situation later.)

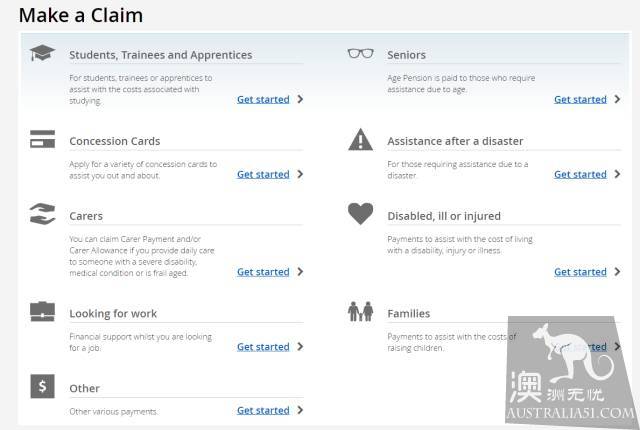

(photo source: Centrelink)

Open the Centrelink web page of the Social Security Bureau and you can see nine categories at a glance.

They are:

As long as you belong to any of these nine categories, you can apply to goverment for subsidies and can operate on your own.

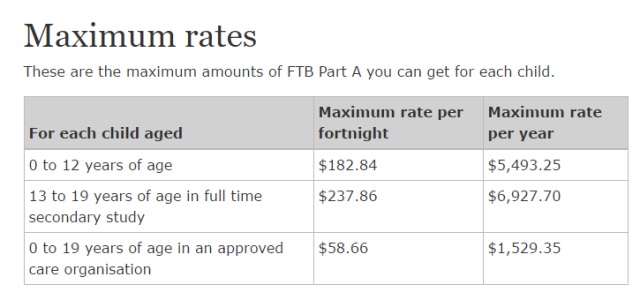

For example, we Chinese often receive "milk gold", in Australia is divided into two types of: FTB Part A and FTB Part B. A is available to the normal family and can be received until the child is 19 years old, with different amounts for each age stage.

FTB Part A Gold scale (photo source: Centrelink)

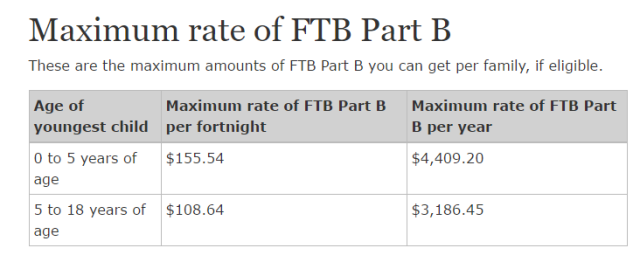

B, on the other hand, is an extra allowance for special families, such as single parents, elderly children, and couples who have only one income.

FTB Part B Gold scale (photo source: Centrelink)

If one of the couples takes care of their children at home, they can also receive a "child care allowance" (Parenting Payment). The amount is also relatively high, but must meet the "low pay" standard set by the goverment.

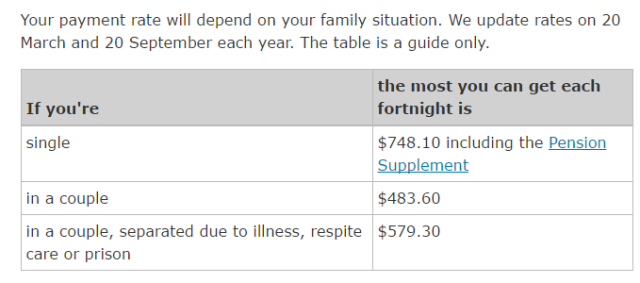

Parenting Payment Gold scale (photo source: Centrelink)

As can be seen from the above example, Australia has a large number of benefits and not a low amount of money, if just a few categories, can also be superimposed claims. So from this point of view, the welfare of Australia is really good enough!

