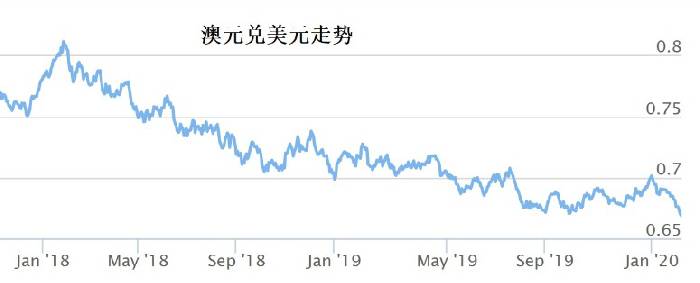

In the face of a new outbreak of coronavirus pneumonia in china, china economic will inevitably be affected, and because china is australia`s largest trading partner, already in the "cross street" australia economic fear will be further worse, meaning the reserve bank of australia may need to further relax its roots. The Australian dollar fell significantly against the dollar in January, its worst performance in five years, following a double whammy of possible worsening outbreaks and falling interest rates. Now that the Australian dollar has fallen at the 0.67 barrier against the US dollar, it could even hit the lows recorded during the global financial tsunami.

Worried about pneumonia drags economic Australia down nearly 5% of the month

The Australian dollar climbed 0.7031 against the US dollar on the last trading day of last year (closing at 0.7013), just as some were looking to see if the Australian dollar could rise to a new level. Stepping into the new year, the Australian dollar moved all the way down against the dollar, falling to 0.6693 on January 31, down 4.6 per cent for the month, the biggest fall so far in January 2015.

On the eve of the Reserve Bank`s meeting, the Australian dollar was at a low of 0.6681 against the dollar in Sydney afternoon on Monday (February 3), the lowest level since October 21 last year. The Aussie`s cumulative fall of 18 percent against the dollar compared to its peak of 0.8135 at the end of January 2018.

Mark Williams, chief Asia economics at Capital Economics, said that according to its initial analysis, China`s economic growth in the quarter could slow to just 3 per cent a year, significantly lower than the 5.7 per cent annual increase in late last year, as a result of China`s extended "offseason ".

Mr williams points out that the impact on economics would be short-lived if the output lost in china could be recovered later, without a major impact on income; however, the longer the off-season, the higher the risk of worker salary falling and even unemployment.

Australia`s trade relationship with china is close, and if china`s economic growth cools, australia`s economics won`t survive. The exact blow to Australia remains to be reckoned, but China`s short-term demand for iron ore and coal is indisputable. Current iron ore futures prices are more than 10% below their latest peak.

Of course, if china introduces measures to stimulate economic, including more infrastructure, that could help stabilize prices for steel and even iron ore.

In any case, speculation that the bank will further relax its roots will naturally heat up amid a gloomy outlook for australia`s economics. Although australian reserve bank on tuesday (february 4th) is not expected to "pawn" a cut in interest rates, it is likely to signal in the statement that economic will be in danger of further cooling. In other words, many in the market believe it is only a matter of time before the bank cuts interest rates or even introduces quantitative easing (QE).

Prashant Newnaha, Asia-Pacific interest rate strategist at TD Securities, believes the RBA has little chance of cutting interest rates this week but is likely to make a move in March because, according to experience, the deterioration of the international situation is one of the prerequisites for the RBA to consider cutting interest rates; if the new outbreak of pneumonia worsens and leads to a global supply chain disruption, it will become even more pressing.

In general, even if the bank didn`t act on tuesday, lowering the economic growth forecast or raising the loss rate forecast, or even pointing out that there is room for a cut in interest rates, would put pressure on the australian dollar, especially in the event of a sharp rise in the diagnosis of a new type of pneumonia.

Down against the Hong Kong dollar

He zhiming, chief executive and chief adviser of hongya international advisory group, said earlier than the lunar new year that he was not optimistic about the australian dollar in the new year, and speculated that the australian dollar would go further down the line against the dollar, or even try 0.65. From a foreign perspective, he added, the fall in the Australian dollar represents a disguised discount on buying Australian assets, which will indirectly benefit the Australian housing and bond markets; however, he does not recommend holding the Aussie currency, which is even cheaper than holding the dollar, and the days of "both interest and income" are over.

The Australian dollar climbed 4.9097 on its first day of the year, recording its highest price since the end of December 2018, but then fell, closing at 4.6267 at the end of January, with a cumulative adjustment of 5.8 percent.

The Australian dollar rose to 5.4692 against the Hong Kong dollar on Jan. On January 31, the Aussie was down 5.1939 against the Hong Kong dollar, down 5% cumulatively. On Tuesday, the Aussie was trading at 5.161 against the Hong Kong dollar in mid-Asian trading.