On May 9, the State Administration of Taxation, the Ministry of Finance, the people`s Bank of China, the Banking Regulatory Commission, the Securities Regulatory Commission and the Insurance Regulatory Commission jointly announced that an inventory of "non-resident" financial account information would begin.

The official implementation date is July 1 this year.

As soon as the news came out, the Chinese local tycoons at home and abroad suddenly struck the tiger`s body.

Is it possible that all of your overseas assets are going to be exposed?

So what is the announcement issued by the six ministries?

What is the impact on Chinese residents and overseas Chinese?

The editor below will take you through a detailed interpretation.

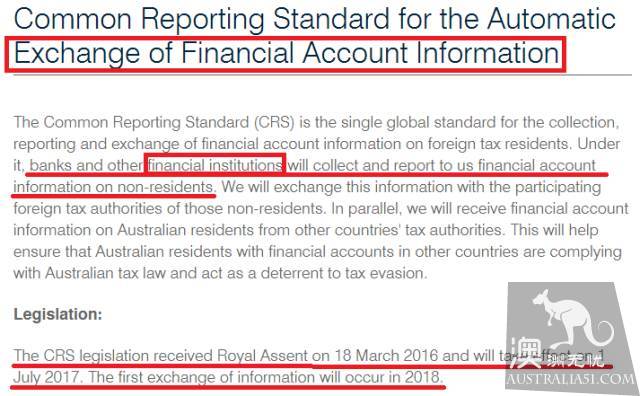

Why are the six ministries about to conduct a detailed investigation of the tax-related information on financial accounts? In order to strengthen international tax cooperation and combat cross-border tax evasion, the OECD (OECD) issued a standard for automatic exchange of tax-related information on financial accounts in July 2014 (Common Reporting Standard).)

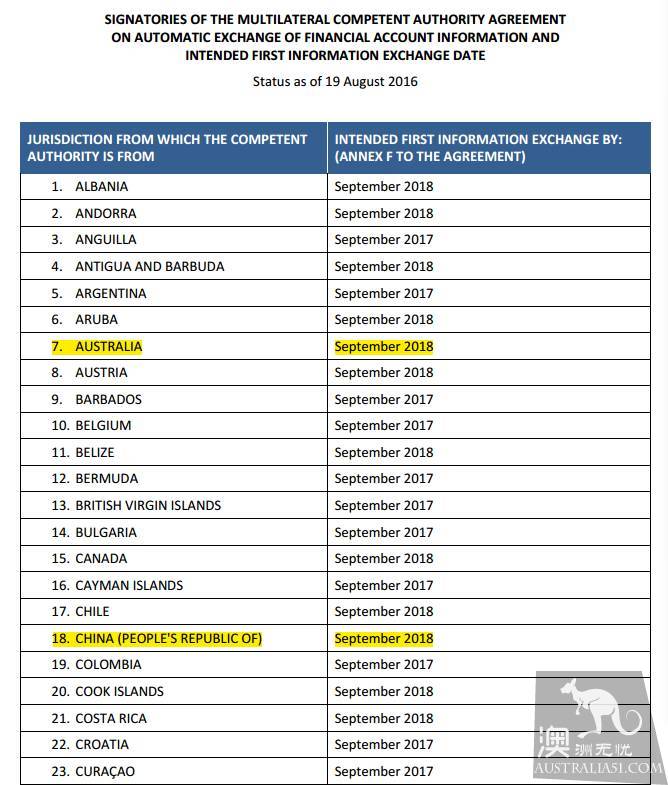

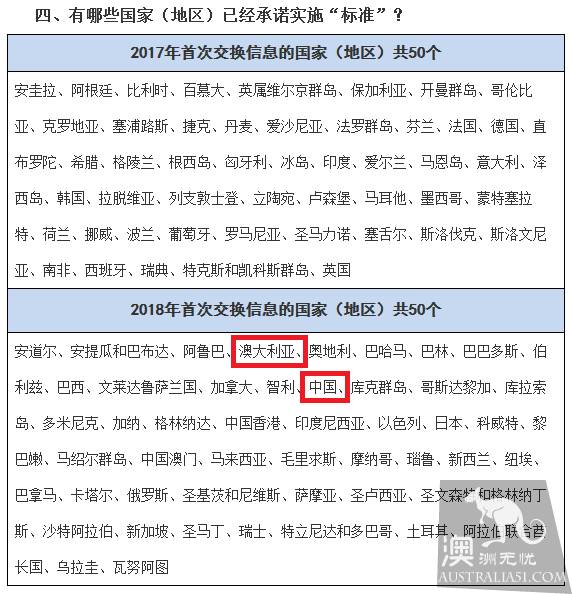

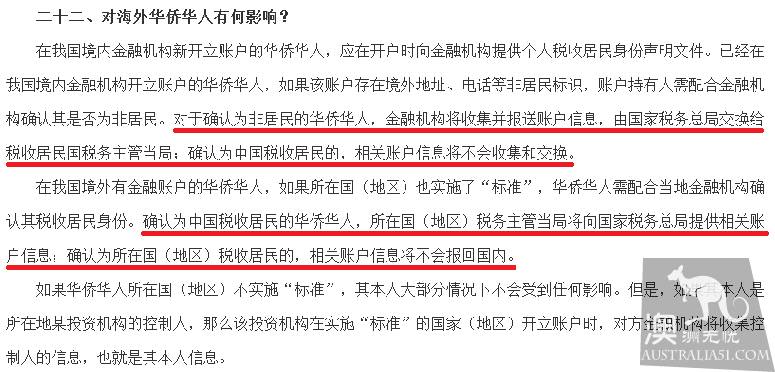

Driven by the G20, 101 countries, including China and Australia, have now acceded to the agreement, promising an open exchange of tax information.