The truth behind high welfare

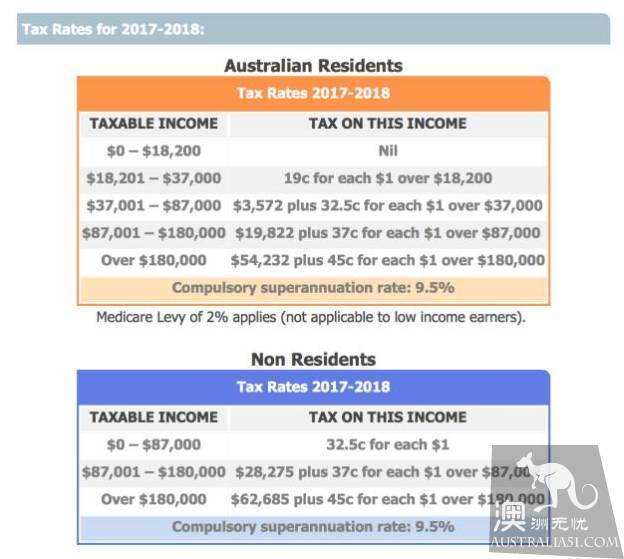

Any common sense of children's shoes should know that high welfare must be accompanied by high taxes. Like tree, like fruit。 Only rich sheep raise poor sheep, although sometimes "rich sheep" may not be really rich, "poor sheep" may not be really poor. First of all, we have to start with personal income tax.

Individual taxes are the main source of revenue for the federal goverment, accounting for about 66% of revenue.

In Australia, in addition to wages, operating income and capital gains are included. In theory, no matter how you earn it, you have to pay tax as long as you earn it.

So what are the current standards for the collection of taxes in Australia?

As you can see from the above table, the tax threshold for Australian residents is $18200, which is completely tax-deductible under this income. People who came to Australia might say: wow! How tall! But in such a high price place in Australia, if the annual income below this figure, basically even the maintenance of a normal life ah!

Then we look at the lowest level of individual tax rates. As long as you earn more than 18200 a year, you pay 19.9 cents for every Australian dollar. In other words, your money 1 to 5 does not belong to yourself!

What's this concept?

Assuming you earn $60000 a year, your tax is as high as A $11,000! Plus excise tax, health tax and other taxes, after deducting home loans, car loans and other consumer loans interest and children's education expenses, you will find yourself still poor.

Here's the point! In fact, a large number of Chinese simply earn less than 60,000 annual salaries, but the taxes that should be paid cannot be reduced at all.

Welfare "rain and dew"?

We've talked about benefits and taxes, so a lot of people might say, "We're willing to pay taxes before we get lucky!"

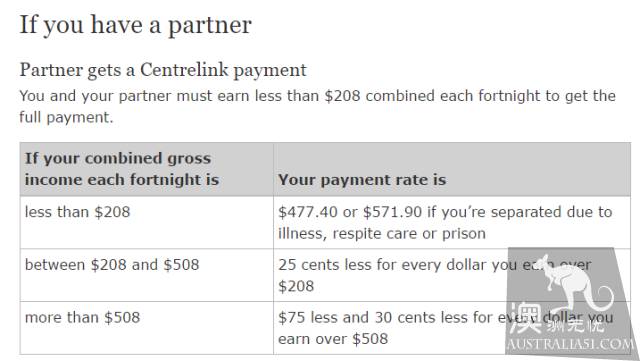

Wait a minute, I don't dare to say that casually. Because Australia's welfare is good, but many claims for subsidies are also demanding, of which the most sad is the "income criteria."

Take the "child-care allowance" mentioned above, if you want to claim the allowance successfully, you must probably reach the level of "extreme poverty".

For a couple to get the highest allowance, their 14-day gross income must be less than $208.

What is this level? Basically in the major state capital cities, a family of three crowded with other people in the rental house, the rent is basically around 200 dollars a week, this income can not even afford to pay rent! Even with the minimum allowance, the couple made a total of $508 over 14 days, that is, just paid the rent, electricity and electricity, and so on, it may even be difficult to eat normally.

The same is true of many other allowances, which look high, but you may not receive them.

