Taku Ekanayake is a 28-year-old Uber driver, but he is not an ordinary generation Y.

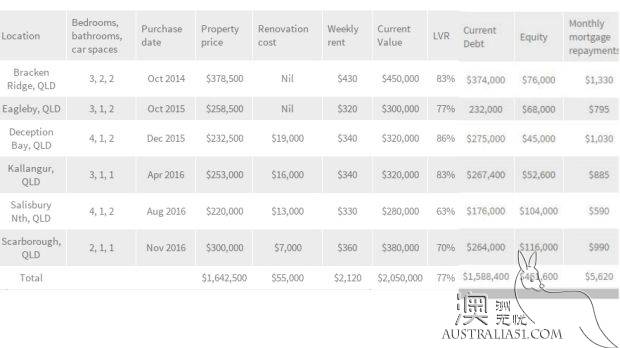

He is also a real estate investor, owns six properties, and 1.5 million debt.

As a middle-income co-owner in Marrickville, much of the extra money he needs to buy a property comes from Uber, whose full-time job is a sales man.

When he lived at home at the age of 24, he initially wanted to buy a house and live on his own.

But he saw Robert Tomasaki`s Poor Dad, Rich Dad, who suggested buying investments rather than debt to generate passive income.

He decided that real estate was the best means.

He worked part-time in retail as a business student at college, saving 70, 000 yuan before moving out of his parents` home.

This will be his first down payment.

But when he planned to invest at the end of 2014, "the current Sydney housing boom is halfway through," he said.

He was squeezed out of the market.

But unlike other young people who thought he had missed the moment and gave up, he began his own research.

His discovery shocked him.

"Sydney does not perform best in the long run with so many different markets in Australia," he said.

"over the past 15 years, Sydney, Brisbane and Adelaide have done the same thing."

But when he found out, he decided to expand the search and finally chose Brisbane, where house prices were cheaper, the city matured and the return on rent was attractive.

When he first visited the city, he planned to experience the house on open day.

But the last time he looked at a house, he ran into a dark auction, and he made it.

Although the property did well, it was one of the most regrettable of his portfolios, because he had no clear strategy to "buy and wait for appreciation".

"12 months after the first suite, I bought the next one. I have to work hard, "he said."

He started driving 20 hours a week outside of full-time work on Uber..

"once I have a clear strategy, I bought four in 13 to 14 months."

"this is a good strategy to allow you to do so."

His current strategy is to buy between 10% and 20% less than the market price, often requiring refurbished properties and negotiating with landlords to get the keys ahead of time.

This allowed him to renovate before the deal, meaning that once he acquired ownership, he could revalue with the bank and withdraw the down payment to buy the next property.

He is also looking for high rental returns and potential for future development.

But he didn`t come up with the strategy alone. He found a good mentor.

This includes buying properties in South Australia through a buyer`s agent, as well as an experienced loan broker, who owns 16 properties of his own and talks almost every day.

"by this time next year, I want to own 10 properties and I want to have a net worth of more than 1 million yuan," he said.

"by the age of 36, I want a net passive income of 1 million."

He owns six homes, wants to buy more, and is working on a strategy to achieve his goals.

"I had coffee with my loan broker and asked him how he did it."

"he taught me how to identify a good property, and basically I was copying what he did."

Although he knew there was always a risk to investing, he said he could sell the property if the market went bad.

Because his strategy is to buy lower-than-market properties, he has confidence in his debt levels and risk management.