The number of countries implementing Common Reporting Standard (CRS) in 2017 is 55, and 46 more countries will join in 2018.

Among them, China and Australia will also join the agreement from 2018.

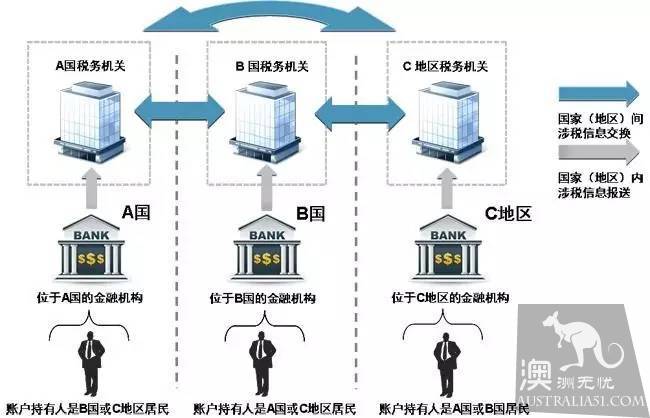

Specific implementation rules between the tax authorities of countries to exchange financial information between individual tax residents and enterprises.

Exchange process of tax-related information

Under the Standard, information on the financial accounts of non-tax residents in financial institutions will be collected and reported to tax authorities between countries.

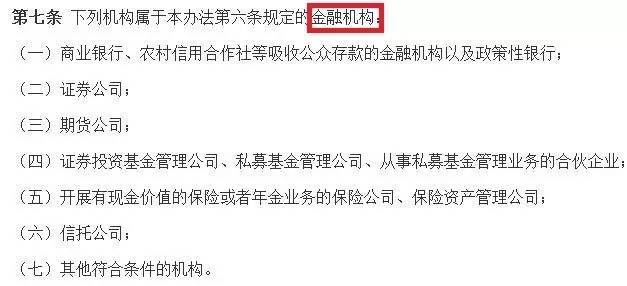

Among them, financial institutions include:

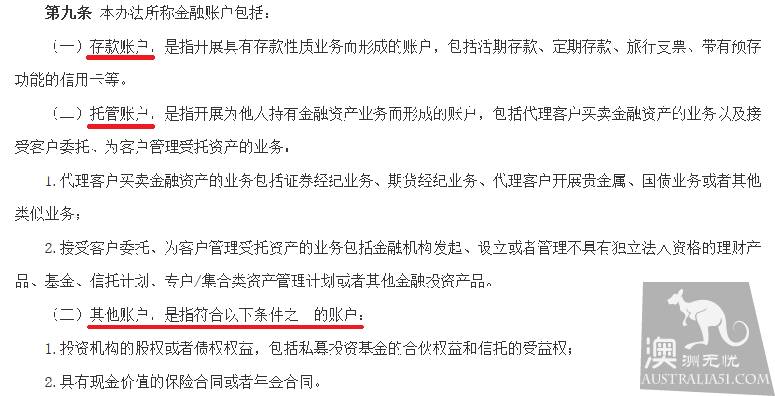

The financial accounts to be exchanged include:

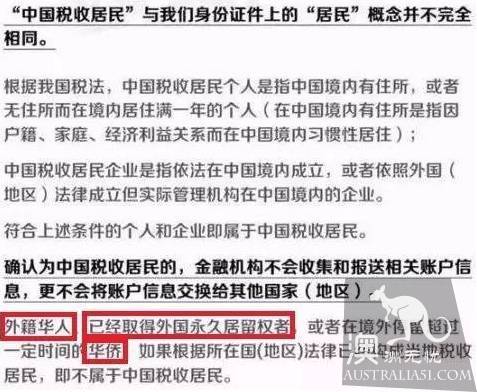

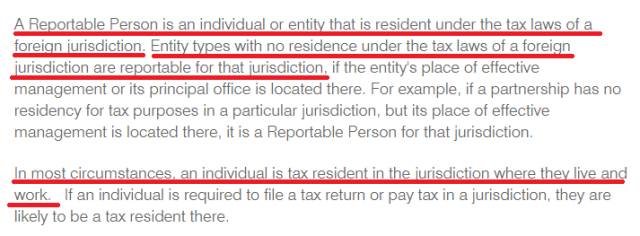

Among them, it should be noted that this management adopts the concept of "tax resident".