Our Chinese community is even more "non-mainstream" in Australia. The culture and education of the Chinese nation for thousands of years, no matter where we are, we never forget to work hard. Although there may be some inequities in the workplace, and the upward passage may not be as good as the locals, generally, the Chinese will not "stand by and die." Therefore, although it is very difficult to be rich and expensive, but also live a little taste.

In addition, Chinese couples do not have many children, so the life of relying on children to eat is far away from us.

Basically, Chinese can only receive "sunshine" type allowance, others, just look at it.

So since we don't get much, who's the benefit?

Mr Morrison, Australia's finance minister, said benefits were given to "non-taxable moths."

As we all know, the unemployed are often the biggest winners of welfare. But there is a big difference between "active unemployment" and "passive unemployment".

If we lose our jobs because of physical defects or disasters, we are certainly willing to give them benefits, because social benefits are supposed to help those in need. But now there are more and more young people who are able to work in Australia who choose to "lose their jobs" and live by adding various goverment benefits. This kind of person is our shameless "moth".

On the one hand, they don't have to pay taxes because they have no jobs, on the other hand, they are squandering taxpayers' hard-earned money. If this group reproduces a large number of children, it will put a lot of pressure on the social and welfare!

Welfare faces great changes

With so many loopholes in the current welfare system, does goverment know nothing about it? Of course not. Goverment is not only aware of the seriousness of the problem, but has begun to fix it.

1. Multiple family benefits cut

Since the first half of this year, the Centrelink has introduced drastic reforms in welfare programs such as child care allowance, (Family Tax Benefit), school subsidy, (Schoolkids Bonus), parental leave wage, (Parental Leave Pay), childcare assistance, (Childcare Assistance), and most of them have come into effect. Many families may lose thousands of dollars in benefits as a result.

2. Pension age extended to 70 years

According to the 17-year federal budget, the pension age for Australians will be extended to 70 in 2029, but the goverment civil service remains unchanged. The move is expected to save goverment A $3.6 billion over four years. According to Australia's average life expectancy of 80 years for men and 84 years for women, most people receive only a few or more years of old-age pensions.

3. Rectify the "fake refugees", stop the loss of the state treasury

The federal goverment will crack down on "fake refugees" who smuggle into Australia but do not apply for and certify their refugee status. The mess has cost the country A $13.7 billion. Australian Immigration Minister Dutton said Australia is one of the most generous countries in the world, but not stupid enough to continue to be deceived!

4. Rectifying teenage pregnancy and youth unemployment

In Australia, 4370 parents under the age of 18 received parental benefits in 2014-15, of which 77 percent were single, according to the latest statistics. Of the first-time teenage mothers who received benefits, 80 per cent of their parents or guardians were also recipients of benefits during their upbringing. To end the vicious cycle of teenage pregnancy, youth unemployment and the dependence of generations on benefits, the Federal goverment will spend A $ two hundred and sixty two million nine hundred and ninety nine thousand nine hundred and ninety nine to implement the ParentsNext program starting in July next year. Provide one-on-one education and help to parents who live on parental allowances.

5. Apply for more

Under the new deal, a new starting point allowance, (Newstart), and a youth allowance, (Youth Allowances), would have to be cleared for drugs, and if they failed to find jobs as required, the allowance would be cut or cancelled.

6. New Parental Visa deal

The Australian federal goverment will announce a new parental visa program. Under the scheme, parents of Australian citizens or permanent residents will be able to live in Australia for a maximum of 10 years at a visa cost of A $20,000. Their children are required to provide financial guarantees for their health care while they stay in Australia and to pay their private medical premiums. Last year, a report from the Productivity Commission showed that a parent visa holder spent an average lifetime of between A $ three hundred and thirty five thousand and A $ four hundred and ten thousand on medical care. Under the new deal, the goverment fiscal can indeed relieve a lot of pressure.

Australia's high welfare is really attractive, and it actually helps a lot of people. But high benefits are supported by high taxes, and taxpayers are really loathed at unnecessary spending. As taxpayers, we do not want the goverment to ban high welfare benefits, we just want to request goverment scientific benefits, taxpayers' money is not used to raise "moth"!