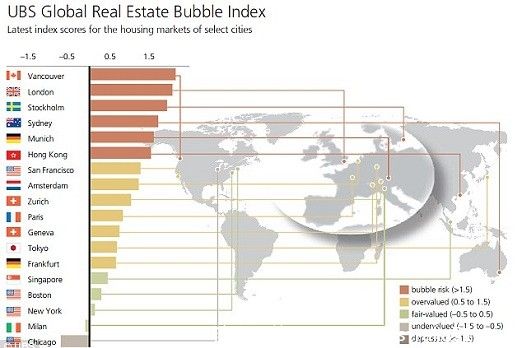

[Today, Australia,28 September] The new global real estate bubble index report shows that the stability of the sydney housing market is a concern. Sydney is fourth, and the demand from Chinese buyers is an important reason for overheating in the city`s housing market. According to the Daily Mail, UBS`s new global real estate bubble index has studied housing prices in 18 big cities across the world. The latest figures show that Sydney is the fourth in the world`s largest cities with bubble risk in the city, and the top three are Vancouver, London and Stockholm, respectively. The prices of these cities remain high, but the stability is worrying.

(Photo Source: The Daily Mail>) reported that Sydney became the target for overseas investors a few years ago. Since then, the city of sydney is at risk of overheating. In 2012, Sydney was also one of the top security in the Asia-Pacific region. In the past four years, the risk is in the first place. The "The supply quantity of the market house is combined with the continuous demand of the Chinese buyers, creating an ideal environment for the rise of the house price. The environment, however, is very dangerous for the overheated housing market. The surge in house supply, rising interest rates, or the flow of international capital can lead to a dramatic change in housing prices.", from mid-2012 to the second half of 2015, has climbed 45 per cent in sydney and a high rate of housing prices. But in 2016, the rate of rising house prices slowed and the rate of growth dropped to a figure. The demand of overseas buyers is an important factor affecting the housing market in Australia. It is reported that with the increase in the number of house supplies and the tightening of overseas investment policies, the phenomenon of housing prices will be curbed. At that time, the housing market has a shock, and buyers and sellers will be greatly affected.