The concepts of "resident" and "tax resident" are not the same-

According to China`s tax law, the individual tax resident of China is a person who has a domicile within the territory of China or who has lived within the territory for a period of one year without domicile (domicile in China refers to a family due to domicile, household registration). Economic interests and habitual residence in China);

Chinese tax resident enterprises refer to enterprises (including other organizations) established in accordance with the law in China or established in accordance with the laws of foreign countries (regions), but whose actual administrative institutions are within the territory of China.

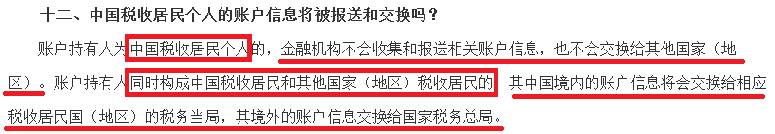

For Chinese tax residents: financial institutions do not collect and submit information about their accounts, nor do they exchange them with other countries.

However, because of the different standards of "tax residents" in other countries, individuals may constitute two conditions for Chinese tax residents and residents of other countries and regions at the same time.

In this case, the account information in China will be exchanged with the tax authorities in the corresponding country, and the account information in the country will also be exchanged with the State Administration of Taxation.

But it also means,

If you`re a tax resident in China,

And in one of the CRS standards participating countries overseas, they have a lot of financial assets.

And is not a tax resident of the country,

Then this part of your overseas financial assets will be nowhere to hide!

Your assets are transparent to the State Administration of Taxation!

Implementation in Australia, based on information already available on the Australian Inland Revenue Service`s (ATO) website, determined that they would start gathering information in July 2017 and that the first exchange of information would begin in 2018.

The implementation rules of Australia`s CRS state that the person who needs to be reported should be the statutory taxpayer of another country.

In other words, if a person is not an Australian tax resident, that person`s information will be exchanged with his taxable country.

So how does Australia`s tax residents define it?

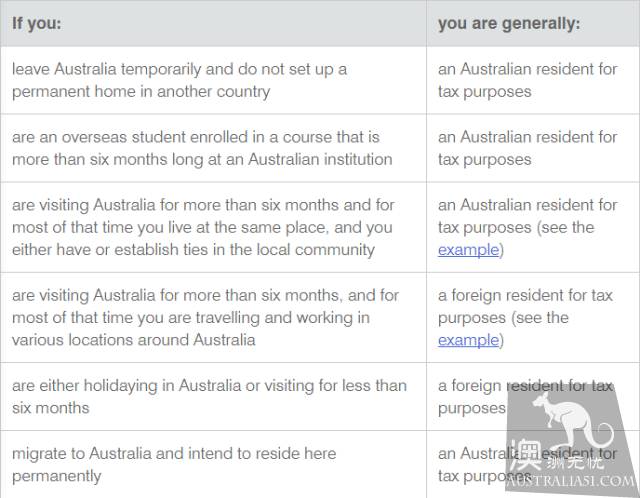

On the IRS website in Australia, the definition of overseas persons in Australia as "tax residents" in Australia is as follows:

In conclusion:

Having been granted permanent status or having a temporary visa to live in Australia for more than six consecutive months (study or work), even if they leave the country for a short period of time, they still belong to Australian tax residents.

But on top of that, tourists, vacationers and six-month vacationers with frequent job shifts, such as migrant vacationers, are tax residents of foreign countries.

So, including international students, permanent immigrants and Chinese Australians, are basically tax residents of Australia, and are not on the list of information exchanges.

But don`t forget!

If, at the same time, you lose your status as a tax resident in China, the State Administration of Taxation will report your financial assets in China to the Australian tax authorities.

What if your information "unfortunately" is collected and reported? First of all, the exchange of financial information is not something to worry about for those who work, live and invest in Australia.

Because this exchange of information is not a policy for disclosing privacy and the amount of assets.

The purpose of collecting this information is to more effectively regulate the overseas assets taxes of this group of people involved and prevent international tax evasion.

So the public exchange of information will not affect you personally, or cause any unnecessary trouble, only those who evade taxes will be affected.

It is worth noting, however, that some grey assets may indeed be exposed.

For example, some of the students` parents are not themselves Australian tax residents, but they may have opened accounts and deposits in Australia, and their sources of assets and funds may be subject to investigation.

Or, in order to evade taxes, some Australian tax residents put some of their assets in the names of Chinese relatives of non-tax residents to achieve the goal of underpaying taxes.

There are also Chinese tycoons who come to Australia as tourists and transfer their assets to Australian financial institutions.

At that point, the holders of these wealth may need to explain three things to China`s goverment about the wealth involved:

Tax interpretation, source interpretation, foreign exchange control interpretation

At that time, the specific implementation process and time node: July 1, 2017, formally investigate the identity of tax residents.

Prior to December 31, 2017, the completion of high net worth account due diligence.

In September 2018, the first exchange of information was completed.

Due diligence on accounts will be banned until December 31, 2018.

All in all, ordinary bystanders don`t have to do anything, and if necessary, cooperate with the investigation.

And the only words waiting for you are those who actually evade taxes, evade taxes and hide assets abroad-