Thanks to the Royal Commission on Financial Services, access to housing loans may be more difficult than ever. This is bad news not only for those who want to buy a house, but also because Australia`s economy is dependent on housing loans, which could have a devastating impact.

Eliot (Shayne Elliott), chief executive of ANZ Bank (ANZ), said the investigation would make the housing loan approval process longer and more cumbersome.

He said in an interview that people still have to buy a house, so the basic needs will not change, but what is about to change is the process in which it may be harder for people to apply for a home loan.

One of the Royal Commission`s most shocking findings is how lax banks` pre-loan scrutiny is. When you apply for a mortgage, the bank should confirm your expenses, they should know whether you are shopping at the Aldi or organic grocery store, are you driving a Mitsuke or Mercedes-Benz, and so on.

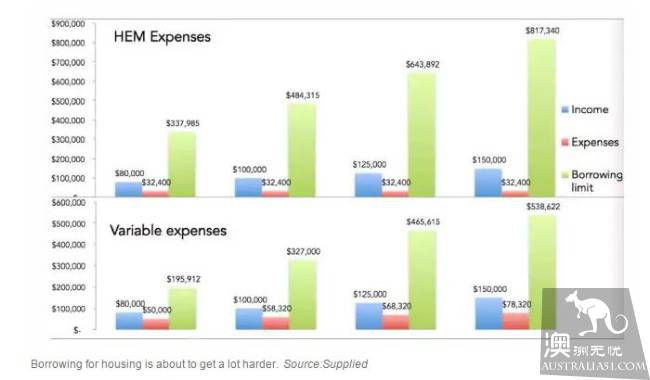

But in fact, we understand that most of the approved home loans do not depend on any actual assessment of your monthly expenses. Instead, some banks use HEM, a measure of household spending, which is used in nearly 3/4 of loans. For a family of four, they simply apply an annual expenditure of $32400. Rent alone is close to that, at least in big cities.

Start with a smile, end with a cry

The good days of easy access to a home loan in the summer are coming to an end. This is bad news for banks, who rely on these loans to make a profit.

This is also bad news for anyone who wants to enter the housing market.

If banks begin to use the more realistic assumption of how much money people can borrow, the size of the loan is likely to decrease. UBS (UBS), an investment bank, analyzed future microloans, which some could borrow more than 800,000 yuan by HEM standards, but could borrow only five hundred and thirty seven thousand nine hundred and ninety nine yuan, based on new and more realistic spending assumptions.

Housing price influence

A more realistic assessment of spending will lead to a decline in housing loans. Lower home loans mean people are less willing to spend more money on homes. In turn, less money can cause house prices to fall, or at least slow home price growth.

This is good news as well as bad news.

The good news is: if you are hardworking, always trying to save money, and you are frugal, try not to go to Bali twice a year, and let the bank check your actual spending without any harm. And now, when you go to the auction, the guy with a million-dollar pre-approved mortgage and the rental Mercedes aren`t going to bid higher than you at the scene. For you, tough bank approvals and lower house prices are good news.

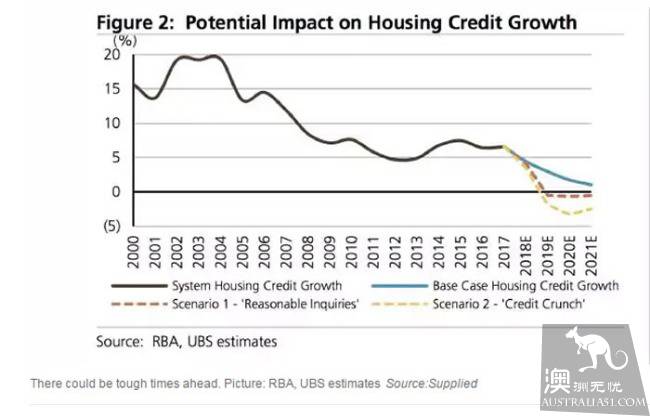

The bad news is that the Australian economy is dependent on house prices, and the chart shows the astonishing growth in Australia`s monthly housing finance. A huge increase in loans of $21 billion a month helped drive Australia`s economy, which in turn boosted house prices.

When house prices rise, Australians go to shops, restaurants and hotels to spend. This has energized the economy, which they call the "wealth effect".

If house prices fall, you`ll hear thousands of people crying, credit card payments making them stressed out and living like the poor. At worst, this could lead to our first recession in decades.

A chart released by UBS shows how the "credit crunch" has caused housing credit growth to fall into negative value.

Australia is one of the most dependent countries in the world on housing loans, a sudden cut in which led to "withdrawal symptoms." This does not mean that Australia should continue to borrow heavily, but should not become so heavily dependent from the outset. The Royal Committee of Banks is helping the country to stop addiction, which is doomed to pain.